Snap is carving out its augmented reality glasses operation into a new subsidiary called Specs Inc, doubling down on a product line it has incubated for years and positioning it for a long-anticipated consumer debut. The move tightens operational focus around hardware, software, and partnerships specific to smart glasses, signaling that Snap sees AR eyewear as a strategic pillar rather than a side project.

A Standalone Bet on AR Wearables Gains Momentum

Creating a dedicated company gives Specs its own roadmap, supply chain, and P&L, a structure that can accelerate decisions on components, industrial design, and retail channels. It also mirrors how rivals segment advanced hardware: Meta’s smart glasses efforts sit alongside its Reality Labs organization, while Apple’s spatial computing hardware is managed as a discrete product family. Snap’s approach is meant to sharpen accountability and reduce the friction that comes with building consumer hardware inside a social app company.

Snap has been iterating on Spectacles for more than a decade. Early versions were novel but limited, culminating in a costly lesson when Snap took roughly a $40 million write-down tied to excess inventory. Recent generations shifted to a developer-first model, giving creators time to build the apps and interactions that make sense on a spatial, hands-free device. Spinning out Specs suggests Snap believes the experience and the ecosystem are ready for a broader audience.

What the New Specs Promise for Everyday AR Use

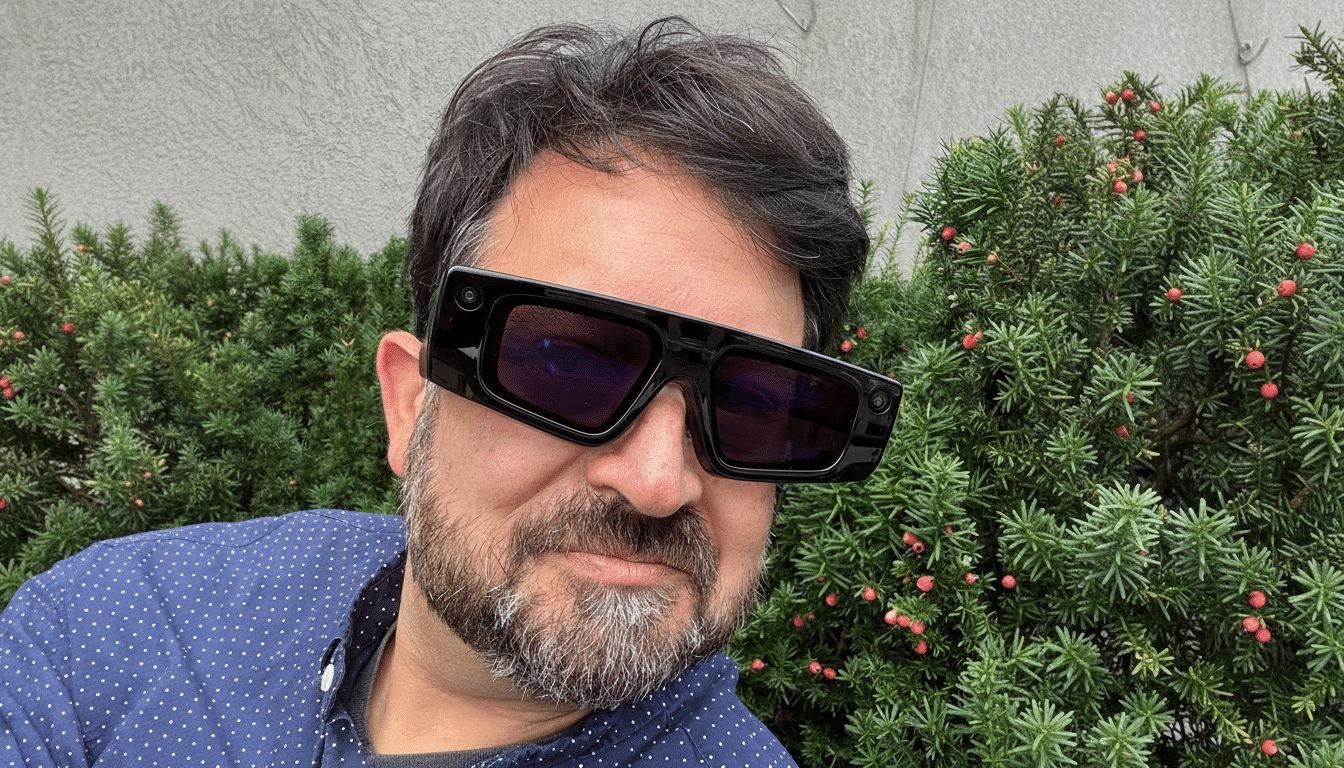

The latest Specs prototypes lean heavily on spatial understanding. Four on-board cameras enable hand tracking and environmental awareness, feeding Snap’s Spatial Engine to anchor graphics in the real world with believable occlusion and persistence. That foundation unlocks interactions a phone can’t match: glanceable prompts, object-aware overlays, and quick, two-handed input without pulling a device from a pocket.

Shared experiences are a highlight. Multiple wearers can synchronize sessions so everyone sees the same virtual character, game element, or instruction pinned to the same physical space. During internal and partner demos, gameplay inspired by major entertainment franchises showed how multiplayer AR can feel less like a tech demo and more like a living-room console—minus the console.

Hardware trade-offs remain. Recent units weigh close to 8 ounces and can warm up under sustained use, a common challenge for camera-rich eyewear. Snap says the consumer design is still in flux, with changes expected to improve comfort, thermals, and battery robustness. The company has hinted at tighter integration with its lens ecosystem, which could bring creator effects, try-on commerce, and utility tools (think translations or tutorials) to the frames at launch.

The Competitive Landscape in Smart Glasses and AR

Snap is stepping into a field dominated by incumbents with deep hardware benches. Meta’s partnership with EssilorLuxottica has put smart glasses into familiar Ray-Ban and Oakley frames, with recent models adding on-device AI and better cameras. Apple’s spatial computing push, though focused on a different form factor, has raised consumer expectations for immersive experiences and developer tools. Analysts at IDC and CCS Insight note that camera-forward smart eyewear remains a niche today, but unit volumes are steadily climbing from the low-millions base as components shrink and use cases sharpen.

Snap’s opportunity lies in software differentiation and network effects. It already operates one of the world’s largest AR distribution platforms inside Snapchat, and Lens Studio has cultivated a global creator community that understands what resonates in social contexts. If Specs launches with seamless ties to Lenses, Memories, and creator-built utilities, Snap can seed usage without starting from zero—an advantage few hardware-first rivals enjoy.

Why Structure Matters for Snap’s Smart Glasses Push

As a standalone entity, Specs Inc can negotiate directly with chipmakers, optics suppliers, and contract manufacturers, while pursuing co-branding with eyewear companies where it makes sense. The structure also simplifies compliance and certification across regions, and it leaves the door open to partnerships or joint ventures that would be harder to execute inside the core app business. For investors, the separation clarifies cost centers and could make hardware progress easier to track.

The stakes are significant. Snap’s ads and AR platform reach hundreds of millions of daily users, giving Specs a built-in audience for discovery, support, and updates. If the glasses can deliver reliable comfort, a clear value proposition beyond novelty, and privacy protections that pass public scrutiny, Snap could finally turn its long-running AR research into a mainstream product line. Price, battery life, and compelling day-one software will be the first tests.

There’s no firm retail date yet, but the formation of Specs Inc suggests Snap is shifting from R&D to go-to-market mechanics. With rivals moving quickly and consumer expectations rising, the message is clear: Snap intends to compete in smart glasses not as a hobby, but as a business.