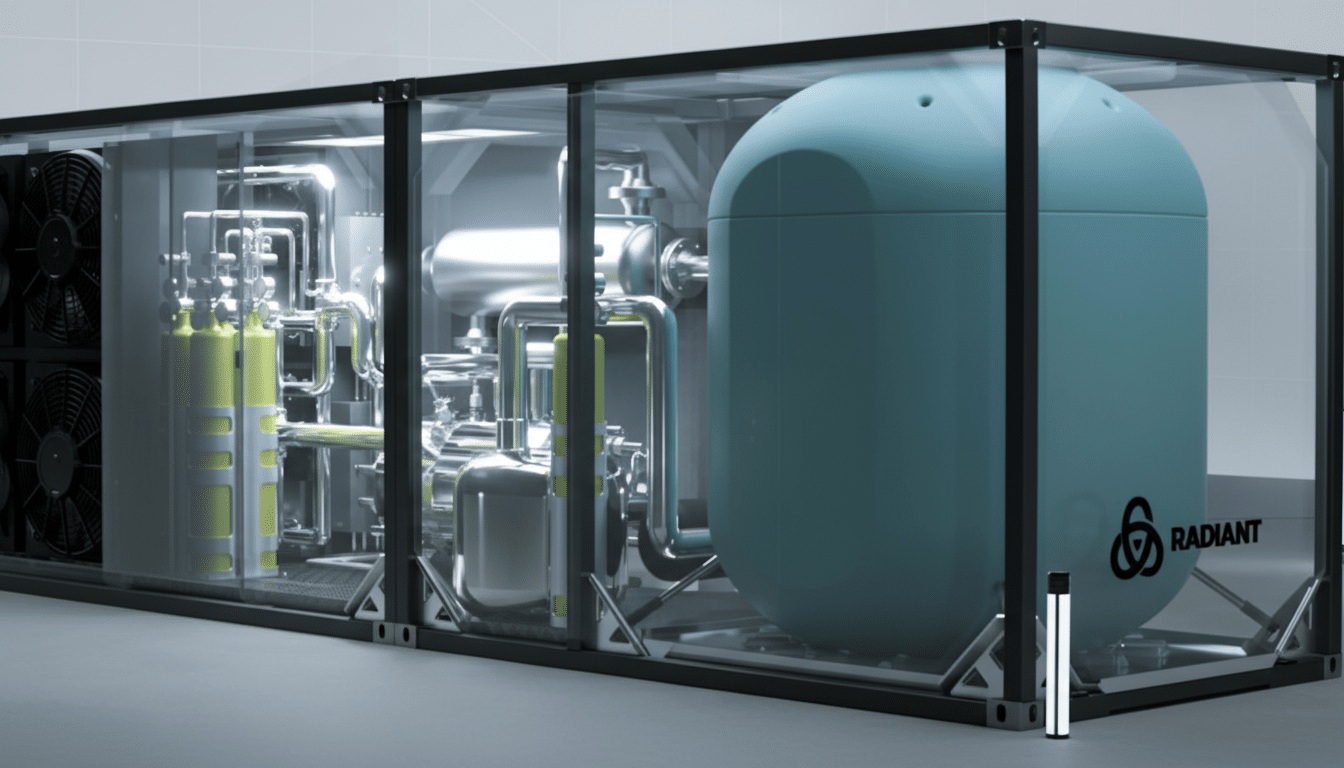

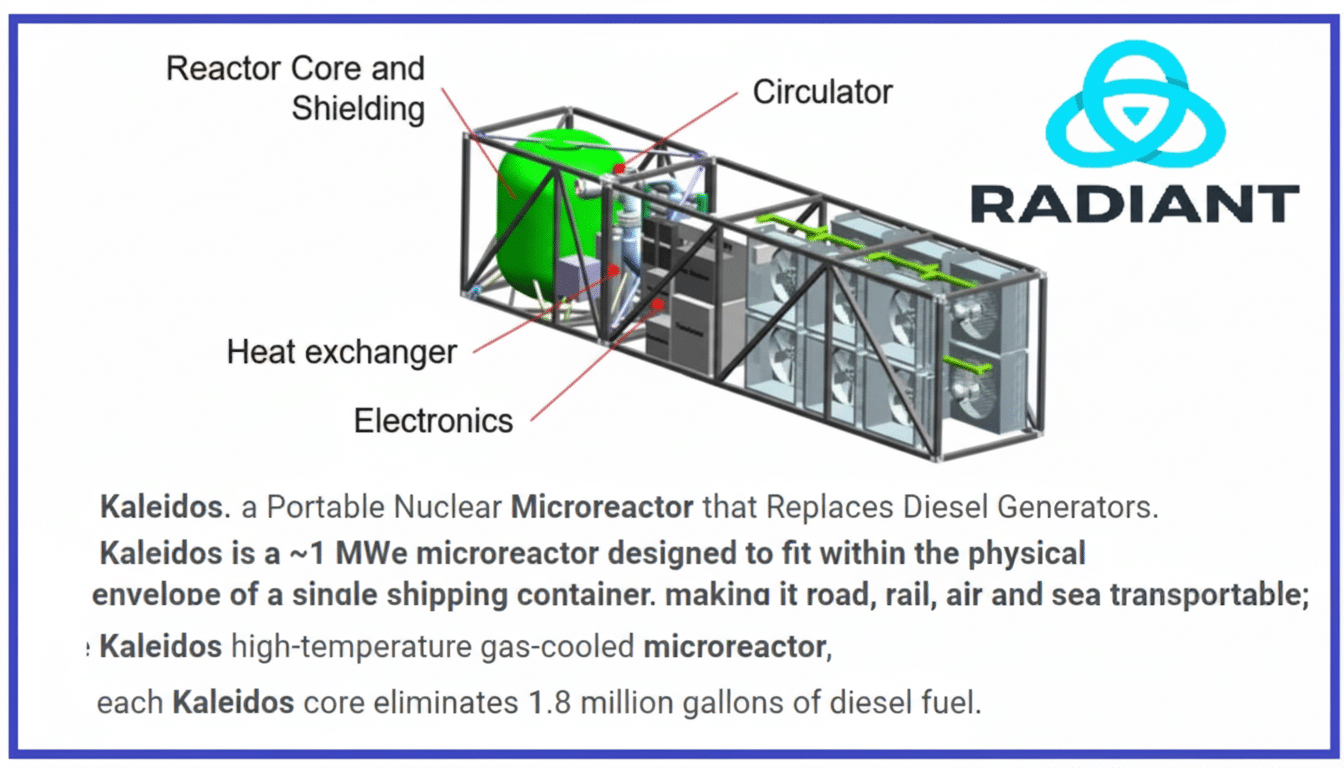

Radiant Nuclear has raised more than $300 million to build a truck-transportable 1 megawatt microreactor, a small helium-cooled design that’s intended to replace diesel generators while supporting power-hungry edge sites.

The company has already experienced significant support from venture capitalists and has now closed a second round of fundraising led by Draper Associates and Boost VC, with participation from ARK Venture Fund, Chevron Technology Ventures, Friends & Family Capital, and Founders Fund, valuing the company at above $1.8 billion amid growing enthusiasm for factory-produced fission among investors.

The financing puts Radiant among a crop of nuclear startups attracting nine-figure checks as demand for dependable, zero-carbon power surges. Past backers include Andreessen Horowitz, DCVC, Giant Ventures, and Union Square Ventures (USV), indicating a cap table that straddles both deep-tech venture capital and strategic energy investors.

A Portable Reactor Targeting Diesel’s Niche

The company’s product has been designed to sit on a standard semi-trailer and produce 1 MW of electricity—similar to that provided by the largest commercial diesel gensets, only without fuel deliveries or local emissions. The reactor relies on helium gas as a coolant and uses TRISO fuel, the ceramic- and carbon-coated uranium “pebbles” engineered to contain fission products as they form at high temperatures, creating an additional barrier for passive safety.

The company estimates that each unit could run for about five months at a time without additional fuel and has a design life of 20 years. Customers can buy a unit outright or enter into a power purchase agreement, with Radiant handling refueling and end-of-life retrieval — a critical selling point at sites seeking nuclear-level reliability but not long-lived decommissioning obligations.

Target markets include military bases, remote industrial sites, disaster recovery zones, and off-grid villages — places where diesel is still the order of the day. The Department of Defense is already trying out this concept with its transportable microreactors program under BWX Technologies, signaling a clear government application for quickly deployable power systems.

Why Data Centers Are Taking Notice of Microreactors

One 1 MW system will not power a hyperscale campus, but microreactors can be clustered to support edge compute, research labs, and modular data halls — particularly in areas where grid interconnection queues or transmission constraints are slowing new-build capacity deployment. Radiant has signed a contract for 20 units with Equinix, the data center developer, reflecting early commercial demand from operators looking for dedicated and certain supply.

The International Energy Agency has warned that global power consumption from data centers, AI, and crypto could increase rapidly in the coming years, adding hundreds of terawatt-hours to demand. Meanwhile, interconnection queue wait times monitored by national labs have bloated to multiple years in several markets. A homegrown energy source that can be rolled out in months rather than years must be an appealing proposition — particularly if it reduces exposure to gas price uncertainty or diesel procurement lead times.

Aside from power, high-temperature gas reactors can provide suitable heat for absorption chillers or direct liquid cooling, creating the ability to tie together compute and thermal management for dense compute. That co-optimization could be a differentiator as operators pursue efficiency gains across the stack.

Funding Momentum And The Race To First Power

Radiant’s raise comes as a flood of capital is flowing into advanced fission, with other companies pursuing microreactors and small modular reactors confirming recent rounds, too. For any player, the immediate challenge is the same: “You’re going to have to build a first-of-a-kind unit and operate it,” shifting technology, licensing, and operations risk.

Radiant will test a demonstration reactor at the Idaho National Laboratory, taking advantage of federal programs that provide easy access to sites and reviews for new designs. These programs don’t offer grants and loans directly, but they can shorten timelines by consolidating oversight across agencies and focusing expertise at national labs.

The Manufacturing Bet And The Bottlenecks

As with many advanced reactor startups, Radiant’s economics rely on being able to mass-produce the reactor in factory settings. The first is about proving that it works; the fleet, about proving that it can be built in the same way, over and over again, at a predictable cost. A stalled small modular reactor project that faced cost inflation and contracting risk, as well as lessons from large nuclear builds, have been hard experiences. Microreactors hope to sidestep that trap by being small, simple, and produced offsite.

There is a real limit on fuel supply. The TRISO concept requires high-assay low-enriched uranium (HALEU), whose commercial supply is restricted. The U.S. Department of Energy’s HALEU Availability Program is supporting domestic production, and companies such as X-energy and BWX Technologies are investing in TRISO capabilities, but near-term volumes will be difficult to secure. All microreactor fleet plans should balance the readiness of such systems with a reasonable fuel logistics approach.

Licensing is also a gating issue. The Nuclear Regulatory Commission has indicated an increased receptivity to risk-informed frameworks for newer designs, but recent history suggests that gaps in such applications can delay progress. Radiant’s use of a helium coolant and TRISO fuel, which behave differently from traditional light-water reactors, will require strong safety cases and open dialogue with regulators and host communities.

What to Watch Next for Radiant’s 1 MW Microreactor

Key milestones are component demonstrations, fuel qualification, and siting approval on the demonstration unit. Commercially, look for customer agreements to convert into firm offtake, clarity on levelized costs under PPA structures, and evidence that the Radiant supply chain can be stood up to produce a serial product.

If the company is able to prove performance and smooth out manufacturing, 1 MW building blocks could serve as units for resilient microgrids within a variety of defense, industrial, and digital infrastructure applications.

With new money and a queue of early customers, Radiant finally has the runway to go from pitch deck to power.