Qualcomm’s play to buy out Arduino has the welcome effect of instantly rewiring the dynamics behind hobby and industrial computers — and lands Raspberry Pi squarely in the blast radius.

An Arduino community reaching into the tens of millions gets to tap Qualcomm silicon and tools, while the debut SBC, an Arduino UNO Q, hits a price-and-capability tier that encroaches on Raspberry Pi territory.

What Changes When Arduino Is Under Qualcomm

Arduino says its open ethos and branding will be preserved, but the center of gravity moves. Qualcomm offers mobile-built chip roadmaps, wireless technology smarts, and a worldwide addressable sales channel. In practice, that translates to faster time-to-market, more consistent supply, and a more direct path from prototype to production — something that makers and small companies tend to bump into.

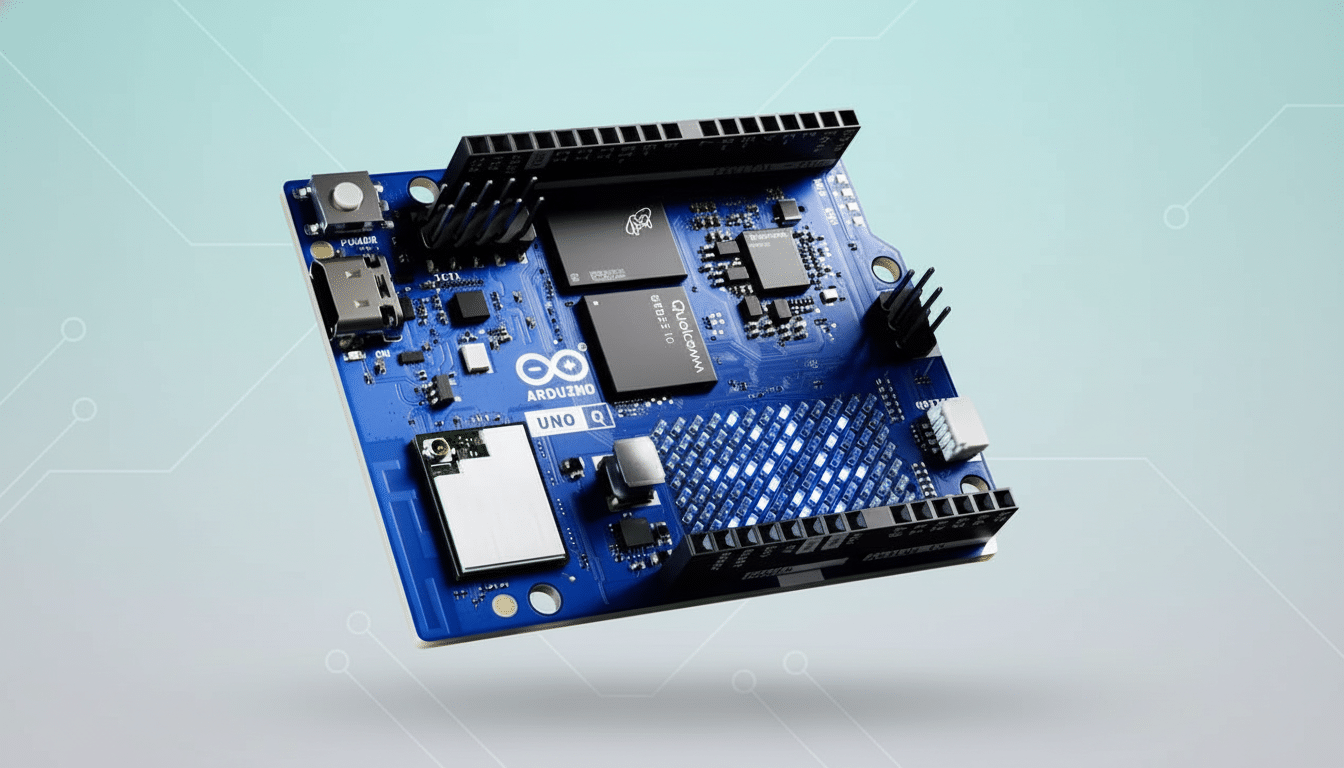

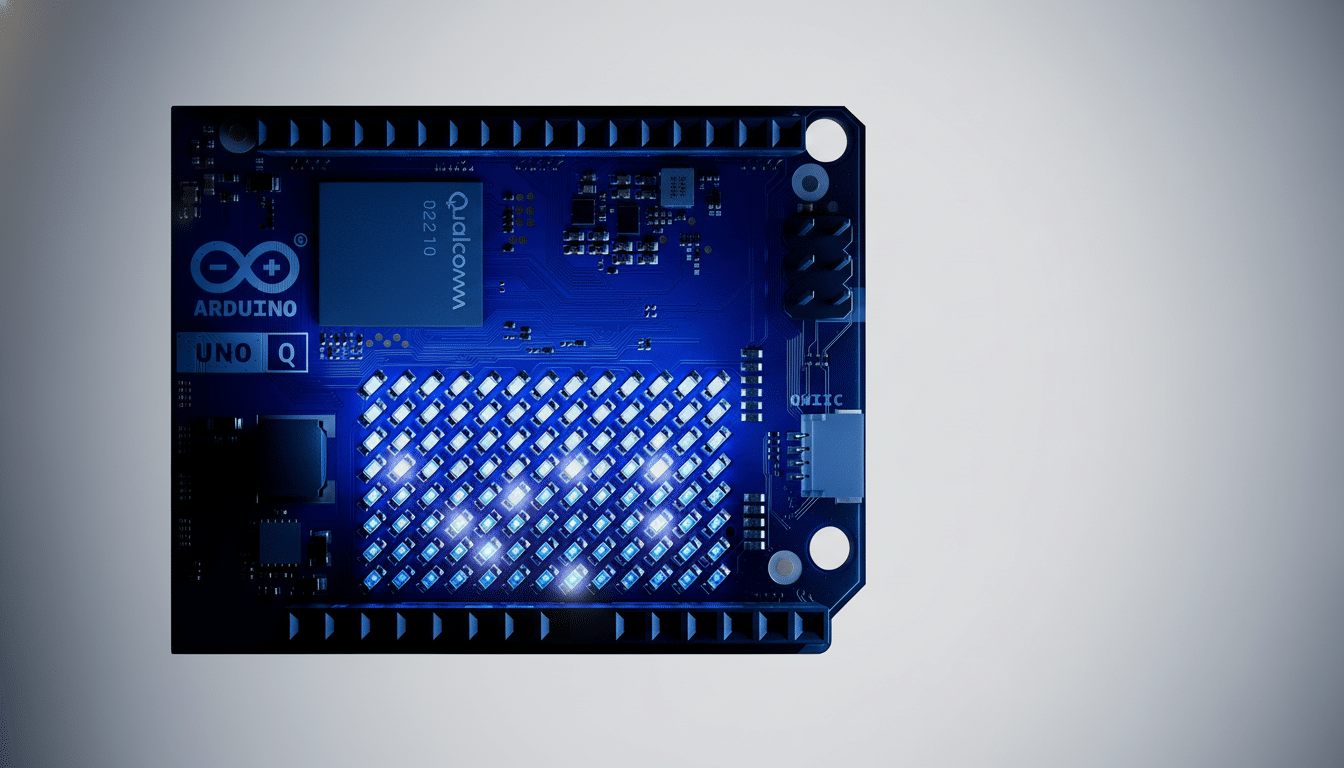

The UNO Q exemplifies the effort. It is based on the Qualcomm Dragonwing QRB2210 with a quad-core Kryo CPU clockable up to 2.0 GHz and a chip integrating an Adreno 702 GPU, coupled with 2GB LPDDR4, 16GB eMMC, as well as Wi‑Fi 5/Bluetooth 5.1. The board features 47 digital I/O pins, six analog inputs, and includes a programmable 8×13 LED matrix — an odd mix of SBC horsepower with classic Arduino interfacing — for a list price of $44 at leading distributors.

Short-Term Impact on Raspberry Pi in the Market

Raspberry Pi still has a strong moat as we speak. Its ecosystem includes millions of developers, a vast selection of tutorials, and robust support for projects based on Linux. The Raspberry Pi 5 and the Raspberry Pi 500 keyboard PC, however, underscore how fast the platform has raced up that performance stack, and tens of millions of shipped units were spotlighted in the organization’s IPO filing post-launch.

In the short term, UNO Q is more of a supplementary tool than a Pi competitor directly. It is playing a price and I/O flexibility game, not an outright CPU punch or RAM capacity one. For developers that require a full desktop‑like Linux with PCIe accessories and multiple display outputs, the Pi 5 will remain their best choice.

Where Competition May Heat Up in Edge and IoT

The most intriguing friction will exist at the edge AI and industrial IoT. Qualcomm’s hardware accelerators and graphics drivers are solid, backed by ecosystems from mobile development, while Arduino already works with TinyML players like Edge Impulse and TensorFlow Lite. If Arduino boards include first‑class AI inference paths in the box, they might become the standard for sensor‑rich, battery‑sipping projects.

Industrial buyers likewise prize analogue inputs, deterministic I/O, and long‑term availability — all high‑water marks for the Arduino, and places where the Raspberry Pi is reliant on HATs and add‑ons. Analyst firms like IDC are predicting double‑digit growth in spending on the edge over the next few years, and that rising tide might benefit the platform that does best at simplifying going from proof‑of‑concept to certified hardware faster.

Software and Developer Experience Across Platforms

Raspberry Pi’s strength is a seamless Linux environment and an enormous universe of Debian packages, Python libraries, and educational materials. Kernel support for Pi silicon has gotten much better, and community docs are kind of a differentiator. The Pi’s “plug in an HDMI display and start learning” story is still unbeatable for many classrooms and labs.

Arduino provides the opposing on‑ramp: a lean IDE, rapid sketches, and instant hardware response on pins and sensors. If Qualcomm can marry that simplicity to strong upstream drivers and long‑life software kits — something supported by groups ranging from Linaro to the Linux Foundation — then the UNO Q line could become the most straightforward way to a deployed‑to‑the‑edge, modern‑connectivity endpoint.

Pricing, Supply, and Channels for Boards and Kits

At $44, UNO Q is cheaper than the Raspberry Pi 5 and adds integrated eMMC and analog I/O, but it has only 2GB RAM with different performance trade‑offs. Raspberry Pi’s pricing is still competitive, and supply constraints of late have eased somewhat on account of stretched production. The wild card is channel muscle: Qualcomm’s scale and Arduino’s presence in distributors like DigiKey and Mouser should make it a little easier to actually get some units, as long as you don’t mind waiting for waves of hobbyists’ sudden interest to pass.

For people buying in volume, Qualcomm’s promise of a “path to commercialization” matters. If reference designs, certifications, and lifecycle guarantees are baked into Arduino’s new SBCs, some projects that begin on Raspberry Pi could move to Arduino for production SKUs without needing a painful redesign.

What to Watch Next in the Arduino and Pi Rivalry

Two indicators will show where the competitive arc is headed. One, if Arduino extends a family of Qualcomm‑powered boards covering between sub‑$20 microcontrollers up through multicores with AI acceleration. Second, the quality of Linux and AI software support on day one — driver stability, above‑ (or even in‑) the‑line pipelines for cameras and GPU acceleration, power management — is make‑or‑break for edge deployment.

Raspberry Pi isn’t standing still. Look for more evolutions of the Compute Module line for embedded use, better camera and AI support by way of community frameworks, and more ready‑made products that meet schools and startups where they are. In a rapidly expanding market, both ecosystems can prosper — but Qualcomm’s move means that Raspberry Pi now has a heavy‑duty contender vying for the next wave of edge innovation.