Reliance is placing a colossal bet on artificial intelligence, announcing a ₹10 trillion (roughly $110 billion) program to build out compute infrastructure across India over the next seven years. The plan aims to deliver gigawatt-scale data centers, a nationwide edge network, and new AI services woven into Jio’s telecom footprint—an assertive move to anchor AI capacity on Indian soil.

The rollout is already underway. Construction of multi-gigawatt facilities has started in Jamnagar, Gujarat, with more than 120 megawatts slated to go live in the second half of 2026. The initiative signals an aggressive push to cut the cost of AI access in India and reduce reliance on foreign compute, echoing the company’s earlier disruption of mobile data pricing.

- Inside the $110B plan to build India’s AI infrastructure

- Why compute is the bottleneck for scaling AI in India

- Green power as a strategic lever for AI data centers

- A crowded field and policy tailwinds for India’s AI

- What it means for industry across India’s AI economy

- Execution risks and open questions for Reliance’s AI push

- The bottom line: India’s AI bet hinges on execution

Inside the $110B plan to build India’s AI infrastructure

Reliance’s blueprint includes hyperscale campuses and a mesh of edge sites near population and industrial hubs to serve latency-sensitive workloads. By embedding services into Jio’s network—already serving hundreds of millions of users—the company is positioned to distribute AI capabilities from the cloud to the last mile, including phones, enterprise branches, and IoT endpoints.

The group is targeting AI models and applications tailored for India’s linguistic diversity, with a focus on major Indian languages to broaden adoption in consumer services and public sector use cases. Partnerships are planned across enterprises, startups, and universities to apply AI in manufacturing, logistics, agriculture, healthcare, and financial services.

Why compute is the bottleneck for scaling AI in India

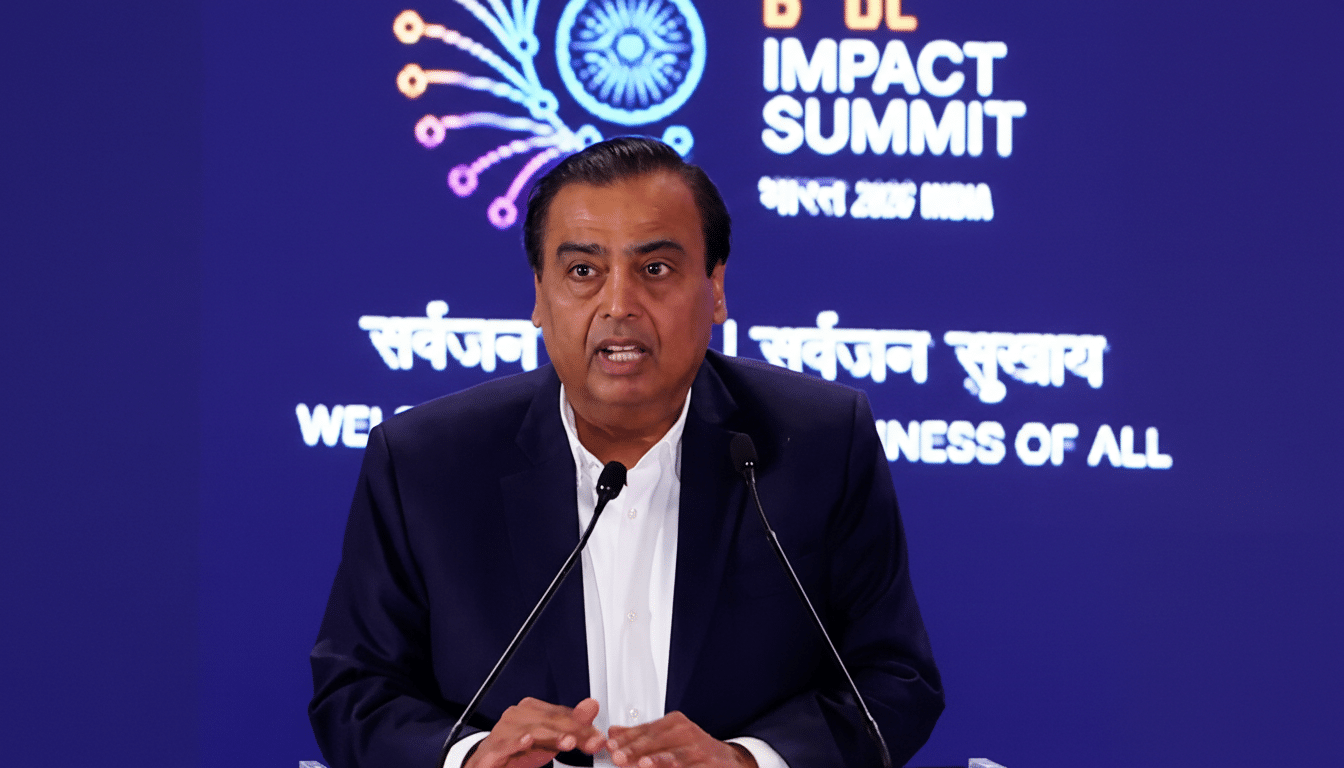

Ambani framed the move as a response to a global shortfall in affordable compute rather than a shortage of ideas or talent. The company’s goal is to compress AI inference and training costs at scale—an ambition that will hinge on access to advanced accelerators, efficient networking, and robust software stacks.

Global demand for high-performance chips has far outpaced supply, with top accelerators backlogged and data center buildouts rising worldwide. Analyses from the Stanford AI Index have consistently underscored the rapid escalation in training compute, while enterprises report soaring inference bills as AI moves into production. Building capacity domestically is intended to blunt those pressures for Indian developers and businesses.

Green power as a strategic lever for AI data centers

Reliance plans to back its AI campuses with up to 10 gigawatts of surplus solar power from projects in Gujarat and Andhra Pradesh. Energy cost is one of the largest components of AI total cost of ownership; pairing renewables with modern cooling and power usage effectiveness targets could be decisive in unit economics.

The International Energy Agency has flagged surging electricity demand from data centers globally, making low-cost, low-carbon power a competitive advantage. Co-locating compute with renewable generation and, where possible, energy storage should help stabilize operating costs and reduce emissions intensity as capacity scales.

A crowded field and policy tailwinds for India’s AI

The announcement lands amid a wave of AI infrastructure commitments in India. Adani Group recently signaled plans to invest about $100 billion in domestic AI data centers. Global players are also circling: OpenAI has teamed up with Tata Group on an initial 100 megawatts of AI capacity in India, with a roadmap to 1 gigawatt over time.

On the policy side, the government’s IndiaAI Mission, led by the Ministry of Electronics and Information Technology, is focused on expanding public compute, datasets, and skilling. Officials have projected more than $200 billion in AI infrastructure spending across the ecosystem over the near term, reflecting the scale of the opportunity—and the need for coordination across power, land, and connectivity.

What it means for industry across India’s AI economy

For enterprises, domestically hosted AI offers lower latency, potential cost advantages, and improved data residency assurances under India’s data protection regime. Jio’s reach provides a ready distribution channel for AI services, from conversational agents in Indian languages to computer vision at factory edges and fraud detection in banking.

Reliance has already been testing the market through partnerships, including a deal with Google that extended access to Gemini AI Pro for millions of Jio users. By integrating model access, edge inferencing, and carrier billing, the company can bundle AI with connectivity—appealing to small and mid-sized businesses that prefer turnkey solutions.

Execution risks and open questions for Reliance’s AI push

The hardest problems lie in execution: securing advanced chips at scale, optimizing supply chains for power and cooling equipment, and attracting top-tier AI researchers and systems engineers. Regulatory clarity on data governance and safety, under frameworks like the Digital Personal Data Protection Act, will also shape deployment paths for sensitive workloads.

Investors will watch for early milestones—commissioning of the first 120 megawatts, visibility on accelerator vendors and networking fabric, and demonstrable reductions in AI unit costs for anchor customers. Power usage effectiveness, water consumption strategies, and carbon accounting will be scrutinized alongside return on invested capital.

The bottom line: India’s AI bet hinges on execution

If Reliance delivers on its seven-year roadmap, India could shift from a net importer of AI compute to a regional production center, with benefits cascading into exports of AI-enabled services. The stakes are high, but so is the prize: cheaper, local compute that can unlock multilingual AI at population scale and give Indian developers the tools to compete globally.