Replit is announcing it has raised $250 million in a financing round that values the company at $3 billion, a bet that browser-based, AI-driven software development is increasingly becoming mainstream. The company claims an annualized revenue run rate of approximately $150 million — an impressive leap that puts the platform in league with some of the fastest-growing developer tools.

The round was led by Prysm Capital, with the participation of Amex Ventures and Google’s AI Futures Fund, as well as previous backers that including Y Combinator, Craft, Andreessen Horowitz, Coatue and Paul Graham. Replit has raised approximately $478 million in total funding, according to PitchBook. Management also pointed to the fact that in under a year, ARR was up from ~$2.8 million all the way to $150 million, when a recent CEO update had suggested a $100 million ARR milestone.

Funding round and strategic backers

Google’s involvement dovetails with a significant commercial relationship: Replit’s environments often run atop Google Cloud, and the two companies have cooperated on various AI features. The momentum travels across ecosystems — Microsoft made Replit an option on Azure, which suggests the hyperscalers are feeling the value of meeting developers where they already build and deploy.

More than fresh cash, the investor lineup illuminates a strategic thesis: a combined coding, collaboration and deployment surface can compress the software delivery cycle. By integrating AI assistants into the workflow, the platform is designed to transform code creation, testing, and hosting into a continuous, consolidated process.

Revenue engine driving surge

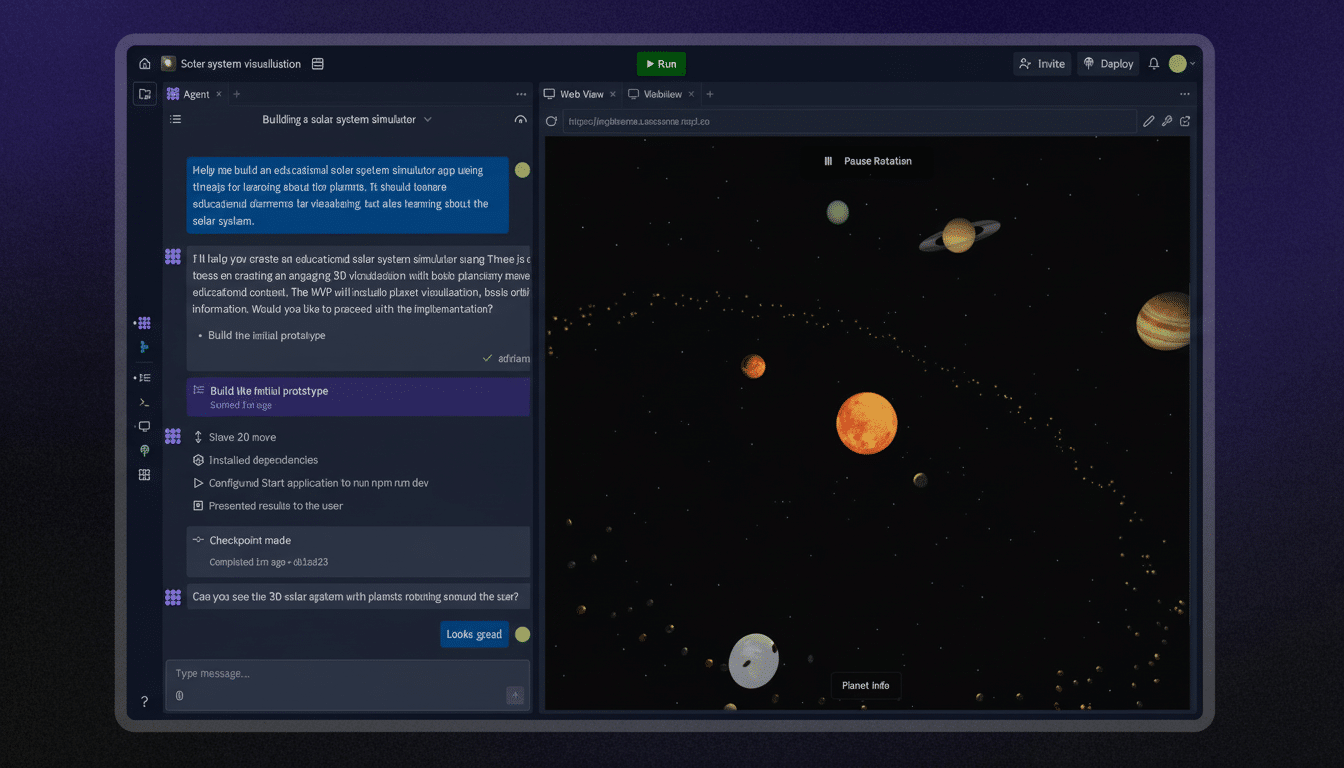

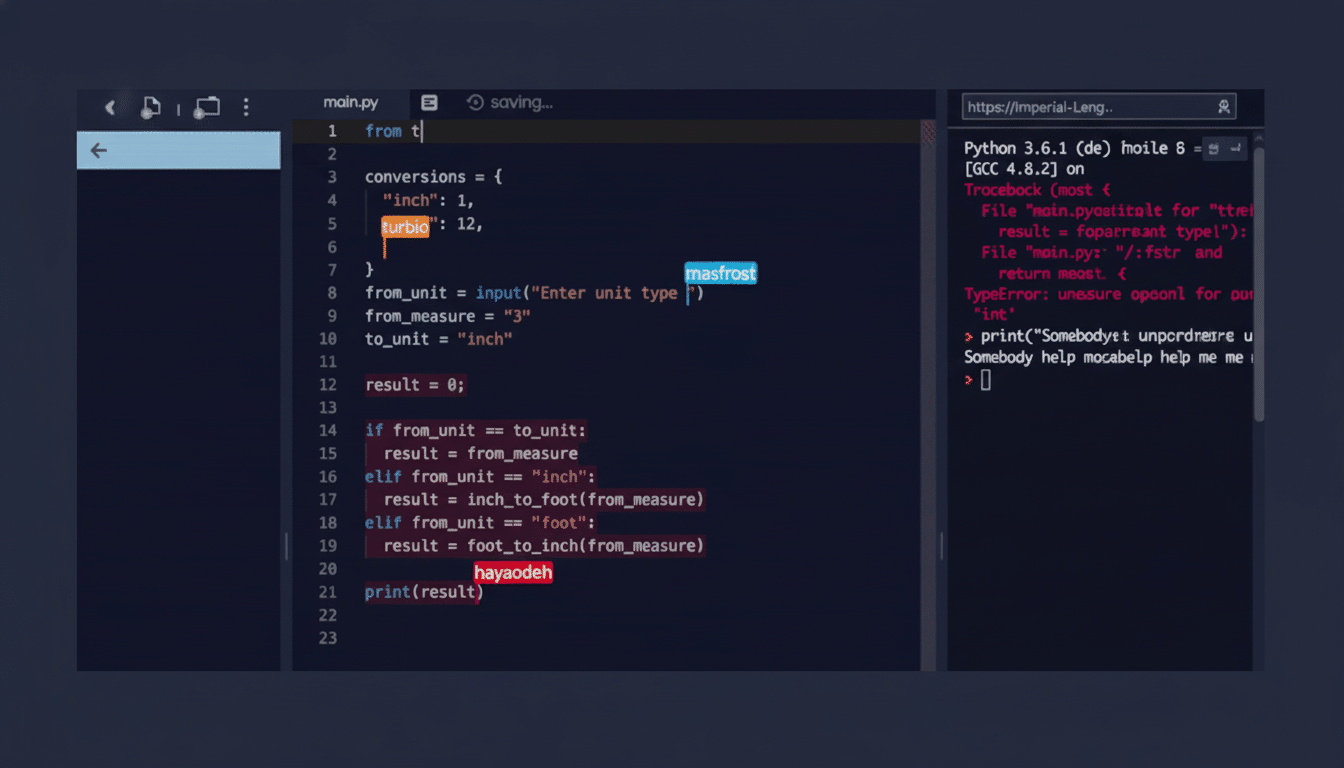

Replit leans on AI-assisted coding, instant cloud runtimes, and team collaboration straight in the browser as the root of its growth—features meant to reduce setup friction and accelerate time to prototype. The company makes money through subscriptions to advanced features; usage-based compute and storage; and for plans designed for teams and education.

Though “annualized revenue” represents a run-rate rather than audited recurring revenue, the trajectory is impressive. The second kind of developer platform, where the product offering expands beyond code editing to provide hosting, collaboration, deployment and more, tend to experience stronger expansion dynamics as the more the product is used, the more the projects, complexity and team members — upon which the number and or contracts of tenants proportionally scale — grows.

Valuation math & market context

At $3 billion on a $150 million run-rate, Replit’s implied revenue multiple is about 20x — rich by public cloud-software standards but increasingly typical of high-growth, AI-native dev tools. Public cloud indexes frequently trade at smaller forward revenue multiples, while premium growth and category leadership may preserve a double-digit private valuations.

That work case is based on gains in efficiency that enterprises are willing to pay for. In addition to that, research from management consultancies have predicted double digit productivity gains for software teams using generative AI, further supporting higher per seat pricing and wider platform adoption. If Replit sustains rapid net revenue growth, the multiple appears less a reach and more a bet on durable expansion.

Where Lemonade Stands in the World of AI-Powered Coding

The competitive set is made up of incumbents and cloud giants: The list of contenders for developer mindshare includes GitHub Copilot, AWS CodeWhisperer, and AI add-ons from IDE vendors. Replit’s uniqueness comes in its browser-native model – no local setup, immediate environments, and a path from creating a blank file to executing code as an application in minutes. That end-to-end loop is in competition with, and frequently complementary to, tools in the traditional IDE.

Hyperscaler partnerships are a double-edged sword. They present opportunities to scale distribution and drive infrastructure costs to their optimal limits, but they simultaneously increase dependence on third-party compute and models. Gross margins and unit economics are the numbers to watch as we enter an era of volatile AI inference and training costs.

Risks and execution priorities

Key questions now: Can Replit maintain its pace of converting free users to paid tiers, deepen its penetration of enterprise and preserve margins as usage scales? Governance over AI-generated code — licensing, security, provenance — will become more important as larger organizations start to standardize on AI dev platforms. These and strong model choices, model guardrails and auditability will likely be table stakes for larger deployments.

Operationally, investment will probably focus on AI model quality, low-latency inference, efficient use of GPUs, and enterprise controls. A browser-first stack also needs to make reliability at scale a priority; interruptions (even small ones) in the editor or runtime can erode developer trust and hinder growth.

Why this deal matters

The round is a sign that venture appetite for AI-native developer platforms is still particularly strong when usage based infrastructure and collaborative workflows generate revenue directly. Relying on that kind of hypergrowth with a $3 billion price tag, Replit now sits at the nexus of how modern software gets made — and how quickly A.I. can upend the economics of coding.