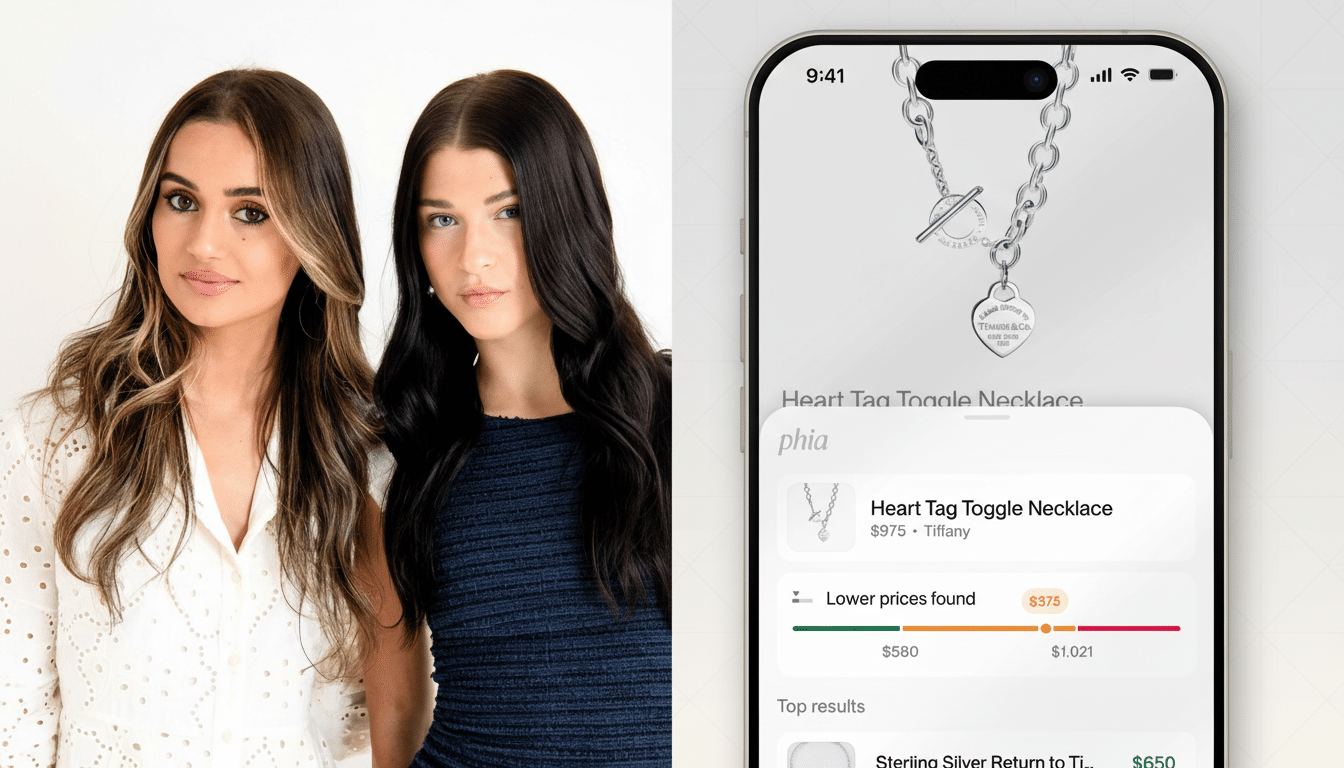

Phia, the AI shopping startup co-founded by Phoebe Gates and climate advocate Sophia Kianni, has secured $35 million in fresh funding to build what the pair describes as a personalized “shopping agent” that blends price-savvy discovery with playful, social buying. The round was led by Notable Capital with participation from Khosla Ventures and returning backer Kleiner Perkins, signaling heavyweight confidence in a new wave of commerce built around intelligent assistance.

Funding and mission behind Phia’s shopping agent vision

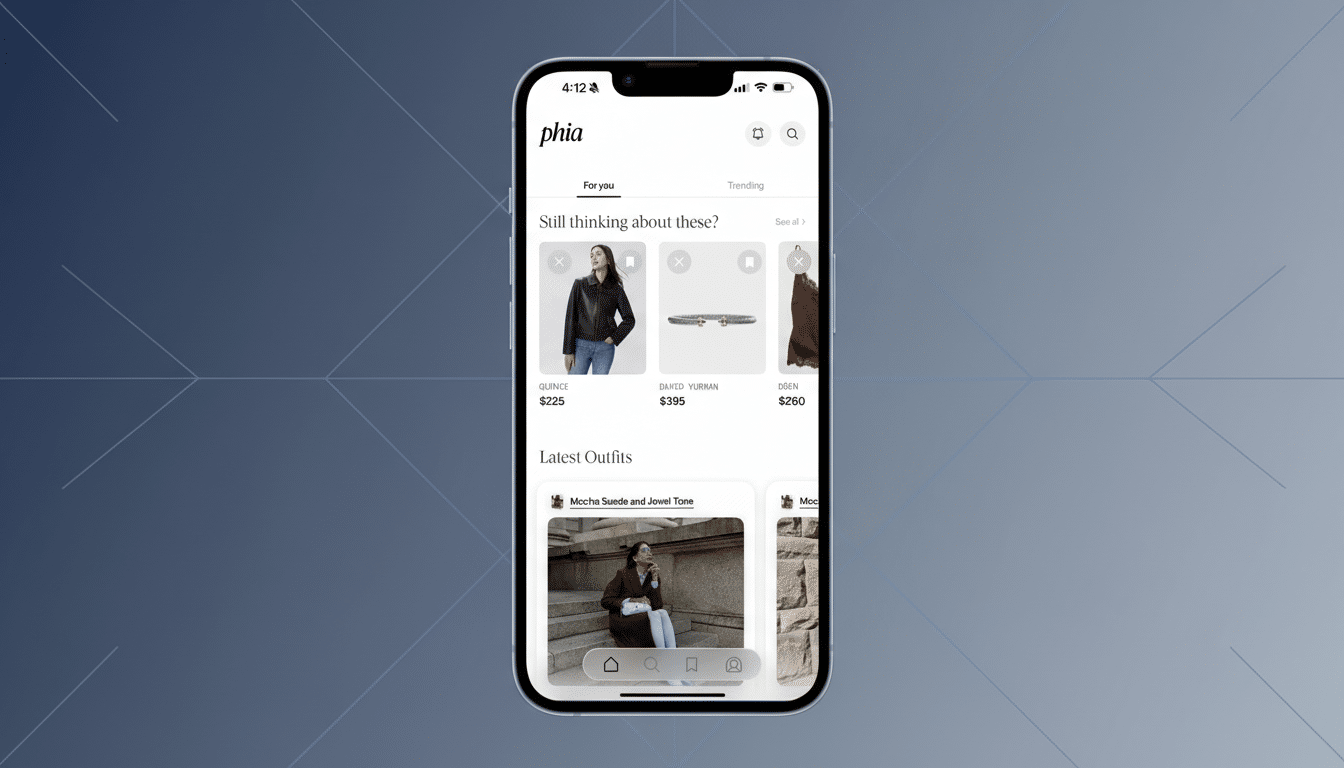

Though less than a year old, Phia says it has amassed hundreds of thousands of monthly active users, booked 11x revenue growth since launch, and onboarded 6,200 retail partners. The company’s pitch is straightforward: make online shopping feel personal again, reduce the endless tab-hopping, and surface smarter choices—often cheaper and more sustainable—without asking consumers to do more work.

- Funding and mission behind Phia’s shopping agent vision

- How Phia works across apps to surface smarter deals

- Why AI shopping agents are surging across retail today

- Founder-led momentum powered by content and community

- Data practices under the microscope as trust becomes vital

- Competitive landscape and what to watch next

The timing aligns with commerce’s broader shift toward assistance rather than search. For years, shoppers have been funneled into static product grids that ignore individual taste, size, budget, and what already lives in their closets. Phia’s founders believe an agent that understands context—style preferences, price sensitivity, and inventory across both new and secondhand marketplaces—can compress the path to the right item from hours to minutes.

How Phia works across apps to surface smarter deals

Phia operates as a mobile app and browser extension. When a user considers buying a product on a retailer’s site, Phia can suggest secondhand listings of the same or similar item, or highlight lookalikes from lower-priced brands. Think of spotting a $200 dress and, in one click, seeing identical or near-identical options on resale platforms for a fraction of the price—alongside comparable styles from value labels.

The business model mirrors affiliate commerce: when a partner brand or marketplace sale occurs through Phia’s recommendations, the startup earns a cut. According to the company, partner data shows the agent can deliver a 15% lift in average order value, 30% stronger new customer acquisition, and 50% lower return rates, a trio of metrics retailers obsess over as acquisition costs rise and return logistics eat margins.

Why AI shopping agents are surging across retail today

Consumer fatigue is real. The Baymard Institute has long reported cart abandonment rates hovering around 70%, a symptom of friction, choice overload, and poor fit prediction. Meanwhile, McKinsey estimates generative AI could add $150–$275 billion in operating profit to fashion and luxury by 2030, much of it through personalization, merchandising, and service automation. An agent that trims steps, aligns to budget, and reduces mis-buys directly tackles those pain points.

Phia’s sustainability angle also meets a cultural moment. Resale has outpaced broader apparel growth for years as price-conscious and climate-aware shoppers embrace secondhand. Kianni’s environmental credibility helps, but the founders are clear that the hook is value: if an AI can find a better deal without sacrifice, that’s how behaviors change at scale—and why brands, not only resale marketplaces, are eager to participate.

Founder-led momentum powered by content and community

Gates and Kianni have leaned heavily on founder-led distribution. Between their social followings—topping 2 million across platforms—and a podcast, The Burnouts, they’ve created a top-of-funnel content engine that feels native to Gen Z and young millennial shoppers. That voice, paired with a steady cadence of product demos, has helped recruit early adopters and retail partners before a massive paid spend.

The new capital will fund a talent-heavy roadmap, particularly in machine learning and retrieval infrastructure. The New York–based team is roughly 20 people but is hiring senior engineers to deepen personalization, improve visual matching, and scale cross-inventory recommendations. The bet is quality over headcount: better models and clean data over sheer marketing muscle.

Data practices under the microscope as trust becomes vital

As with any agent that learns user preferences, data stewardship is paramount. Fortune previously reported that a legacy version of Phia’s browser extension captured webpage HTML to detect shopping destinations. Phia removed the capability and said the content was not stored, emphasizing that permissions are disclosed and data is aggregated and anonymized for recommendation purposes.

The scrutiny is a reminder that trust fuels adoption. Groups like the Electronic Frontier Foundation have urged clear, plain-language disclosures for extensions that read page content, and browser makers are tightening rules around tracking. For a shopping agent, transparent controls—what’s collected, why, and how to opt out—could be a competitive advantage, not just a compliance checkbox.

Competitive landscape and what to watch next

Big platforms are marching toward conversational commerce—search engines are blending product answers with recommendations, and fintechs and marketplaces are testing AI concierges. Phia’s edge is its cross-inventory viewpoint: unifying new retail, resale, and budget alternatives in a single flow, then learning from each user’s taste and closet.

Key signals to track: repeat usage and session depth, conversion lift for partners, and the durability of affiliate economics as traffic scales. On the tech side, accuracy in visual and semantic matching—and latency at checkout moments—will separate useful agents from novelty chatbots. If Phia can combine trustworthy data practices with measurable retailer ROI, it could carve out a durable beachhead.

The promise is simple and ambitious: shrink the distance between want and have, surface smarter choices, and reintroduce delight to a process that’s become chore-like. If the technology holds and the trust lands, Phia’s plan to make shopping fun again may be more than a catchphrase—it could be the new default.