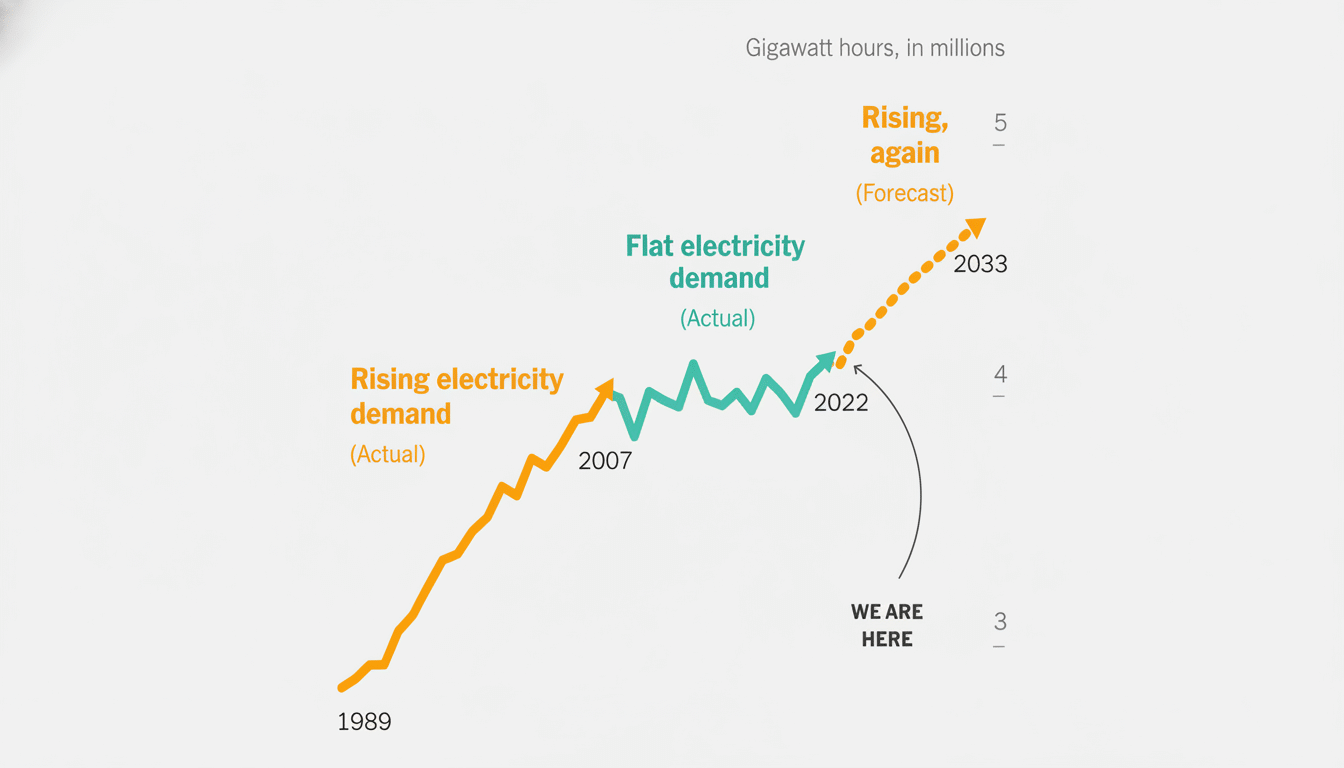

The rapid build-out of data centers is crashing into winter’s harshest stress test on the grid, prompting fresh warnings that severe storms could lead to shortfalls and possibly even rolling blackouts. A new winter outlook from the North American Electric Reliability Corporation forecasts that peak demand on the grid will increase by nearly 2.5% over last year, bringing in about 20-odd gigawatts across the continent — a more extreme jump than usual, largely resulting from always-on digital infrastructure used to provide AI and cloud computing.

Why AI Data Centers Make Winter Reliability More Complicated

Data centers, unlike most commercial loads, consume and operate at full power all days of the week with no time to dial back on a tight day. The constant draw is a weakness when winter storms knock out generators simultaneously — particularly gas plants prone to freeze-offs in power supplies and equipment — and whipsaw heating demand. NERC points out that the latest generation of AI facilities also includes dense compute clusters and liquid cooling, which further increase site-level power demand.

One hyperscale campus alone can consume 100 to 500 megawatts, comparable to a midsize city. Clusters of such campuses in select counties — go ahead and conjure up Northern Virginia’s “Data Center Alley” or fast-growing hubs in Georgia, Ohio, and Arizona — can swamp local transmission at peak times without upgrades on schedule. Dominion Energy had previously warned of transmission constraints associated with Virginia’s accumulation of facilities, and several utilities have lifted load forecasts as pipelines of new data center projects lock in.

The International Energy Agency estimates that global data center electricity use could hit 800–1,000 terawatt-hours in the middle part of this decade, with AI workloads a major factor.

That macro trend has trickled down to the regional level in winter reliability modeling, where compute demand timing and inflexibility are as relevant as totals.

Areas With the Toughest Reserve Margins This Winter

Areas of concern for NERC are the Mid-Atlantic, U.S. Southeast, West, and Texas when it comes to rapidly expanding data center load squeezing reserve margins.

PJM, which covers a large portion of the Mid-Atlantic region, has long pointed to demand growth driven by data centers in its planning outlooks. In the Southeast, utilities from Georgia to Tennessee are rushing to buy new generation and upgrade grids to match clusters of new campuses.

Texas is a specific focus because it can experience both fuel supply constraints and extreme cold at the same time. The 2021 crisis exposed weaknesses in gas delivery systems and generator winterization. Since then, the ERCOT system has added thousands of megawatts of battery storage and enhanced weatherization that should ameliorate low power spikes. Yet an extended cold spell is difficult to handle when data center load is flat and storage fleets run dry within hours.

Batteries Help But Limits to Durations Remain

Batteries that can supply power for a short time are good at meeting evening peaks and smoothing irregular imbalances. Today, most installations offer 2–4 hours of discharge — great for handling short demand spikes or genset trips. Winter storms, on the other hand, can be multi-day stress events. If thermal plants underdeliver and imports are limited by weather, operators might be inclined not to use batteries serving baseload-like demands from data centers in order to conserve them for contingencies.

It’s why grid planners preach a portfolio approach: more winterization for gas units and fuel systems, demand response that can shed large blocks with quick speed, incremental flexible generation, and transmission that can carry power across regions when storms are localized. Following Winter Storm Elliott, PJM and others raised penalties and performance standards to ensure that units themselves perform when dispatched in severe conditions.

How Operators and Data Centers Can Mitigate Risk

Data center operators are beginning to behave like grid citizens, not simple passive loads. Best practices that are emerging now include:

- On-site battery storage sufficient to ride through a few hours

- Dynamic involvement in demand response programs

- Moving latency-insensitive AI training or batch jobs outside peak windows

- On-site generation using low-emission fuels

- Reusing heat to serve nearby buildings, reducing combined electric and thermal demand during cold snaps

Utilities and regional operators are promoting these measures. NERC, ERCOT, and PJM have all favored firm service with curtailment provisions during emergencies. Where possible, siting data centers near strong transmission nodes and renewable hubs can reduce congestion risk for such load, particularly when combined with long-duration storage pilots that extend coverage from a single evening peak.

What to Look For as Winter Storms Develop

Three indicators will tell if blackout risks are moderating or increasing:

- The pace of interconnection upgrades in data center hot spots

- The deployment of longer-term storage and fast-ramping resources

- The depth of voluntary curtailment tools that larger customers would be willing to accept

If those continue in the right direction, the grid can handle the compute boom without compromising reliability.

But if bad storms come in advance of those steps scaling, operators could once more require emergency imports, public appeals for conservation, and load curtailments — first among commercial and industrial users with high loads. The bottom line from reliability planners is this: the digital economy’s winter resilience will be determined by how fast data centers transition from giant, immovable loads to flexible partners in grid operations.