Ethos Technologies, the Sequoia-backed life insurance software provider, opened trading on the Nasdaq under the ticker LIFE after raising roughly $200 million by selling 10.5 million shares at $19. The stock finished its first session at $16.85, down 11%, but the listing still marks a notable milestone for an insurtech sector that has struggled to convert venture momentum into durable public companies.

Ethos arrives as a bellwether for the new IPO cycle and a case study in how a capital-light, distribution-centric model can find daylight where rivals stalled. The company is not an insurer; it is a licensed agency and software platform that makes selling term life policies faster for consumers, agents, and carriers.

- Why Ethos Reached The Public Market And How It Positioned Itself

- A Capital-Light Model That Reduced Risk For Growth

- What Set It Apart From Fallen Rivals In Insurtech

- Inside The Numbers Investors Are Watching

- Why Going Public Matters To Carriers And Partners

- What To Watch Next As Ethos Navigates Public Markets

Why Ethos Reached The Public Market And How It Positioned Itself

When the easy-money era ended, Ethos pivoted decisively to profitability rather than chasing maximum growth at any cost. According to its IPO filing, the company turned the corner to profitability by mid-2023 and sustained year-over-year revenue growth above 50% through 2025.

In the nine months ended September 30, 2025, Ethos reported nearly $278 million in revenue and about $46.6 million in net income. That mix of expansion and earnings power is precisely what public investors have demanded after a string of unprofitable tech debuts in recent years.

A Capital-Light Model That Reduced Risk For Growth

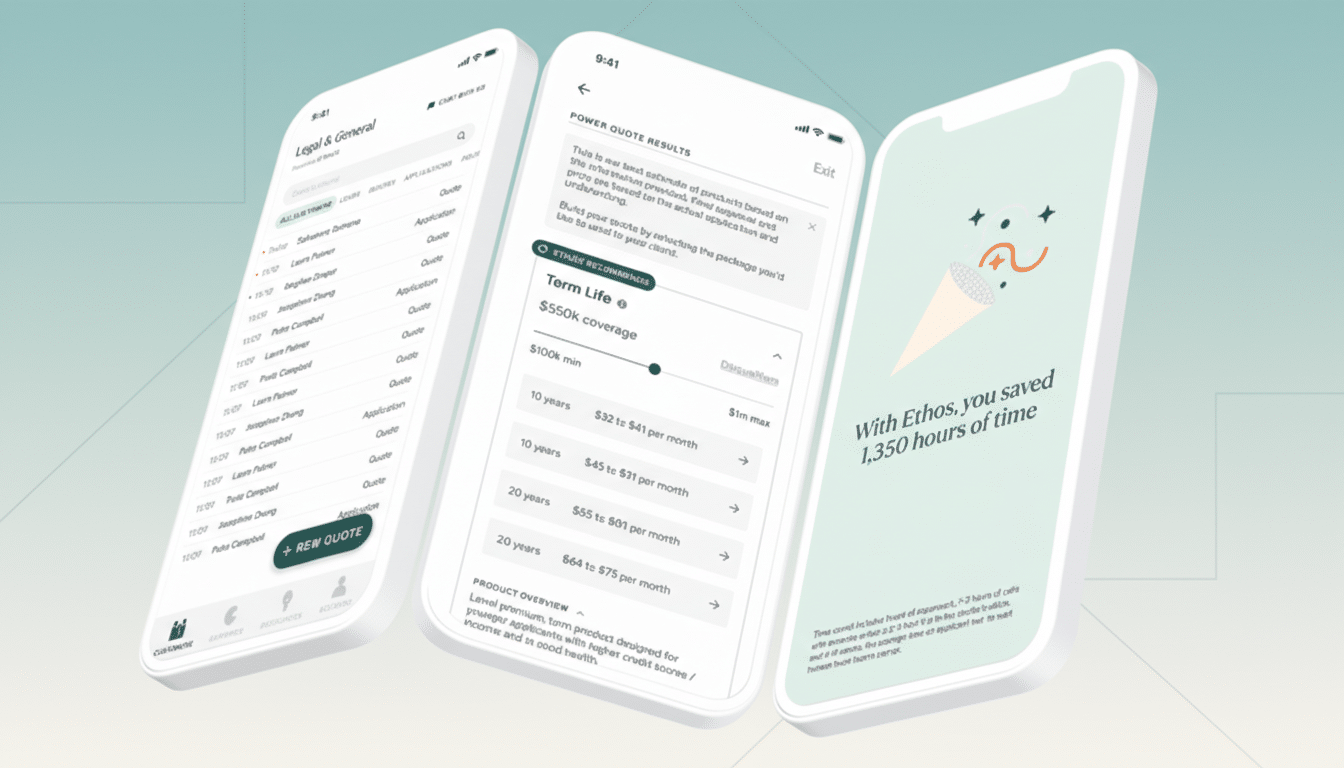

Ethos operates a three-sided marketplace: consumers can buy term life in minutes without medical exams, independent agents use the company’s software to streamline sales, and carriers leverage Ethos for underwriting and administrative services. More than 10,000 agents work on the platform, and marquee insurers such as Legal & General America and John Hancock power the underlying policies.

Because Ethos earns commissions and software-driven fees rather than taking on underwriting risk, it avoids the capital intensity and loss volatility that weighed on some earlier insurtechs. This structure also lightens regulatory capital requirements compared with being a full-stack insurer, while still benefiting from modernization in underwriting and distribution that industry analysts at LIMRA and AM Best have highlighted as key growth areas.

What Set It Apart From Fallen Rivals In Insurtech

Several high-profile peers struggled to scale sustainably. Policygenius, an insurance marketplace that raised more than $250 million from investors including KKR and Norwest Venture Partners, was acquired by Zinnia in 2023. Health IQ, backed by well-known venture firms, filed for bankruptcy that same year.

Ethos took a different path. Rather than relying primarily on expensive direct-response marketing, it leaned into agent enablement and embedded distribution to lower customer acquisition costs and improve conversion. Industry groups like LIMRA have consistently noted that human-assisted sales remain dominant in U.S. life insurance; Ethos met the market where it is, using automation to augment agents rather than attempting to displace them outright.

Crucially, the company diversified supply across established carriers, avoiding concentration risk and pricing shocks. That partner-first posture fostered resilience when advertising markets whipsawed and when investors soured on models that shouldered balance-sheet risk without sufficient scale or pricing power.

Inside The Numbers Investors Are Watching

Ethos ended its first trading day with a market capitalization near $1.1 billion, well below the $2.7 billion valuation it achieved in a 2021 private round led by SoftBank Vision Fund 2. The downshift underscores the broader valuation reset across late-stage venture portfolios.

Key backers include Sequoia, Accel, GV, SoftBank, General Catalyst, and Heroic Ventures. Notably, Sequoia and Accel did not sell in the IPO, a vote of confidence as the company transitions to public markets. From here, investors will scrutinize channel mix, policy retention, and cohort profitability to gauge how durable Ethos’s unit economics are through different rate cycles and consumer demand environments.

Why Going Public Matters To Carriers And Partners

For century-old insurers, vendor selection hinges on trust, compliance, and longevity. By entering the public markets, Ethos gains additional transparency through SEC reporting and the governance rigor that large enterprise partners and state insurance regulators value, including oversight frameworks aligned with NAIC standards.

That credibility can be a meaningful commercial lever. Large carriers are more likely to commit meaningful distribution and underwriting volume to partners with balance-sheet visibility and stable access to capital—advantages a public listing can enhance.

What To Watch Next As Ethos Navigates Public Markets

Ethos’s near-term challenge is to balance growth with margin discipline as it scales its agent network and self-serve channels. Any shifts in carrier pricing, reinsurance capacity, or consumer demand for term life could ripple through commission revenue, making diversification and product breadth important hedges.

If Ethos can maintain profitability while compounding revenue and deepening carrier partnerships, it could become the rare insurtech to translate startup velocity into sustained public-company performance. In an industry where many digital upstarts hit the wall, Ethos’s path suggests that distribution excellence and capital-light focus still travel the farthest.