Amazon plans to light up its Project Kuiper consumer service in five countries by the end of the first quarter, initially covering the United States, Canada, Britain, France and Germany. Ricky Freeman, who heads government solutions for Project Kuiper, described the plan in remarks reported by Bloomberg from the World Space Business Week conference.

If Amazon gets to that tipping point, Kuiper could rapidly go from pilot demos to having a real (if limited) commercial footprint — posing a direct challenge not only to existing players but also to SpaceX’s Starlink in some of the planet’s most fiercely contested broadband markets.

- Why These Five Markets Are First for Project Kuiper

- The Coverage Math: Satellites Versus Capacity

- Speeds, Terminals, and Early Performance Expectations

- Regulatory and Spectrum Hurdles Across Five Nations

- Competition and Differentiation in the LEO Broadband Race

- What to Watch Next as Project Kuiper Nears Launches

Why These Five Markets Are First for Project Kuiper

Selected countries would provide a combination of high broadband demand, large rural coverage gaps and relatively mature regulatory approaches to satellite communications. Kuiper gives the US and Canada broad expanses of territory and an established spectrum process via the FCC and Innovation, Science and Economic Development Canada. Ofcom, ARCEP and ANFR in Europe, and the Bundesnetzagentur in Germany all offer clear licensing routes to market with extensive addressable audiences.

Amazon has also taken on the work of building ground infrastructure in North America and Europe, which is a necessity for low-latency backhaul and capacity. You can expect early availability to focus on gateway services rather than base stations, as well as near-urban edge compute hubs where Kuiper can connect to local terrestrial networks and cloud services.

The Coverage Math: Satellites Versus Capacity

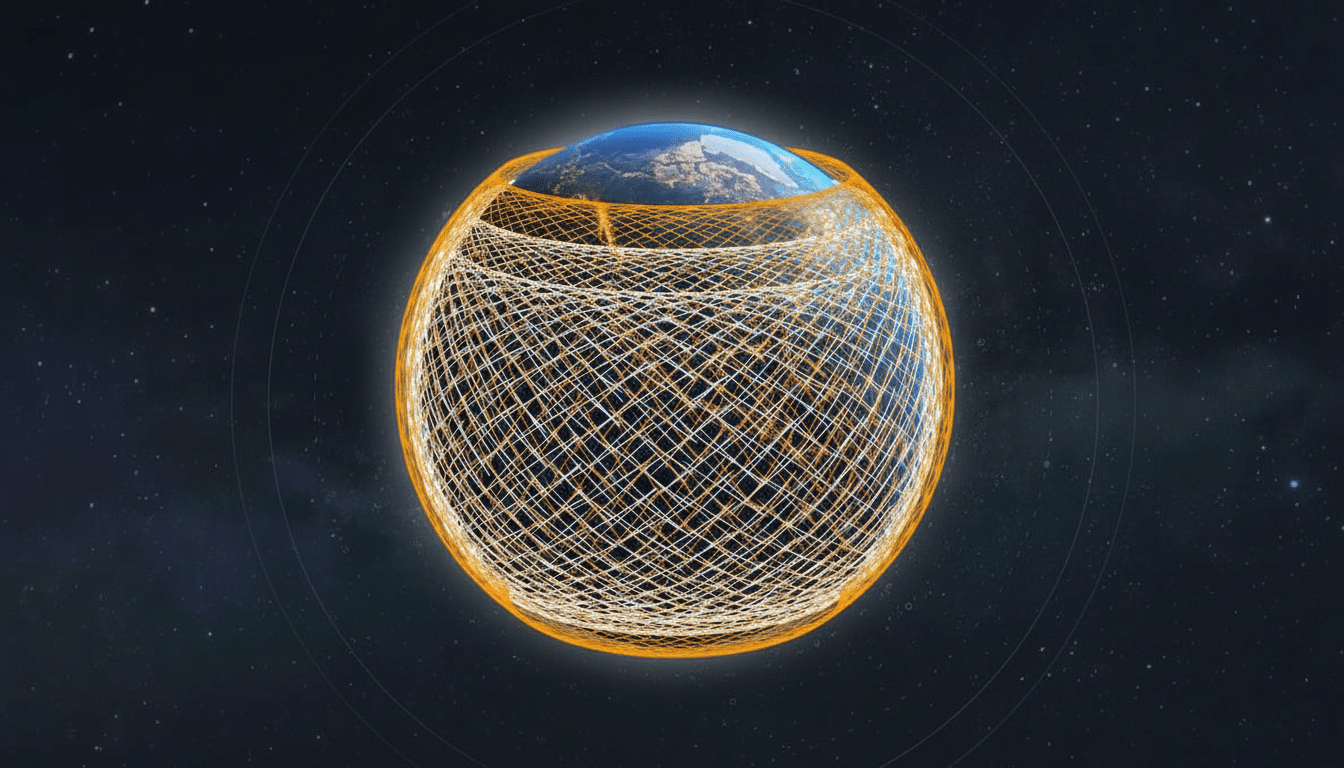

Kuiper has sent four missions with 102 satellites into orbital space, and executives say they aim to nearly double that number in the near term. That’s progress, but it remains well shy of the hundreds to thousands a network usually requires for dense enough coverage and capacity in multiple regions.

For comparison, SpaceX, when its constellation had racked up about 800 satellites, started granting early users access to Starlink. Kuiper’s first service will probably resemble controlled pilots and selective commercial deployments more than a wide-open, sign-up-on-the-site offer — especially in parts of Europe where population is dense and satellite re-use of spectrum and placement of gateways are important.

Amazon has a full slate of launches booked with United Launch Alliance, Arianespace and Blue Origin in order to scale up quickly. There is no way to just hit an aggressive cadence that’s solely about customer experience; you also have licensing milestones from the FCC around constellation deployment that require demonstrating constellation deployment within the current authority window.

Speeds, Terminals, and Early Performance Expectations

Just a few months ago, Amazon showed off an enterprise-grade Kuiper terminal that could pull in 1,280 Mbps of download — a certifiably sexy number that showcases what today’s phased-array antennas and Ka-band links can do. The consumer dish, by contrast, is meant to provide around 400 Mbps, and at those speeds it’s squarely in the competitive range with what existing LEOs like Starlink are offering for home internet.

Amazon has shown off a number of terminal designs, ranging from a small unit for apartments and smaller homes to higher-gain models for business and community sites. Cost will be key: Amazon previously indicated that it would look to push hardware bill of materials below traditional satellite dishes, a lever that could eliminate drag on mass-market adoption.

Regulatory and Spectrum Hurdles Across Five Nations

Working in five jurisdictions means a thicket of approvals: space-to-Earth authorizations, user terminal certifications, gateway siting and coordination in Ku- and Ka-band. In the US, under regulation by the FCC, that license to orbit also carries debris mitigation and deorbit requirements that reflect an industry-wide move toward space sustainability. European regulators have also focused attention on power flux densities and interference mitigation with geostationary systems, which might affect beam patterns and capacity planning.

Amazon’s experience wrangling spectrum for its AWS edge services and relationships with national regulators should help, but the nitty-gritty of getting sites secured, frequencies coordinated, and local telecom rules aligned often defines how quickly things roll out as much as rockets do.

Competition and Differentiation in the LEO Broadband Race

Starlink is the established player for LEO broadband with a huge active fleet and strong rural and mobile brand recognition. Eutelsat OneWeb is more focused on enterprise and mobility, whereas Telesat Lightspeed is geared to high-throughput services. Kuiper’s differentiators will probably include integration with Amazon’s broader ecosystem — think AWS for edge compute and content distribution, retail channels in which to offer the hardware, maybe some bundling for SMBs and public-sector customers.

The true test is one of consistency at scale: peak-hour performance, contention management and ease of installation. Early enterprise wins — such as backhaul for carriers, emergency response kits and connectivity for remote operations — may come before a floodgate is thrown open to all consumers.

What to Watch Next as Project Kuiper Nears Launches

- Launch cadences, and timelines for satellite commissioning that define cell density and throughput.

- Build out gateways and peer with local carriers to achieve low latency and bring content closer to users.

- Pricing and availability of hardware, particularly the extent to which Amazon uses retail logistics to shrink lead times.

- Data on regulatory filings and approvals in the five target markets, showing where service will light up first.

Even if Amazon delivers service in the US, Canada, the UK, France and Germany by the end of Q1 on a small scale, it would be a meaningful moment for satellite broadband: a true multi-continent competitor that poses clear challenges to incumbents on speed, price and coverage.