SpaceX has struck a deal to buy another tranche of EchoStar’s spectrum for as much as $17 billion, a deal that should help turbocharge its planned Starlink direct-to-cell service and will also reduce its dependence on traditional mobile carriers. The package has 50MHz from 1.9 to 2.2GHz and features U.S. rights to the S-band and PCS H-block as well as EchoStar’s global licenses.

With the additional airwaves, along with second-generation Starlink satellites and data-centric Internet protocols, SpaceX claims to be capable of 20x more throughput per satellite and over 100x total network capacity as the constellation grows. Meanwhile, EchoStar will shutter its own satellite-to-device plans, and Boost Mobile will get access to Starlink’s service as part of a deal.

Why these frequencies matter

The’re 2000 let me 1920MHz during the uplink as well as 2180 up to 2200MHz (to let you know about D-band activities), so let me wrap up with 1915 to 1920MHz and again 1995 to 2000MHz on the H-block halfway to PCS. Mid-band spectrum in this range offers a practical mix of coverage and capacity and – crucially – lines up with the 3GPP standard NTN (non-terrestrial network) and means phones won’t have to have an exotic satphone chipset inside to work.

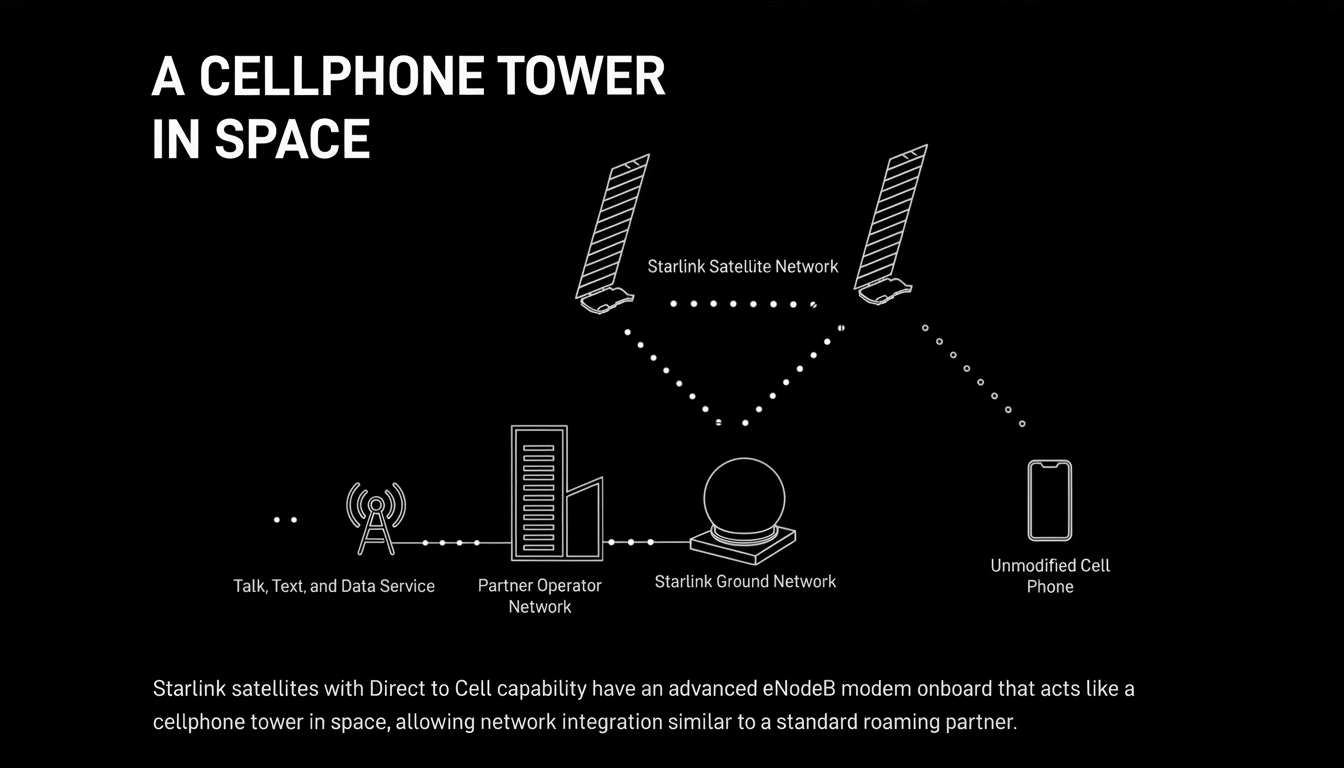

Starlink’s early direct-to-cell trials serving as downlink transports had previously relied on partner spectrum falling in the 1.91–1.995GHz band to offer basic messaging capabilities for coverage dead zones. Users could type and receive text messages and send photos, and if necessary reached emergency services, but message delivery was slow, taking 20 to 120 seconds at times. With dedicated spectrum and satellites designed specifically for these bands, SpaceX is promising full cellular coverage that feels like LTE from the ground, supporting data that can be used for mainstream apps and, eventually, voice and video services.

A shift in leverage strategy

Holding large, continuous blocks changes SpaceX’s leverage position with mobile network operators (MNOs). Lluc Palerm Serra, an analyst who covers the satellite industry, observes that a spectrum portfolio developed in house frees SpaceX from having to rely entirely on third-party carriers to light up service, giving it leverage in roaming and capacity deals. It also allows for direct-to-consumer offerings in some markets, if regulations and business models support them.

The terms of the transaction indicate the high stakes: As part of the deal, EchoStar will gain as much as $8.5 billion in cash and as much as $8.5 billion in equity in SpaceX. The research firm MoffettNathanson describes the action as EchoStar shedding most of its spectrum holdings; at the same time, drawing down a contract with MDA for over 100 spacecraft, EchoStar formally abandoned its pursuit to be competitive in direct-to-device.

What this means for users and carriers

ViaSat-2 is already in orbit, and the next planned launches will bring even more bands to bear, with radios that can communicate in them. SpaceX has already launched hundreds of direct-to-cell capable satellites, though the company suggests the real improvements will come from new-gen hardware purpose built for these frequencies and 5G NTN waveforms.

It’s pretty simple for the carriers’ pitch: they can increase coverage and capacity without having to build towers in challenging areas. T-Mobile is the first U.S. partner; the planned entry of Boost Mobile implies broader wholesale models. Should SpaceX’s promised 20x per satellite throughput increase materialise, MNOs would be in a position to offload rural traffic, improve disaster recovery and differentiate roaming in large parts of remote geography – all while maintaining spectrum assurance in ultra-dense urban centres.

Regulatory checkpoints and standards

FCC approval is needed to transfer licenses and harmonize service rules in both the MSS and PCS bands. EchoStar has said it believes the deal will settle an F.C.C. review of its use of the S-band. On the standards front, 3GPP Release 17 defined the NTN framework for satellite-to-phone, and Release 18 added the necessary details — important for ensuring that it all plays nice with other components that make up chipsets, radios, and roaming agreements.

Competitive pressure ramps up

SpaceX’s spectrum win reorients the chessboard. AST SpaceMobile, whose partners include AT&T and Vodafone, has proven broadband connections from space to unmodified phones and is in the process of bringing it to the market commercially. Lynk Global is live with text services in a handful of countries and is now available to use following regulatory approval. Apple uses Globalstar for iPhone satellite emergency features. “SpaceX’s combination of spectrum control, launch pace and production scale leaves rivals struggling to catch up — particularly since EchoStar’s withdrawal,” writes analyst Tim Farrar of TMF Associates.

What to watch next

Milestones include gaining FCC approval for the license transfers, the launch of new satellites specifically for the new bands and incremental expansion from messaging to general app data, voice and video.

Outside the U.S., expect to see roaming agreements that draw on EchoStar’s international holdings. The true proof points will be user experience stats around; message delivery in seconds vs minutes, sustained data rates in Mbps on common smartphones, and seamless transitions between terrestrial 5G and space-based coverage.

If SpaceX hits its throughput and capacity numbers, direct-to-device may be not be an emergency lifeline as much as the everyday connectivity layer that fills in consumer dead zones, unlocks the potential of IoT in remote industries, and offers carriers a new lever to balance network economics.