Polestar is accelerating its growth with a four-car rollout that will reshape its electric lineup by 2028, calling it the largest model offensive in the brand’s history. The sequence includes the high-performance Polestar 5 sedan, a revamped Polestar 4, a next-generation Polestar 2 compact sedan, and an all-new Polestar 7 compact premium SUV aimed squarely at Europe’s hottest segment.

Four-Model Push Reshapes Polestar Lineup

The plan turns Polestar from a two- or three-nameplate niche player into a full-range EV marque with clear coverage across sedan and SUV body styles. The company says deliveries for the Polestar 5 start first, followed by a refreshed Polestar 4 later in the cycle, then a comprehensive update to the Polestar 2, and finally the debut of the Polestar 7 to complete the four-model push by the end of the period.

Polestar characterizes this as a strategy announcement rather than a full product reveal, but the intent is unambiguous: sharpen performance credentials, broaden appeal, and plug gaps where rivals have been quickest to scale.

What Each New Polestar EV Signals for the Market

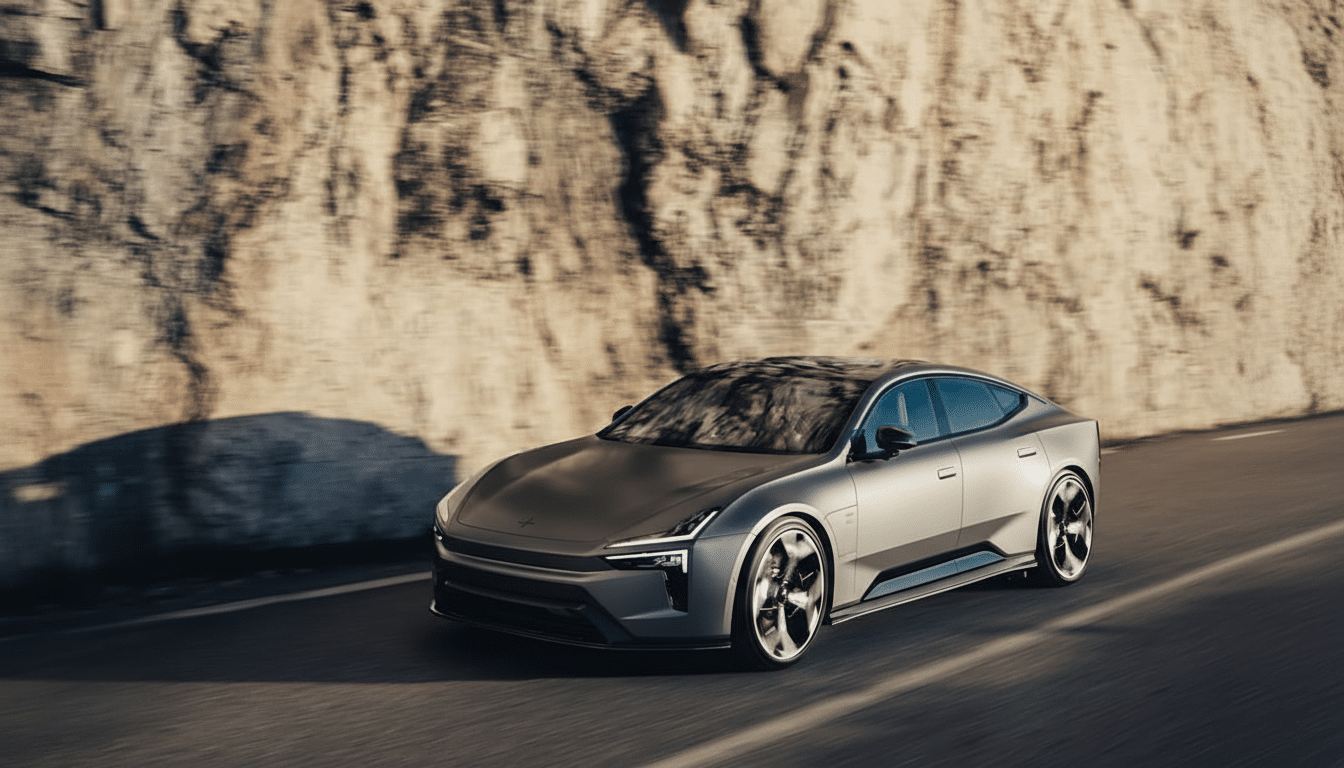

Polestar 5 underscores the brand’s performance ambitions. Positioned as a rapid electric grand tourer, it targets the upper end of the market where dynamic capability, long-range touring, and fast charging are table stakes. Expect it to square up against cars like the Porsche Taycan and high-spec versions of the Mercedes and BMW electric sedans, with the Scandinavian design language and minimalist cabin that have become Polestar signatures.

The revised Polestar 4 is pitched as blending the space of an estate with the versatility of an SUV and the dynamic response Polestar is known for. The current 4 has already stood out with daring packaging choices, and a revamp suggests the brand is listening to early feedback while doubling down on usable cargo space, efficiency, and ride-and-handling balance to win over family buyers who don’t want to trade agility for practicality.

A new iteration of the Polestar 2 will build on recent upgrades that improved efficiency and performance. The outgoing version moved to rear-wheel drive in its base form and introduced a larger battery and quicker DC charging. The next version should deepen those gains, with attention on energy density, software refinement, interior materials with lower lifecycle emissions, and value-added standard equipment to keep it competitive against fast-moving rivals.

Polestar 7 may be the volume linchpin. Described as a compact, premium SUV built in Europe at an attractive price point, it targets the continent’s core battleground. JATO Dynamics reports SUVs accounted for roughly half of new-car registrations in Europe recently, with compact crossovers leading growth. A well-priced, Europe-built model can reduce logistics complexity, buffer tariff risk, and align with evolving EU battery and sustainability rules.

Manufacturing, Software, And Supply Chain

Diversifying production locations is more than optics. European assembly for Polestar 7 would spread geographic risk beyond China and North America, strengthen proximity to key suppliers, and support compliance with local content and battery passport regulations. It also shortens delivery pipelines, a proven lever for improving cash conversion in a capital-intensive category.

On the software side, Polestar has leaned on a native infotainment stack powered by Google services and frequent over-the-air updates. Expect continuity there, alongside advanced driver assistance that leverages higher-resolution sensors and centralized computing. The brand’s insistence on clean, responsive UX—paired with continuous feature rollouts—has been a differentiator for early adopters who expect their car to improve over time.

Sustainability threads through each model. Polestar has published lifecycle assessments on existing vehicles and is pursuing supply chain transparency on materials such as cobalt and nickel. The upcoming cars will likely expand the use of recycled and bio-based components, lower-emission aluminum, and traceable battery materials to cut embedded CO2 without diluting perceived quality.

Market Context and Competitive Stakes for Polestar

The timing is calculated. According to the International Energy Agency, global EV sales surpassed 14 million in the most recent year tracked, reaching about 18% of light-vehicle sales worldwide. Europe remains a pillar market, but competition is intense and pricing power is under pressure as more entrants arrive from both legacy automakers and newer players.

Polestar’s answer is to prioritize design, driving character, and credible sustainability while tightening cost discipline through shared architectures and supplier scale within its wider corporate ecosystem. S&P Global Mobility notes that brands which marry clear identity with well-executed, high-volume segments tend to weather demand swings better. The Polestar 7’s positioning suggests the company is aiming precisely at that formula.

What to Watch Next for Polestar’s EV Roadmap

Key milestones include final performance and charging specs for the Polestar 5, detailed packaging and efficiency targets for the refreshed Polestar 4, the extent of the Polestar 2’s upgrade, and confirmation of Polestar 7’s European manufacturing footprint and pricing corridor. Also watch for updated lifecycle emissions reporting and supplier disclosures as regulations tighten.

If Polestar executes to plan, it will enter 2028 with a far broader, more resilient lineup. The products will do the talking soon; for now, the roadmap sends a clear message that the brand intends to play offense across the EV market’s most contested ground.