Skild AI has surged to a valuation above $14 billion after closing a $1.4 billion Series C, a rapid ascent that underscores how aggressively investors are backing foundation models for robotics. The round was led by SoftBank with participation from Nvidia, Macquarie Group, 1789 Capital, and others, according to Bloomberg. The company has now raised more than $2 billion in total and has more than tripled its valuation in roughly seven months.

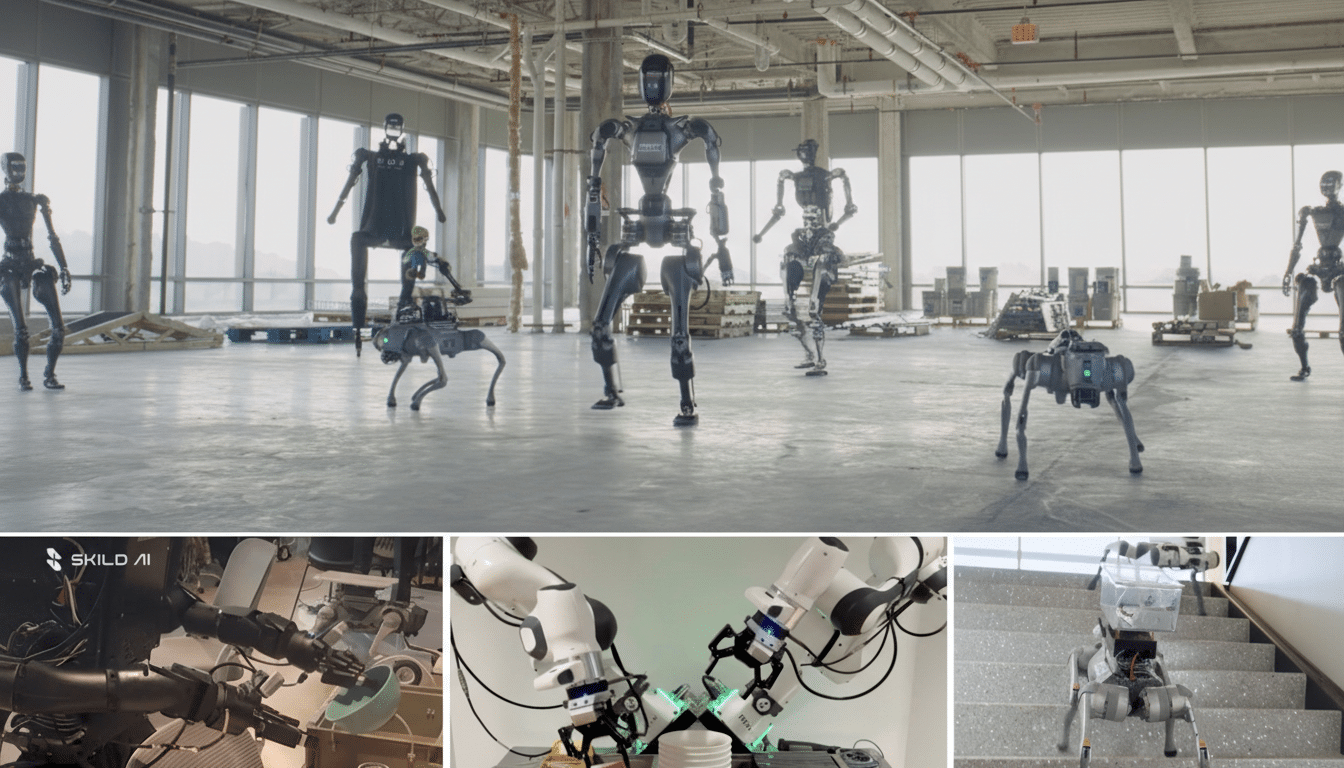

Founded by CEO Deepak Pathak, Skild AI builds general-purpose software for robots that promises to adapt across different hardware and tasks with minimal retraining. Rather than programming a robot for each new action, Skild’s models aim to learn from large-scale datasets—teleoperation logs, simulation, and video of humans performing tasks—and generalize skills in the wild.

Why Investors Are Betting On Robot Foundation Models

Traditional automation excels at repetitive, structured workflows. The bottleneck has always been task variability: even small changes in objects, lighting, or layouts can break a carefully tuned system. Foundation models promise a step-change by learning transferable representations that handle unfamiliar scenarios without exhaustive reprogramming.

The appeal is practical. If a single model can be fine-tuned to run on a bin picker today, a mobile manipulator tomorrow, and a humanoid later—without an expensive, months-long integration per setting—the cost curve for robotics adoption improves dramatically. Research directions such as vision-language policies, world models, and diffusion-based controllers, exemplified by work from Google, DeepMind, and university labs, show how robots can parse instructions, reason about scenes, and correct actions in real time.

Market signals support the thesis. The International Federation of Robotics has reported record-level global installations of industrial robots and a growing installed base, while logistics and manufacturing continue to chase productivity gains amid labor shortages and demand volatility. A software layer that makes heterogeneous fleets more adaptable is precisely where value is concentrating.

Strategic Backers And The Ecosystem Play

SoftBank’s lead role fits its long-standing conviction that robotics and AI are converging into an infrastructure layer. Nvidia’s participation is equally strategic: its edge platforms, such as Jetson and the Isaac robotics stack, benefit when developers deploy compute-hungry models at scale. Macquarie’s interest reflects automation’s growing relevance in industrial infrastructure, from fulfillment centers to energy and utilities.

For Skild AI, those relationships can accelerate real-world deployment. Expect partnerships with robot OEMs and systems integrators, with business models ranging from per-robot subscriptions to API-based usage. The core challenge is not merely training large models; it’s building a data engine—collecting, curating, and continuously improving multimodal datasets across diverse environments while maintaining safety and compliance.

Where Skild AI Fits In A Crowded Robotics Field

The race to general-purpose robot intelligence is heating up. Covariant has introduced a robotics foundation model to expand beyond e-commerce picking. Nvidia has unveiled efforts in world models for embodied agents. Humanoid-focused groups like Figure, Sanctuary AI, and 1X are showcasing increasingly capable systems, with 1X also releasing a world model for generalization across tasks. Field AI is among startups pursuing flexible software that can be deployed on existing robot platforms.

Skild AI’s differentiation is its retrofit-first software posture. Rather than anchoring around one flagship robot, it aims to be the intelligence layer that can sit atop many embodiments—industrial arms, mobile bases, and emerging humanoids—abstracting away differences in kinematics and sensors. If achieved at scale, that creates a powerful network effect: each new deployment generates more data to improve a shared model, which in turn reduces integration friction for the next deployment.

The Hard Problems Still Standing In The Way

Generalization is the promise, reliability is the hurdle. Robots need consistent behavior across long horizons, with graceful failure modes and robust recovery. That demands heavy investment in evaluation harnesses, real-to-sim feedback loops, and data governance to avoid spurious correlations that only work in the lab.

Safety and compliance add another layer of complexity. In factories and warehouses, models must meet strict functional safety standards and operate under tight latency and power budgets at the edge. Security matters too: as robots become networked and model updates ship over the air, software supply chains and runtime monitoring become mission-critical.

What A $14B Price Tag Signals For Robot Software

This valuation suggests investors believe general-purpose robot software is nearing commercial breakout. If Skild AI can demonstrate reliable cross-robot performance and unit economics that make sense—shorter integrations, lower per-task costs, higher uptime—it will validate the idea that the most valuable layer in robotics is increasingly software-first.

The next milestones will be depth, not demos: multi-site deployments, measurable reductions in time-to-autonomy, and customer references across distinct industries. With capital, strategic partners, and escalating demand for adaptable automation, Skild AI now has the runway to prove that foundation models can move robots from brittle tools to flexible collaborators.