Google’s newest flagships are translating buzz into hard numbers. Fresh industry tracking indicates the Pixel 10 lineup delivered the company’s highest monthly smartphone sales in the US to date, with overall Pixel volumes rising 28% year over year, according to Counterpoint Research.

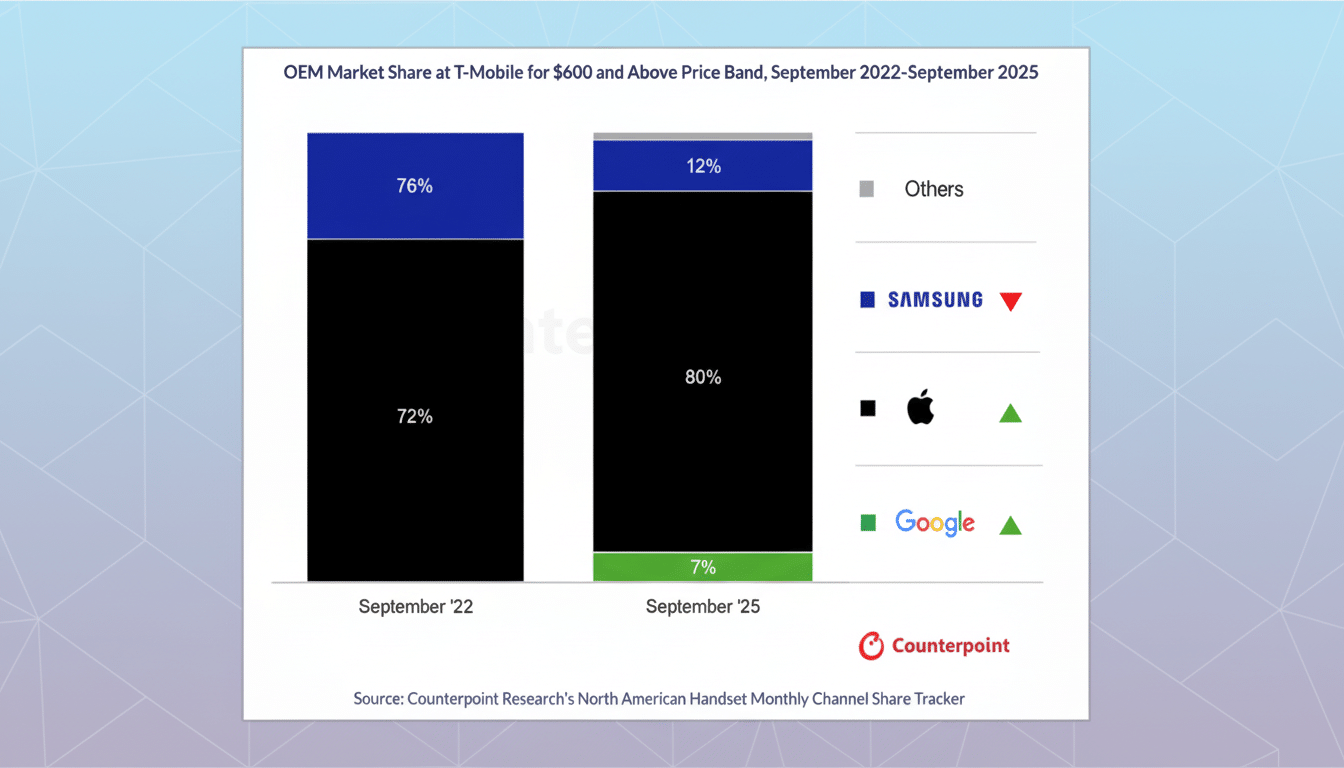

Perhaps more notably, Google’s slice of the US premium market—devices priced $600 and up—has climbed to just over 6% in the latest measurement. For a brand that only recently began to make consistent inroads above the midrange, that shift signals momentum that is finally breaking into the mainstream.

What’s Powering The Surge

The Pixel 10 family spans four models—Pixel 10, 10 Pro, 10 Pro XL, and 10 Pro Fold—giving Google its broadest premium portfolio yet. Each carries the Tensor G5 platform and deep Gemini AI integration, a one-two punch that underpins Google’s pitch: smarter photography, more helpful on-device intelligence, tightly woven software experience.

The hardware is just the beginning; Google’s marketing has been unapologetically comparative, leaning into side-by-side demos and playful jabs at iPhone. The company also reduced friction for switchers by letting buyers start iPhone data transfers before the Pixel arrives when ordering through the Google Store—a small operational tweak that can remove a big psychological barrier for first-time Android converts.

Carriers have played a role as well. Aggressive trade-in credits and installment deals have become table stakes at the high end, and the breadth of the Pixel 10 lineup makes it easier for operators to slot a Pixel at multiple price points without diluting the “premium” sheen.

Reading The Numbers With Context

Counterpoint highlights a leap in Google’s share of the $600+ tier from a near rounding error a couple of years ago to over 6% now. That is real progress, but the comparison comes with caveats.

In that earlier period, Google had just one aging model clearing the $600 bar, the Pixel 6 Pro, and its newest generation had not yet rotated into stores. Today, four fresh Pixel 10 devices sit comfortably above that threshold.

In other words, part of the dramatic premium-share jump reflects a simple portfolio effect: more current, high-priced SKUs on shelves naturally lift share in that bracket. The record month for total US Pixel sales stands on its own, but any year-on-year premium comparison should account for timing, product age, and mix.

Why The Record Matters

The US premium market has long been a two-horse race. Cracking even mid-single digits there is meaningful because it signals that Google’s differentiation — especially AI-first features and Google-branded silicon — resonates with buyers who pay top dollar. Analysts have repeatedly noted that premium Android success rides on clear advantages in camera, software longevity, and intelligence; Google’s current strategy aligns squarely with that playbook.

There is also a halo effect. Strong flagship sell-through tends to lift brand perception for the entire portfolio, from future A-series models to wearables. As the Pixel ecosystem grows, cross-selling services and accessories gets more manageable, creating a flywheel that the company has struggled to initiate in past generations.

What To Watch Next

Sustaining a record month requires more than launch excitement. Supply continuity, continued carrier support, and timely software updates will all be critical to maintaining the trajectory.

Watch for how Google balances AI feature rollouts between the Pixel 10 series and older devices; keeping marquee features and capabilities exclusive too long can frustrate loyalists, while moving too quickly can blunt the Pixel 10’s premium appeal.

The early read is clear: with the Pixel 10 series, Google has turned a corner in the US. Counterpoint’s data shows a brand that’s no longer just competing for enthusiasts — it’s winning over premium buyers at scale, and setting new internal records in the process.