Samsung has worn the Android crown for more than a decade, but the throne is wobbling. Competitors are catching up on hardware, software promises are no longer unique, and the company’s most daring ideas face real pressure from upstarts. So is Samsung still the Android king, or has it already crested?

Where Samsung still leads on scale, software, and security

Scale, distribution, and brand power still tilt the market in Samsung’s favor. Its devices are sold virtually everywhere, supported by strong carrier relationships and aggressive trade-in programs that keep premium phones within reach. That reach matters when rivals are still building retail footprints.

On software, Samsung has transformed from laggard to leader. The Galaxy S24 family launched with a seven-year update pledge, matching or beating much of the industry and turning One UI into a safe long-term bet. Enterprises also value the Knox security stack and device management tools, which are widely certified by governments and regulators worldwide.

The numbers still show muscle. IDC reported that Samsung reclaimed the top spot in global smartphone shipments in early 2024 after Apple edged it for the full year 2023. Even with quarterly swings, maintaining a consistent top-two position across regions is a sign of resilient demand and operational depth.

Signals of a plateau in innovation, foldables, and chips

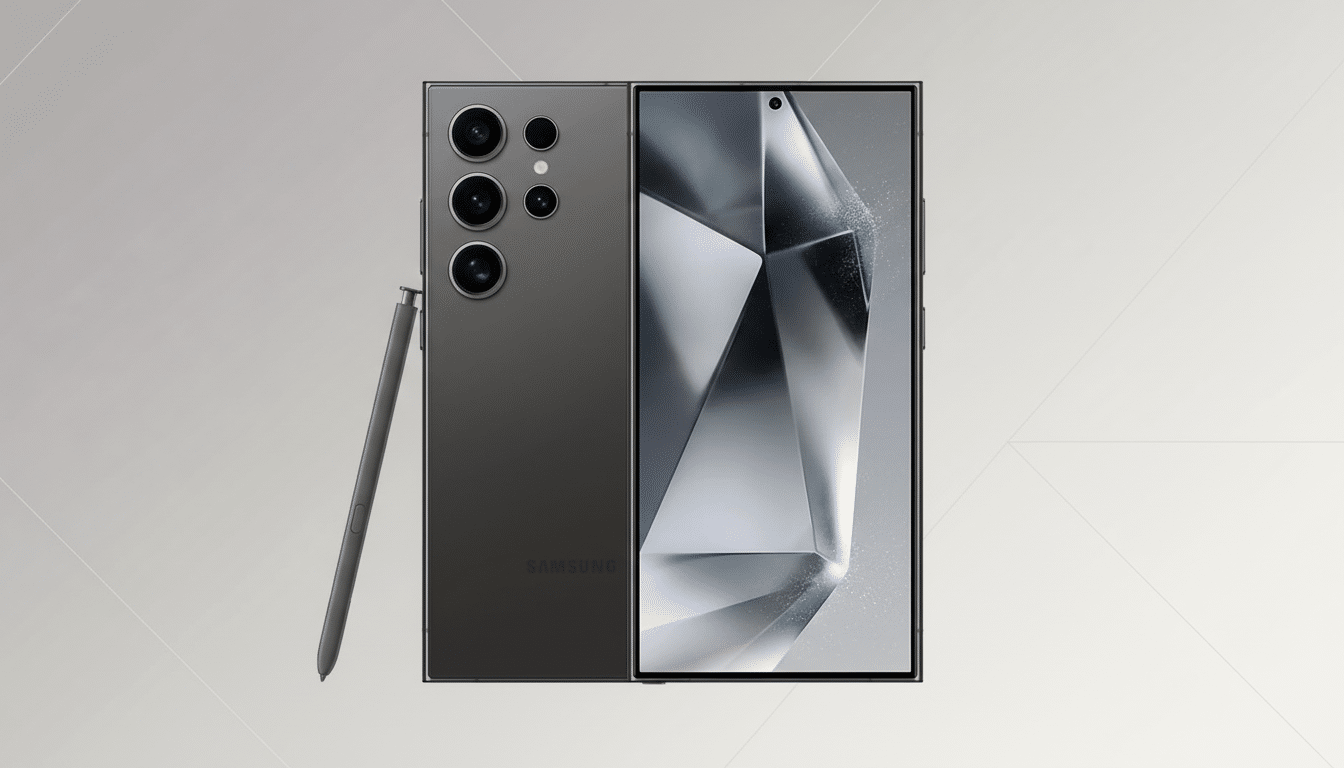

Innovation cadence is the critique most often leveled at Samsung lately. The Galaxy S line has seen careful, sometimes conservative evolution—excellent, yes, but rarely jaw-dropping. The S24 Ultra’s telephoto shift prioritized overall image quality but felt like a step sideways to power users; the core camera stack has changed less than rival overhauls from brands chasing 1-inch sensors and brighter optics.

Foldables, once Samsung’s uncontested sandbox, are no longer a one-horse race. Counterpoint Research estimates that Huawei led global foldable shipments in Q1 2024 with roughly 35% share, ahead of Samsung at around 23%. In China, Honor and Huawei are setting the pace on thinness, battery life, and crease reduction. Motorola has made clamshells cool again in the West, while OnePlus and Oppo continue to iterate quickly.

Chip strategy remains a sore point for enthusiasts. Year-to-year performance and efficiency can vary depending on whether a region receives Snapdragon or Exynos variants, clouding the message for power users who expect consistency across markets.

There’s also the perception problem. Supply-chain chatter suggests more incremental changes across upcoming flagships, and rumors hint at tweaks to S Pen capabilities and camera tuning rather than wholesale reinvention. While leaks rarely tell the full story, the narrative of “safe and steady” isn’t the kind of momentum that wins mindshare in a year of rapid AI pivots.

Competition on every front, from Pixels to Chinese OEMs

Google has turned the Pixel into a software statement piece. With seven years of updates and a clear AI roadmap, Pixel offers an alternative to Samsung’s feature-rich approach—leaner UI, bold computational photography, and first-in-line Android releases.

Chinese OEMs are applying pressure from both ends. At the high end, Xiaomi, Honor, and Oppo deliver premium cameras and ultra-fast charging at aggressive pricing, often with lighter devices. In the midrange, brands like Xiaomi’s Redmi, OnePlus Nord, and Transsion’s Tecno and Infinix have expanded rapidly across Asia, Africa, and parts of Europe with surprisingly polished $200–$400 phones. Samsung’s A-series is better than ever, but the price-to-spec calculus is tighter than it has been in years.

Even in wearables and tablets—areas where Samsung traditionally pairs its phones effectively—competition has stiffened. Google’s Pixel Watch ecosystem is maturing, while Huawei and Apple exert gravitational pull on either side of Samsung’s cross-platform ambitions.

What could reignite momentum for Samsung’s Android leadership

Samsung still controls critical parts of the stack—displays, memory, batteries, and advanced manufacturing. It can leverage that vertical integration to push ultra-thin foldables, brighter LTPO panels, and longer-lasting cells into mainstream price tiers faster than rivals can copy.

A true camera reset would resonate. A larger primary sensor, better low-light periscope optics, and streamlined processing that preserves texture could vault Galaxy flagships back to the top of camera rankings. Pair that with a unified global chipset strategy and the performance narrative clears up overnight.

On software, Galaxy AI needs to move from eye-catching demos to everyday utility. Seamless on-device summarization, translation, and creative tools that work reliably offline—and across phones, tablets, watches, and TVs—would give Samsung a stickier ecosystem story than faster charging or one more lens ever could.

The bottom line on Samsung’s future in the Android market

Samsung is still the default Android choice for millions, with unmatched distribution, long updates, and a broad ecosystem. But the crown is contested. Market data shows leadership is no longer a formality, and rivals are out-innovating in niche categories that once belonged solely to Galaxy.

Past its peak? Not yet. At risk of coasting? Absolutely. The next two product cycles will decide whether Samsung defines the Android future—or just defends its present. If the company couples bolder hardware with meaningful, durable AI features, it can keep the throne. If not, the Android kingdom is ready for a new royal rotation.