OpenAI chief executive Sam Altman is preparing to visit India as global AI leaders converge in New Delhi for a major technology summit, according to people familiar with the matter. While Altman’s itinerary is not yet public and could change, the planned trip underscores OpenAI’s escalating push to tap India’s fast-growing AI user base, enterprise demand, and developer ecosystem.

A High-Profile AI Gathering in New Delhi Brings Global Leaders

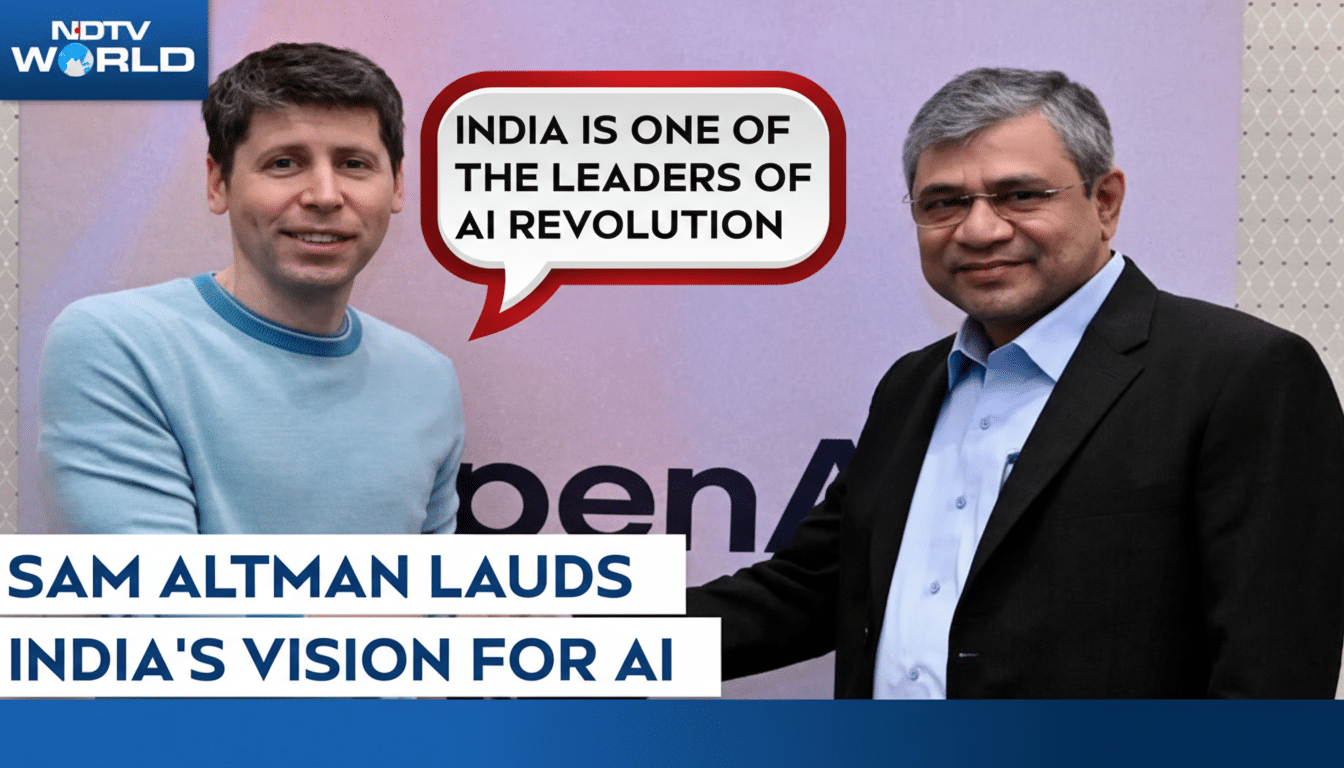

The India AI Impact Summit in New Delhi is expected to draw a formidable lineup of global and Indian leaders, including Nvidia’s Jensen Huang, Google’s Sundar Pichai, and Anthropic’s Dario Amodei, alongside Reliance Industries chairman Mukesh Ambani, according to the summit’s program. Altman is not listed as a confirmed speaker, but sources say his visit is timed to coincide with the gathering, which has become a focal point for policy, compute capacity, and AI safety conversations.

- A High-Profile AI Gathering in New Delhi Brings Global Leaders

- OpenAI’s India Bet Grows with Hiring and Expansion

- Distribution Power And Local Partnerships

- The Infrastructure Question for AI Compute in India

- Why India Matters for AI’s Next Phase of Growth

- What to Watch as OpenAI Sharpens Its India Strategy

Organizers have marketed the summit as a platform for large-scale AI investment and public–private collaboration. Indian officials have signaled that the country intends to position itself as a credible hub for foundational model development, enterprise AI deployments, and specialized, domain-specific models tailored to local languages and sectors.

OpenAI’s India Bet Grows with Hiring and Expansion

OpenAI has been steadily widening its footprint in India, recruiting across enterprise sales, technical deployment, partnerships, and legal roles focused on AI policy and compliance. Current listings span New Delhi, Mumbai, and Bengaluru, reflecting a dual strategy: deepen relationships with large enterprises and expand mass-market adoption of ChatGPT.

India has emerged as ChatGPT’s largest market by app downloads and among the top by monthly active users, per app intelligence firms that track mobile usage. Monetization has lagged broader engagement, prompting OpenAI to introduce a lower-priced ChatGPT Go tier under $5, with extended trials aimed at easing price sensitivity and accelerating conversion in cost-conscious markets.

People familiar with the planning say Altman is expected to meet technology executives, startup founders, and policymakers to discuss enterprise deployments in sectors such as education, media, and financial services. The company has also been in active talks with distribution partners, mirroring a regional trend where AI services are bundled with telecom plans and productivity suites.

Distribution Power And Local Partnerships

India’s telecom giants have become critical gatekeepers for consumer AI, with partnerships that bundle premium AI features into mobile plans. Reliance Jio and Bharti Airtel collectively reach hundreds of millions of subscribers—Jio reported more than 470 million users and Airtel over 375 million in recent company filings—creating a powerful channel for paid AI offerings and enterprise upsell.

Rival AI companies are already moving. Anthropic has opened an office in Bengaluru and appointed a seasoned leader to run its India operations. Google and Perplexity have struck alliances with major carriers to distribute premium plans at scale. The competitive backdrop makes timing crucial for OpenAI as it seeks to translate user enthusiasm into sustainable revenue.

The Infrastructure Question for AI Compute in India

Sources say OpenAI is evaluating India as a potential base for future infrastructure. That dovetails with a broader wave of multi‑billion‑dollar cloud and AI investments announced by U.S. hyperscalers, as well as India’s own IndiaAI Mission, which earmarks public funds to build compute capacity, foundational datasets, and skilling programs.

Execution, however, is not trivial. India’s data-center buildout faces constraints that matter for AI workloads: uneven power availability, high electricity costs relative to average revenue per user, and water stress in several urban hubs. Analysts point to findings from the World Resources Institute and the International Energy Agency on water and grid reliability to illustrate the scale of the challenge. Several states, including Maharashtra, Tamil Nadu, and Uttar Pradesh, have introduced data-center policies and renewable energy incentives to improve the economics of AI compute.

Why India Matters for AI’s Next Phase of Growth

India’s combination of a massive smartphone user base—GSMA counts well over 650 million smartphone users—and one of the world’s largest pools of software developers gives AI platforms both distribution and talent advantages. NASSCOM has highlighted rapid growth in data and AI roles, with Indian enterprises adopting generative AI for customer support, content creation, and analytics, even as governance and risk frameworks mature.

Local language support is a differentiator. Policymakers have encouraged the development of smaller, efficient models for Indic languages and sector-specific tasks, an approach that can lower costs while boosting accessibility. For global players, collaborating on such models—whether through open tools, fine-tuning, or enterprise solutions—could unlock usage beyond early adopters.

What to Watch as OpenAI Sharpens Its India Strategy

Key variables include whether Altman appears on the summit stage, new enterprise or telecom distribution deals, and any announcements related to compute investments or research collaborations. Also in focus: how OpenAI engages with India’s evolving regulatory regime on AI safety, data protection, and content provenance—areas that are increasingly central to enterprise buying decisions.

OpenAI, India’s IT ministry, and the summit’s organizers did not immediately comment on Altman’s travel plans. For now, the prospect of an OpenAI reset in India arrives as the country seeks to convert AI buzz into durable infrastructure, local innovation, and jobs—while global players look to turn outsized engagement into long-term revenue.