Sarvam has rolled out Indus, a new AI chat app for web and mobile, staking its claim in a market where OpenAI, Anthropic, and Google already loom large. Built around Sarvam’s newly unveiled 105-billion-parameter model, the launch signals a push to create India-first AI that can serve local languages, devices, and use cases at scale.

What Indus Brings to the Chatbot Race in India Today

Indus is designed as a conversational interface that accepts typed or spoken prompts and delivers responses in text or audio. It is currently in beta on iOS, Android, and the web, with sign-in via phone number, Google, or Apple ID. Availability appears limited to India for now, underscoring Sarvam’s focus on building a mass-market assistant tuned to local context and multilingual needs.

- What Indus Brings to the Chatbot Race in India Today

- A New Indian Model Stack: Sarvam 105B and 30B Explained

- Early Limitations and Sarvam’s Planned Phased Rollout

- Competition Intensifies as Generative AI Usage Surges in India

- Partnerships Hint at Device and Enterprise Ambitions

- Why This Indus AI Launch Matters for India’s AI Future

The product choice is telling. In a country with more than a billion mobile connections and dozens of widely used languages, voice-first experiences and adaptive multilingual support are not features—they’re table stakes. Sarvam’s positioning suggests it aims to reduce friction for everyday queries, customer support, and productivity tasks in the languages people actually use at home and work.

A New Indian Model Stack: Sarvam 105B and 30B Explained

Indus rides on Sarvam 105B, a large language model unveiled alongside a leaner 30B variant at the India AI Impact Summit. Parameter count isn’t a perfect proxy for capability, but the 105B size places Sarvam in the upper tier for models developed by Indian startups, aimed at richer reasoning, longer-context tasks, and more nuanced language handling. The 30B model likely serves latency- and cost-sensitive scenarios where faster responses beat maximal depth.

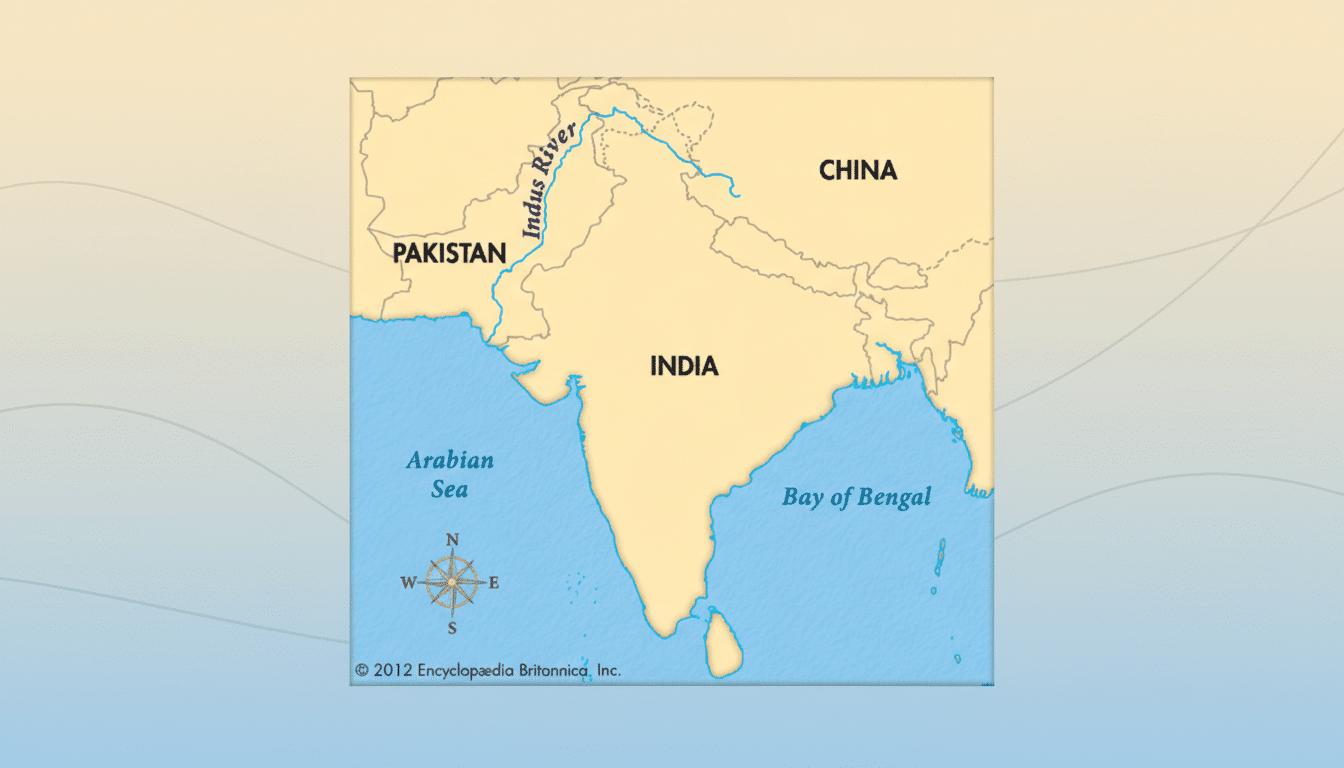

Sarvam says it is tailoring its stack for India’s linguistic and cultural diversity. That ambition matters: India recognizes 22 scheduled languages and thousands of dialects, a reality that often exposes global models’ blind spots. Success will hinge on data coverage, guardrail quality, and domain adaptation—not just raw scale.

Early Limitations and Sarvam’s Planned Phased Rollout

As a beta, Indus carries constraints. Users currently cannot delete individual chat histories without deleting their account, and there’s no option to disable the app’s “reasoning” behavior, which can slow some responses. Sarvam has cautioned that access may be throttled while it expands compute, and some users may initially hit a waitlist.

Co-founder Pratyush Kumar noted on X that access will broaden over time and that the team is actively collecting user feedback to refine the experience. That loop will be vital if Sarvam wants to differentiate on utility and trust, not only on domestic provenance.

Competition Intensifies as Generative AI Usage Surges in India

India has rapidly emerged as one of the world’s most active markets for generative AI. OpenAI has said ChatGPT now counts more than 100 million weekly active users in the country, and Anthropic reports India represents 5.8% of global Claude usage, second only to the U.S. Those numbers underscore both demand and the opportunity for localized offerings that speak to Indian languages, price points, and device realities.

Global incumbents are pushing hard—Google continues to expand Gemini’s Indic language capabilities—while homegrown efforts are gathering steam. Beyond Sarvam, Indian initiatives such as Krutrim are building model ecosystems tailored to local data and deployment needs. The competitive edge for domestic players will likely come from language coverage, edge deployments, and enterprise customization, areas where proximity to users and partners can matter as much as model benchmarks.

Partnerships Hint at Device and Enterprise Ambitions

Alongside the model reveal, Sarvam announced partnerships with HMD to bring AI features to Nokia feature phones and with Bosch for automotive applications. That span—from entry-level devices to in-vehicle systems—highlights a strategy that looks beyond a single chat app toward embedded AI across India’s device spectrum.

Feature phones remain a significant slice of India’s handset base, and AI that works reliably with constrained hardware and patchy connectivity could be transformative for first-time or non-English users. In the car, low-latency voice assistance and on-device reasoning can enhance safety and personalization. Sarvam has also flagged hardware plans and enterprise offerings, signaling it wants to compete where value pools are shifting: at the edge and inside business workflows.

Why This Indus AI Launch Matters for India’s AI Future

Indus arrives at a pivotal moment. India is investing in AI infrastructure through initiatives championed by the Ministry of Electronics and IT, and public platforms like Bhashini aim to broaden access to high-quality language data and tools. As cloud and compute capacity scale—helped by partnerships among global chipmakers and Indian conglomerates—the door opens for domestic models to improve quickly and serve use cases that global players may overlook.

The road ahead is crowded and technically demanding. Yet if Sarvam can pair strong research with disciplined product execution—faster responses, better guardrails, richer Indian language support, and thoughtful privacy controls—Indus could become more than another chatbot. It could be a fixture across devices and industries, and a proof point that India can build world-class AI for its own market at global scale.