Rivian has established a new standalone business unit called Mind Robotics, an industrial AI and robotics company that aims to turn the EV maker’s factory know-how and operations data into a cloud-based machine learning application for manufacturability. CEO RJ Scaringe is the chairman of the new company’s board and Rivian is still an investor, effectively making Mind Robotics both a strategic supplier and innovation playground for the automaker’s facilities.

Rivian’s New Unit Is a Strategic Bet on Industrial AI

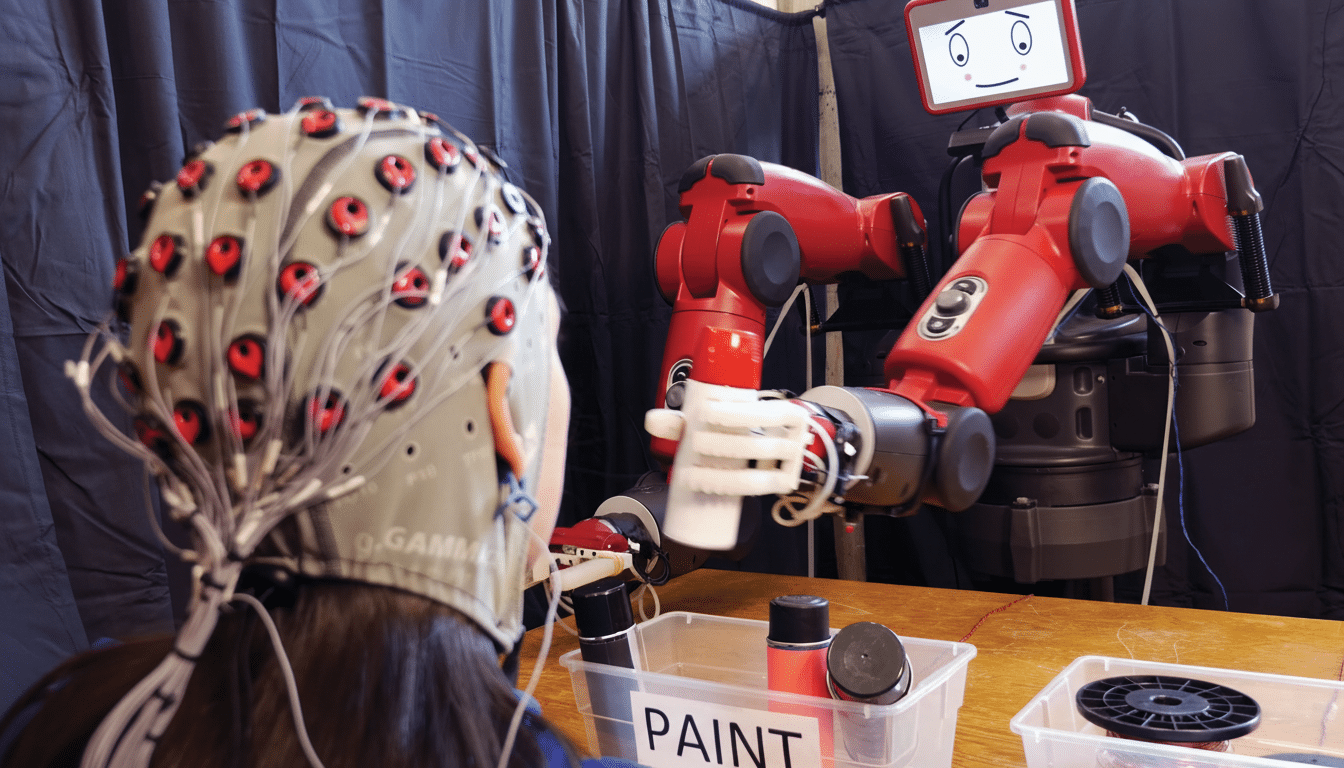

At its heart is a “data flywheel” strategy: Use Rivian’s manufacturing operations — stamping, paint, battery module assembly, end-of-line testing — as a rich source of training data and then feed that insight back into robots and AI systems capable of reducing downtime, increasing throughput and consolidating quality.

Put more plainly, the company is seeking to turn years of messy real-world factory telemetry into adaptive software and robotics that get smarter over time.

That focus is timely. The International Federation of Robotics has been documenting record numbers of robot installations across factories in the last several years, due to labor constraints, reshoring and the complexity of EV manufacturing. McKinsey predicts that generative and traditional AI could unlock trillions of dollars in annual productivity, and identifies manufacturing as an especially high-impact sector due to predictive maintenance, computer vision inspection, and scheduling optimization. Mind Robotics is meant to package those levers into products initially tested on Rivian’s own lines.

Why a Spinoff Structure Suits Rivian and Mind Robotics

Rivian has already demonstrated it’s comfortable incubating and spinning out focused bets. Earlier this year it spun out a micromobility skunkworks into Also Inc., with backing from investors including Eclipse and Greenoaks. It can lure specialized capital with a separate corporate wrapper, hire domain talent with focused equity and partner more widely with external manufacturers — while still offering Rivian favored access to the tech.

It’s unclear yet if Rivian engineers will join Mind Robotics en masse or how revenue will be divvied up on joint deployments. What is clear: Scaringe craves greater control over next-generation automation that’s designed for the rigors of an advanced electric vehicle factory, rather than having to make do with black-box systems that often require expensive integration and produce uncertain results.

How the Strategy Fits into Today’s Accelerating Robotics Boom

Industrial robots are back in vogue. Additionally, companies such as Figure AI, Agility Robotics and Apptronik have raised large rounds to address general-purpose factory work with humanoid or mobile manipulation, while incumbents like ABB, FANUC and Yaskawa are injecting more perception and autonomy into their arms. Tesla still demonstrates Optimus for internal jobs, and General Motors has been building up its own in-house robotics and AI to use for manufacturing. And on the software side, Nvidia’s Isaac stack, AWS’s robotics services and Siemens’ digital twin toolchains are maturing the “brains” that orchestrate fleets of robots and simulate factories before a single bot hits the floor.

Rivian’s advantage is its living laboratory. Unlike pure-play robotics startups that have to grovel for pilot sites, Mind Robotics can iterate within Rivian’s facilities, prove ROI, then sell outside. Intel, for example, quotes analysts (from BCG, McKinsey) who predict that AI-enabled predictive maintenance can cut unplanned downtime by 30-50 percent and extend equipment life by 20-40 percent. Scrap rates are frequently reduced by vision inspection systems, and traceability is increased. If Mind Robotics can waft those gains into a bottle and ship them as repeatable products, it will have the highest-octane sales pitch possible for any plant manager chasing OEE improvements.

What Mind Robotics Could Build for Smarter Manufacturing

Imagine a stack that combines perception-heavy software with application-specific hardware: mobile robots for line-side supply, self-driving inspection cells, simulation tools for process optimization and scheduling engines to coordinate humans and machines. A Rivian-esque plot twist might include “closed-loop” systems that capture on-the-line production anomalies, retrain models in the cloud overnight and push updates back to the floor — software practices from cars imported into factories.

Don’t be fooled by the scope of its trademark filing to cover everything from machinery and vehicles to “incubators for eggs.” The spectrum is typical at formation and it conveys optionality more than product range. The short-term goal is industrial use cases where data gravity and quick iteration can amplify the benefits.

Key Unknowns and Early Milestones to Watch at Mind Robotics

Open questions remain over the kind of initial customer slate Mind Robotics might land beyond Rivian, the size of its founding team, the compute partners behind its AI stack and whether it will court outside capital as did Also Inc.

Early signs to look for:

- Hiring of perception and controls engineers

- Partnerships with established robot OEMs

- Pilot projects that quantify gains in throughput or reductions in scrap

And if those pilots deliver double-digit enhancements, the technology could spread quickly — especially for manufacturers retooling their vehicles around an EV platform.

The calculus is simple for Rivian: more efficient plants yield better unit economics and faster model ramps. For Mind Robotics, the prize is a believable route from proofs of concept in individual factories to a scaled business selling into an international market that is hungry for smarter automation. The wager is that the physical world has matured enough for AI not just to predict, but to perform.