Samsung has set the U.S. sticker price for its Galaxy Z TriFold at $2,899, signaling an aggressive bid to define the ultra-premium end of the foldable market. The device unfolds twice to reveal a tablet-like 10-inch canvas — the largest display yet on a Galaxy phone — and arrives with 512GB of storage in a single black finish.

Price Sets a New Bar for Foldables in the U.S. Market

At $2,899, the TriFold becomes the most expensive mainstream smartphone on sale in the U.S., surpassing even maxed-out traditional flagships and Samsung’s own Galaxy Z Fold line. It’s a clear message: this is a showcase device aimed at buyers who want the cutting edge and are willing to pay for it.

- Price Sets a New Bar for Foldables in the U.S. Market

- Design Targets Tablet-Class Tasks and Long-Term Durability

- Direct Sales Strategy Skips Carriers in the U.S. Market

- A First for the U.S. Market in TriFold Devices and Apps

- Who This Device Is For: Early Adopters and Creators

- Competitive Context in the Race for Flexible Screens

That pricing also reflects the realities of multi-fold hardware. Two hinges, multiple display layers, and the mechanical tolerances required to keep a 10-inch panel crease-managed and aligned drive costs well beyond a single-fold design. Display Supply Chain Consultants has long noted that multi-fold panels are among the most complex and yield-sensitive screens to manufacture, which explains why early models arrive at rarefied prices.

Design Targets Tablet-Class Tasks and Long-Term Durability

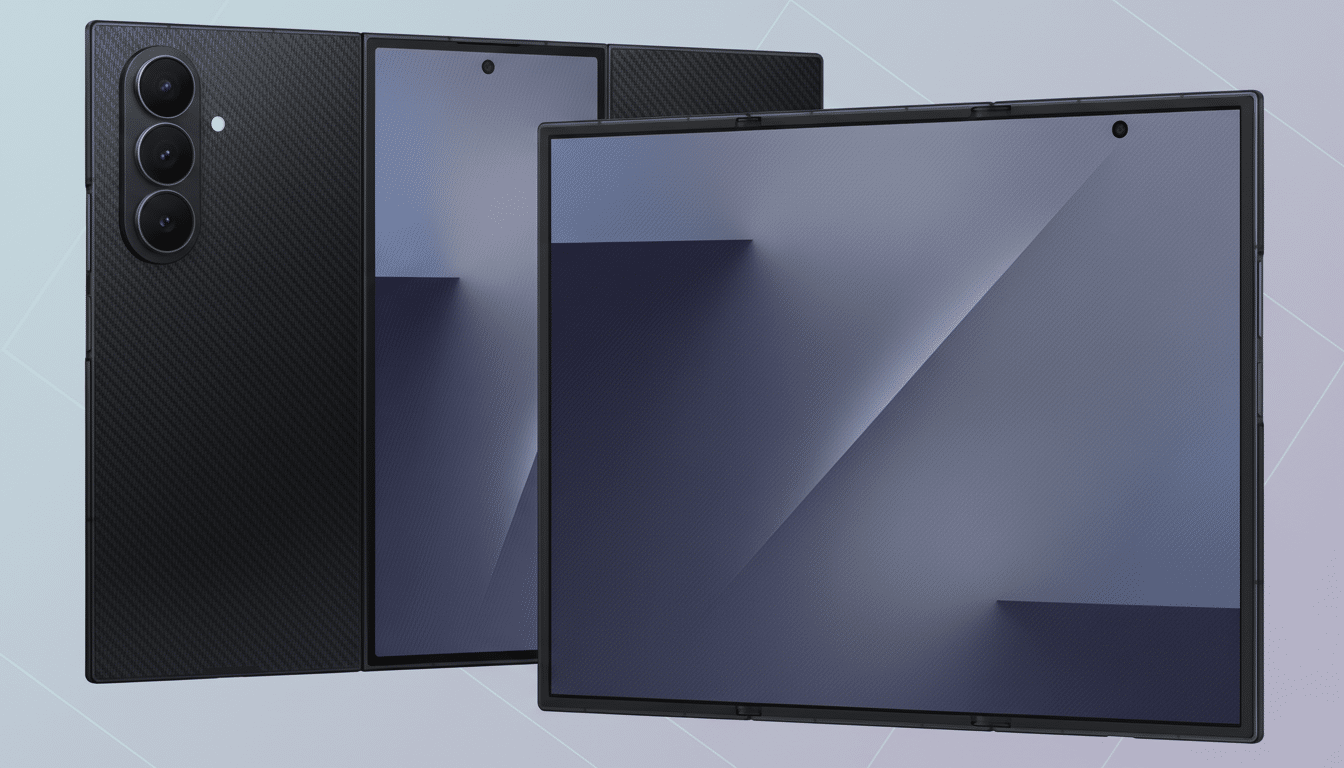

Samsung’s engineering brief emphasizes both size and survivability. The TriFold measures just 3.9 millimeters at its thinnest point when open, a figure that speaks to the company’s relentless thinning of glass, adhesives, and hinge components. It’s rated for up to 200,000 folds — roughly 100-plus opens and closes a day for five years — a useful real-world translation for anyone worried about longevity.

The expanded 10-inch display pushes the TriFold into a space usually reserved for compact tablets. That extra area should make multi-window workflows less cramped, whether it’s side-by-side email and documents, a timeline view in a mobile video editor, or full-page note-taking. Early foldables proved that more screen changes how people use phones; this much screen could blur the boundary between phone, tablet, and travel laptop.

Direct Sales Strategy Skips Carriers in the U.S. Market

In the U.S., the TriFold will be sold through Samsung.com and Samsung Experience Stores, not through carriers. That’s unusual for a flagship-priced device and has real implications: most Americans still buy phones via carrier installments, and skipping that channel limits exposure — and financing options — for a phone at this price point.

It also suggests Samsung wants to control the narrative and the margins. Direct sales let the company manage inventory, educate buyers with in-person demos, and build packages around trade-ins and accessories without carrier constraints. Expect Samsung to lean on generous trade-in credits and limited-time promos to broaden the TriFold’s appeal, a playbook it has used effectively with prior foldables.

A First for the U.S. Market in TriFold Devices and Apps

While Huawei has showcased trifold hardware abroad, the Galaxy Z TriFold is the first of its kind available stateside. That gives Samsung a head start in defining what a tri-panel experience looks like for U.S. consumers and developers. The company’s Android customization and multitasking features already underpin its single-fold devices; expanding those experiences onto a 10-inch canvas will be the next test.

It lands amid a steadily growing foldable category. Counterpoint Research estimates global foldable shipments grew about 25% in 2023 to roughly 16 million units, even as the broader smartphone market was flat. DSCC expects multi-fold devices to remain niche near term, but they’re important as halo products that stretch what’s possible — and reset expectations about what a “phone” can be.

Who This Device Is For: Early Adopters and Creators

The TriFold is overkill for casual upgraders. Its natural audience includes early adopters, mobile professionals who prioritize on-the-go productivity, and creators who benefit from a larger canvas without carrying a second device. For this crowd, the calculus is straightforward: pay laptop-level money to consolidate a phone and tablet into a single object that shrinks into a pocket.

For everyone else, the TriFold’s existence still matters. High-end experiments have a way of setting design language and software expectations that trickle down. If Samsung nails the hinge feel, crease visibility, and app continuity here, those wins are likely to inform the next generation of more affordable foldables.

Competitive Context in the Race for Flexible Screens

Samsung isn’t alone in chasing the future of flexible screens. Chinese brands have pushed out lighter and thinner folds, while U.S. buyers have watched from afar due to limited availability. Apple remains the wild card; industry analysts and supply chain chatter continue to point to active work on foldable concepts, though nothing has been made official.

For now, the TriFold plants a very expensive flag. It’s both a product and a provocation — a statement that the next chapter of mobile won’t be a single slab of glass, and that some buyers will pay a premium to live in that future first.