Samsung is planning its biggest foldable push yet, with an aim to sell around five million of the Galaxy Z Fold and Flip in 2021, according to a report out of Korea from Maeil Business News passed along by 9to5Google. The initiative also highlights how the industry comes to believe that foldables are emerging from a niche market and entering the mainstream in earnest, as new models are expected to launch around midyear as part of a broader thrust to sell more mobile phones.

The company’s mobile arm has indicated ambitious aims all across the portfolio, but it is a high-wire target because it builds on Samsung’s early lead in the category by seeing how far consumer appetite for foldables can stretch when better hardware and AI-heavy features are available.

- Samsung Makes a Big Bet on Foldables as Demand Grows

- Inside the Five Million Foldable Phone Sales Target

- AI and Hardware Upgrades Seen as Growth Triggers

- Pricing and Channels Will Be Make or Break

- Competitive Pressure Is Rising Across the Foldable Market

- What to Watch as Samsung Targets Five Million Foldables

Samsung Makes a Big Bet on Foldables as Demand Grows

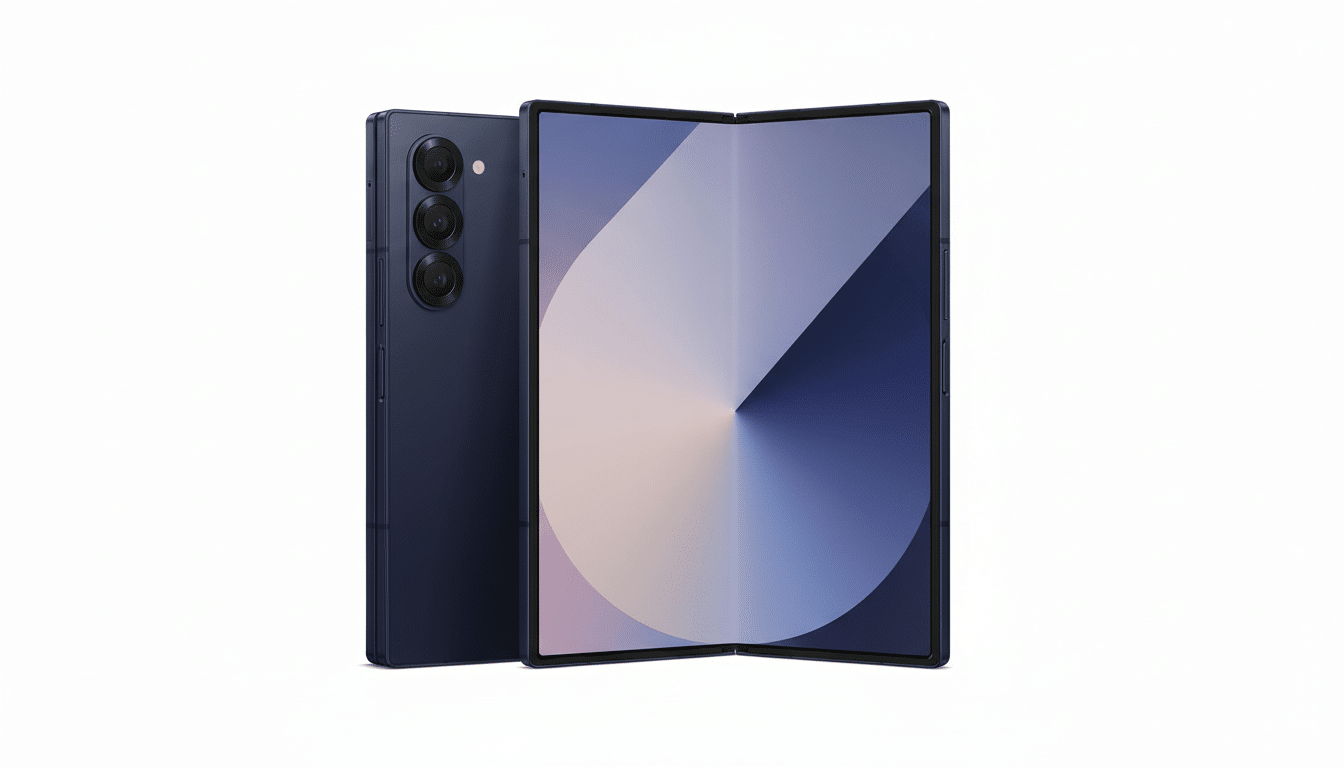

Foldables have come along quickly: hinges are stronger, displays brighter and more durable, software is much better about taking advantage of a larger and flexible screen. What started as an early-adopter experiment is now a strategic growth area that Samsung sees as a flagship-caliber pillar of its business, one to stand next to the brand’s traditional slab phones.

Market watchers like IDC and DSCC have estimated foldable shipments worldwide were in the mid-teens millions of units for the most recent full year, with double-digit growth and Samsung the top vendor. Its share has come under pressure, meanwhile, from rival Chinese brands on the rise again such as Huawei and Honor in China and Motorola with its Razr line in the Americas, which makes Samsung’s volume goal bold but also necessary.

Inside the Five Million Foldable Phone Sales Target

A five million-unit goal would be a significant piece of the current foldable market, and even more if overall category growth begins to slump.

If the market continues to grow, it nevertheless solidifies Samsung’s resolve to maintain leadership while rivals close in.

Samsung has already demonstrated its ability to drive volume with targeted channel tactics: aggressive trade-in values, carrier subsidies and wide retail presence have all been instrumental in the success of Flip models especially. And expect the company to double down on those levers, particularly in markets where financing and promotions can push effective pricing below psychological thresholds that analysts at Counterpoint Research and IDC see as essential for mass adoption.

AI and Hardware Upgrades Seen as Growth Triggers

Samsung has made it obvious that next-gen AI will be at the fore in its upcoming phones. The company has teased new camera sensors, a new chipset and expanded on-device AI features that lessen reliance on the cloud for tasks such as real-time translation, image processing and summarization. All those are capabilities that especially shine on foldables, where larger screens and multitasking can help turn AI into a daily productivity tool and not just a demo feature.

On the hardware front, watch for thinner chassis, lighter builds and better crease management on Fold, as well as larger cover displays and better battery life on Flip. Display industry analysts at DSCC have also reported ongoing decreases for foldable OLED panel costs, which should enable Samsung to pack in more tech without having to raise prices.

Pricing and Channels Will Be Make or Break

Aggressive unit goals will rely as much on go-to-market execution as specs. Launch promos, worldwide day one and even more carrier involvement will be key. Samsung’s powerful trade-in environment and bundling plays (think wearables and tablets) have already proven effective and will likely be front-and-center in the playbook next year.

Context into the company’s larger mobile-revenue aspirations for foldables (which are reportedly measured in tens of B’s for the year) is this: Foldables aren’t just a halo—they’re expected to contribute meaningful volume and margin accretion within Mobile eXperience.

Competitive Pressure Is Rising Across the Foldable Market

Samsung’s push won’t be uncontested. Huawei and Honor have finally found traction in China for compelling book-style models, while Motorola has sought to build out its Razr portfolio in North America after a European launch last month, and the arrival of Google on the scene has moved Android developers to optimize apps for foldable layouts. The end result is a faster-moving, more colorful category — one in which the differentiation will come down to software polish, long-term support and ecosystem integration as much as pure hardware.

What to Watch as Samsung Targets Five Million Foldables

Watch for the launch cadence, preorder traction, and early channel sell-through with a larger weighting in the US, Korea, and Western Europe where carrier promotions tend to matter more. The reliability claims — the number of hinge cycles, how well it can take a display whack and water resistance — will matter for fence-sitters. And AI utility will also have to demonstrate plain-Jane, everyday value within more personal foldable form factors to convert curiosity into sustained demand.

If Samsung reaches its goal of five million foldables, it will establish that the category is moving beyond gimmick into lasting mainstream growth. Miss, and that’s a sign price, perception or competition continue to stand in the way. Either way, next year is shaping up to be a make-it-or-break-it time for the future of phones that bend.