Pony.ai is stepping on the driverless deployment gas pedal, telling investors it will grow its global robotaxi fleet more than threefold by the end of 2026. The autonomous driving company, which is dual-listed in the United States and in Hong Kong, said it aimed to end this year with about 1,000 vehicles on its network and to “surpass” 3,000 by the end of 2026 — a scale-up that would shift the business from small pilots into true network operations.

Rapid Expansion Plans in China and Internationally

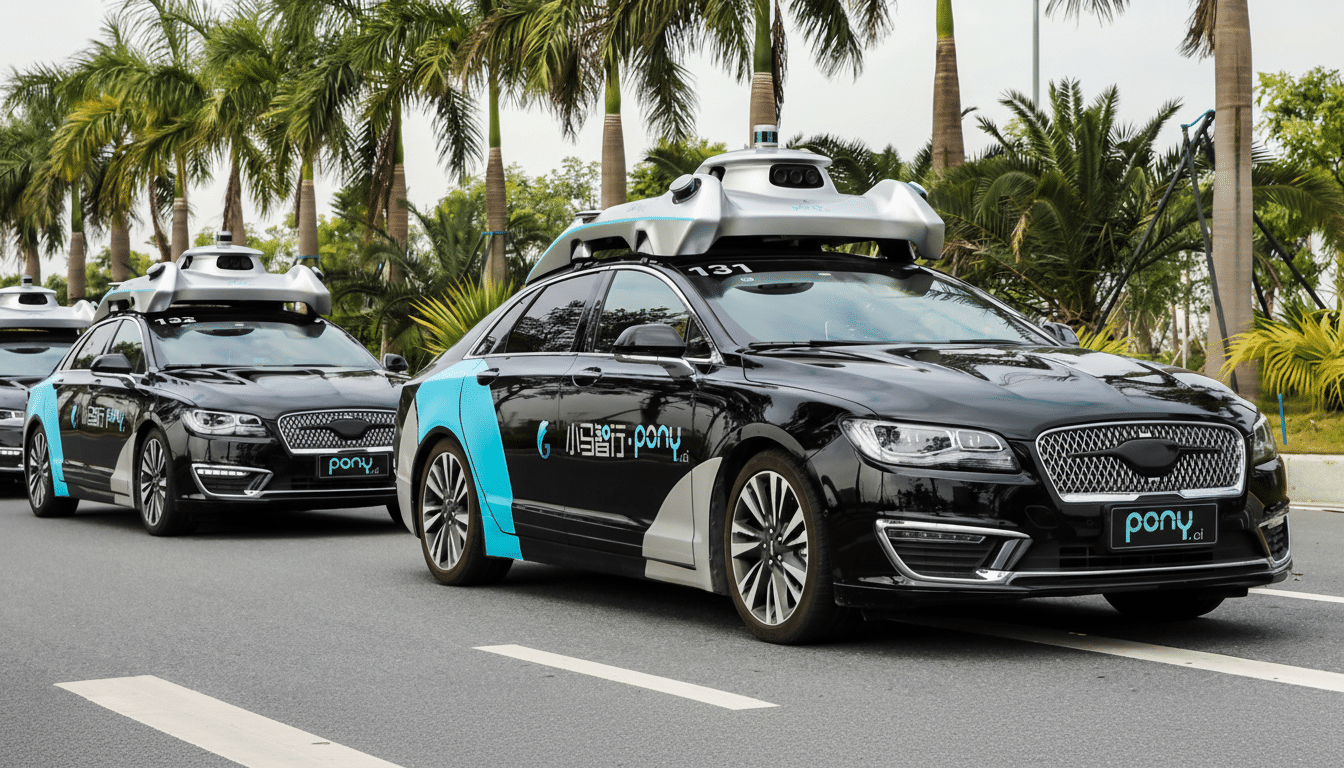

The company’s commercial robotaxi services are up and running, with customers paying for rides, in Beijing, Shanghai, Guangzhou and Shenzhen. They are some of the largest and most sophisticated autonomous driving testbeds in China, with growing areas for driverless operation and more ride-hailing partners integrated into the system. Pony.ai is also pushing beyond China, pointing to a play in more countries through local partnerships across eight markets such as Qatar and Singapore, as well as integrations with ride-hail platforms like Bolt and Uber to capture existing demand logistics.

Tripling, to 3,000 vehicles, would mean steady month-over-month additions. From a base of roughly 961 vehicles today, that would mean, beyond covering more than 3,000 in two years’ time, some additional numbers — on the order of 80 — to ramp up the rate at which it adds robotaxis over the next two years. Hitting these numbers is going to be a matter of localization, obtaining regulatory sign-off for driverless operation, and the reliable supply of purpose-built vehicles/sensor stacks.

Key Financial Numbers Behind Pony.ai’s Growth Plans

With the growth plan have come soaring revenue — and ballooning costs. Pony.ai earned $25.4 million in Q3 revenue, a whopping 72% year-over-year increase, thanks to robotaxi services and an increasingly busy robotruck business — not to mention software licensing. Robotaxi services added $6.7 million, robotrucks $10.2 million, and licensing and application fees $8.6 million. But even with momentum, the company reported a third-quarter net loss of $61.6 million, 46% higher than in the same period a year ago, underscoring how capital-intensive autonomy at scale is.

Liquidity is significant but shrinking: we exit the year with cash, cash equivalents and short-term investments of $587.7 million, down from $747.7 million in the latest quarter. About half the sequential decrease was due to a one-time cash outflow, including investment in a joint venture with Toyota Motor Corp. for production and deployment of its Gen-7 robotaxi, management said. Investors cheered the speed of commercialization, sending shares up more than 6% in trading following the announcement.

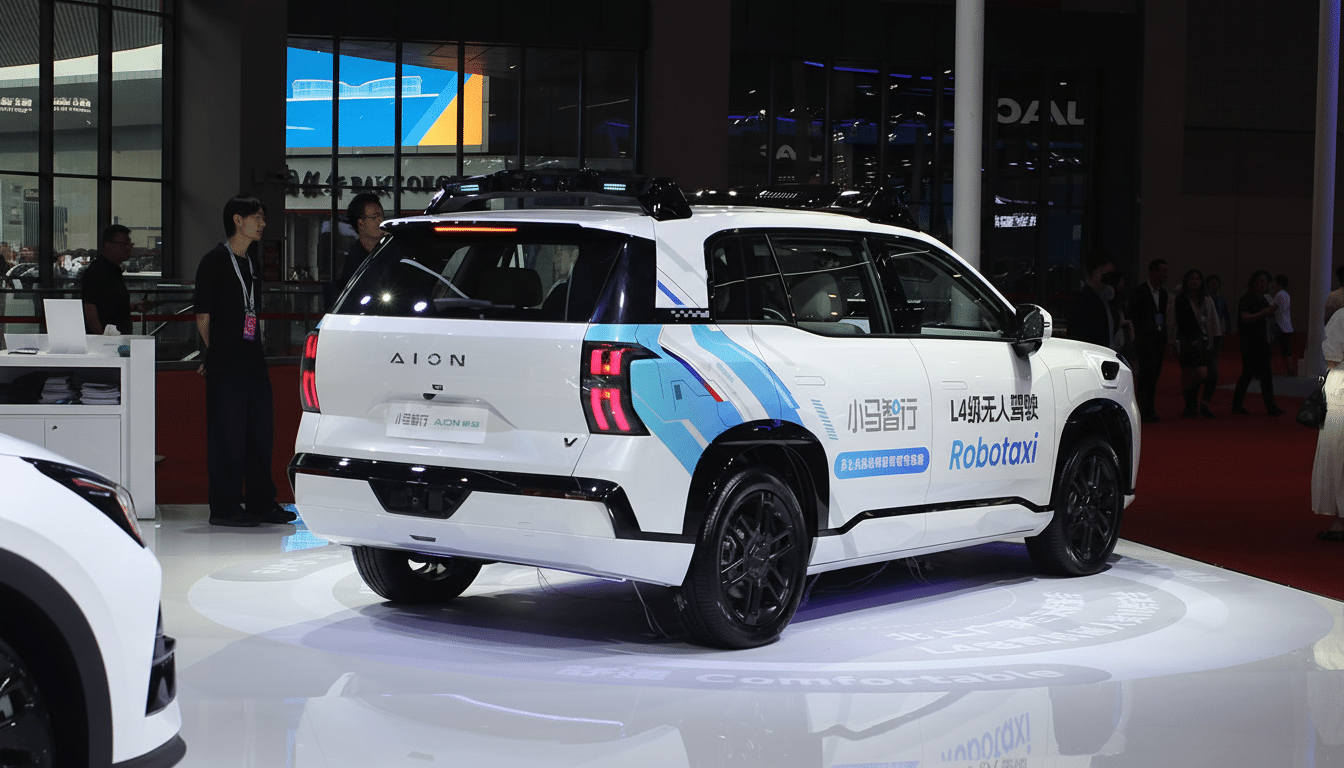

Hardware Partnerships and the Evolving Fleet Mix

As robotaxi services move out of pilot and onto the platform, the hardware roadmap is key. The Toyota partnership is the heart of Pony.ai’s next-generation fleet, designed for greater manufacturing consistency and more seamless software-hardware integration. The company is also making a robotruck — an area where long-haul routes and high utilization can lend momentum to unit economics — as well as licensing out its autonomous driving stack to third parties. That diversification is what helps smooth out revenue as ride volumes grow.

For fleet operators, of course, cost per kilometer is the North Star. Industry studies from firms like McKinsey identify declining sensor and compute costs, increased vehicle uptime through remote-assisted help and route densification as levers pulling autonomy to positive margins. Pony.ai’s capacity to push utilization beyond typical ride-hailing volumes — longer service windows and tighter dispatch, if you will — is what’s necessary for that larger fleet to translate into good economics.

Competitive Landscape and Global Regulatory Context

China’s policy environment for ICVs has matured at pace, with both national guidelines and municipal programs in place that allow fully driverless testing within a bounded zone. Larger operators have been able to scale up, with clearer safety oversight and expanded ranges of operation in cities like Beijing and Shanghai. Pony.ai faces competition from homegrown competitors like Baidu’s Apollo Go, WeRide and AutoX, while global benchmarks include Waymo and other U.S. programs that have resumed expansion after high-profile pauses for reviews.

Regulators around the world are coalescing on similar themes: staged approvals from supervised to driverless, robust reporting of incidents and playbooks for remote operations. For Pony.ai’s “global” push, the standard patchwork means deployments will rely on local solutions and compliance, even as the underlying autonomy stack remains the same.

What Success Looks Like for a 3,000-Vehicle Fleet

With more than 3,000 vehicles on the road, Pony.ai could provide tens of thousands of paid rides each day if you assume even a modest 10 to 20 trips per robotaxi. That ride density would hone the company’s mapping, prediction and planning models — a data edge that compounds as operations expand. It would also spin the flywheel with cities and consumers: shorter wait times, more comprehensive reach, visibly competent reliability.

The challenge is execution. Scaling safely involves disciplined geofencing, strong remote support and ongoing software validation. Financially, the path will be measured in revenue mix, cash burn and how fast per-ride costs come down as its Gen-7 fleet gets introduced. If Pony.ai transforms those manufacturing partnerships and regulatory advances into higher utilization and lower costs, tripling the size of the fleet by 2026 might represent a pivot from promise to durable, operating-scale autonomy.