Three former SpaceX engineers are taking their experience from laser links in orbit to fiber links on Earth. Their new company, Mesh Optical Technologies, has raised a $50 million Series A led by Thrive Capital to mass-produce high-performance optical transceivers for AI-scale data centers.

Founded by CEO Travis Brashears, President Cameron Ramos, and VP of Product Serena Grown-Haeberli, the Los Angeles startup is targeting the plumbing that lets thousands of GPUs communicate at blistering speeds. As model sizes and clusters surge, optical I/O is becoming the bottleneck—and the profit pool—inside modern hyperscale networks.

From Satellite Lasers to AI-Scale Networking

The trio previously worked on the optical inter-satellite links that keep Starlink spacecraft talking to each other. That experience—building compact, power-efficient optics that must operate flawlessly at scale—translates directly to the data center, where latency, power draw, and yield dictate the economics of AI training.

Optical transceivers convert light into electrical signals and back again, stitching together racks of accelerators. One established U.S. supplier, Applied Optoelectronics (AOI), recently secured a multi-billion-dollar supply agreement with a leading cloud provider, a sign of how strategic these parts have become. As Ramos put it, if someone boasts of a million-GPU cluster, you can roughly quadruple or quintuple that number to estimate how many transceivers they’ll need.

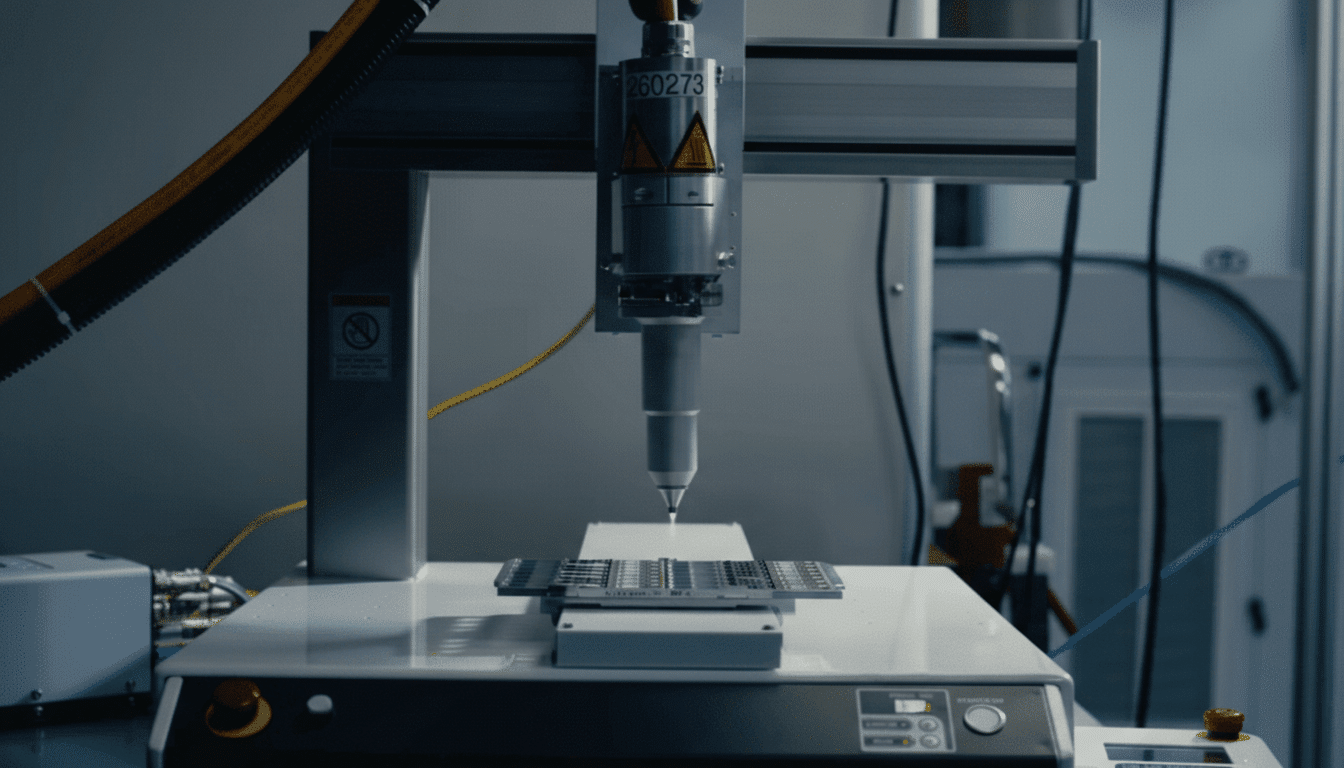

Manufacturing at Scale Is the Strategic Moat

Mesh plans to reach production of roughly 1,000 units per day within the next year, a rate intended to support qualification for bulk orders in 2027 and 2028. The hard part is not just design; it’s manufacturing. High-yield, lights-out assembly—where lines run with minimal human intervention—remains uncommon in U.S. photonics, even as it’s standard practice among top Chinese vendors.

The company says co-locating design and production will shave engineering loops and lower cost per bit. That view echoes research from AIM Photonics and other U.S. manufacturing institutes, which have urged tighter integration between designers and fabs to improve yields in advanced packaging and silicon photonics.

Power Savings at Hyperscale Data Centers

Mesh’s current design removes a commonly used, power-hungry element in many modules, targeting immediate system-level efficiency gains. The team estimates a 3%–5% reduction in GPU cluster power, a small percentage that matters at campus scale. On a 30 MW AI facility, that translates to nearly 1–1.5 MW avoided—millions of dollars per year in energy costs, plus room for more compute within the same power envelope.

As hyperscalers seek every practical watt back—from liquid cooling to smarter job schedulers—squeezing power from optics is one of the few levers that scales across fleets. Data from the Uptime Institute and other operators show energy efficiency is now a board-level KPI, not just a facilities metric.

A Supply Chain Bet Outside China for Optics

Today’s optical transceiver market is dominated by suppliers with deep manufacturing bases in China. Mesh is deliberately structuring a supply chain outside the country, anticipating customers will want geographic diversification and simplified compliance as export policies evolve. While trade restrictions have not yet hit this niche directly, procurement teams are building playbooks to reduce single-region dependencies.

Founders say even some European toolmakers assume Chinese buyers by default—a signal of how concentrated expertise has become. Rebuilding that proficiency in the U.S. will require automation know-how as much as capital, but it could pay off with faster design loops and more resilient logistics.

Timing the 800G to 1.6T Transition in Data Centers

The industry is in the middle of an upgrade cycle from 400G to 800G optics, with 1.6T modules moving from pilot to volume over the next few years. Market researchers at LightCounting report sustained double-digit growth in data center optics as AI clusters expand, with spending increasingly concentrated in the highest-rate modules.

Qualification windows for transceivers are long and unforgiving—vendors must hit performance, reliability, and cost targets across countless corner cases. Mesh’s aim to ramp output now and lock in design wins for 2027–2028 positions it for the next big capacity wave, when multi-die GPUs and memory-rich architectures push even more bandwidth into each server.

Why This Funding Round Matters for AI Networking

With cloud giants accelerating AI capex, most near-term constraints are power, cooling, and optics. Dell’Oro Group has tracked hyperscaler spend shifting toward networking and accelerators, reflecting the premium on low-latency, high-throughput fabrics. If Mesh can prove automated, domestic manufacturing at scale—while delivering measurable power savings—it will have a compelling wedge into a market where a single design win can be worth hundreds of thousands of units.

The founders insist data centers are only the first stop, arguing that optical wavelengths are the next paradigm for communications across compute domains. For now, the task is more immediate: build a repeatable U.S. manufacturing engine, qualify with the biggest buyers on Earth, and ship modules that let the world’s largest AI clusters talk faster while using less power.