The big story in corporate power is no longer the behemoth conglomerate. It’s the rise of personal conglomerates — sprawling, cross-industry portfolios anchored not by a single corporate charter but by a single individual’s capital, audience, and influence. From rockets to chocolate bars to private equity, founder- and creator-led empires are redrawing the map of who owns what, and how fast those empires can move.

While industrial giants continue to slim down or split apart to “unlock value,” a new model is scaling in plain sight: people as platforms, assembling companies across sectors with speed that traditional conglomerates can’t match.

- What Personal Conglomerates Really Are Today

- Why The Shift To Personal Conglomerates Is Accelerating

- The Musk Test Case For Personal Conglomerate Power

- Creators Are Building Mini Empires With Real Scale

- The Finance Angle And The Conglomerate Discount

- The Risks Regulators Are Watching In Personal Empires

- What To Watch Next As Personal Conglomerates Evolve

What Personal Conglomerates Really Are Today

Think of a personal conglomerate as a diversified business portfolio with a person at the center. The glue isn’t shared back-office systems or a common corporate balance sheet. It’s the founder’s capital, distribution (often a massive social audience), recruiting magnetism, and control over partnerships.

Unlike legacy conglomerates, these empires flex different muscles: they can seed deals quickly, cross-promote instantly, and negotiate as a brand in their own right. The “parent company” is effectively a personality and its network. That has real leverage in an era where attention and data compound returns.

Why The Shift To Personal Conglomerates Is Accelerating

Three forces are pushing this pivot.

- First, wealth concentration gives founders unprecedented dry powder to fund adjacent bets; global billionaire wealth has climbed sharply in recent years, according to the World Inequality Database.

- Second, platforms and AI have collapsed distribution and coordination costs, letting a single operator influence multiple markets at once.

- Third, public markets increasingly penalize traditional conglomerates with a valuation discount, pushing large corporates to spin off divisions while individuals knit assets together informally.

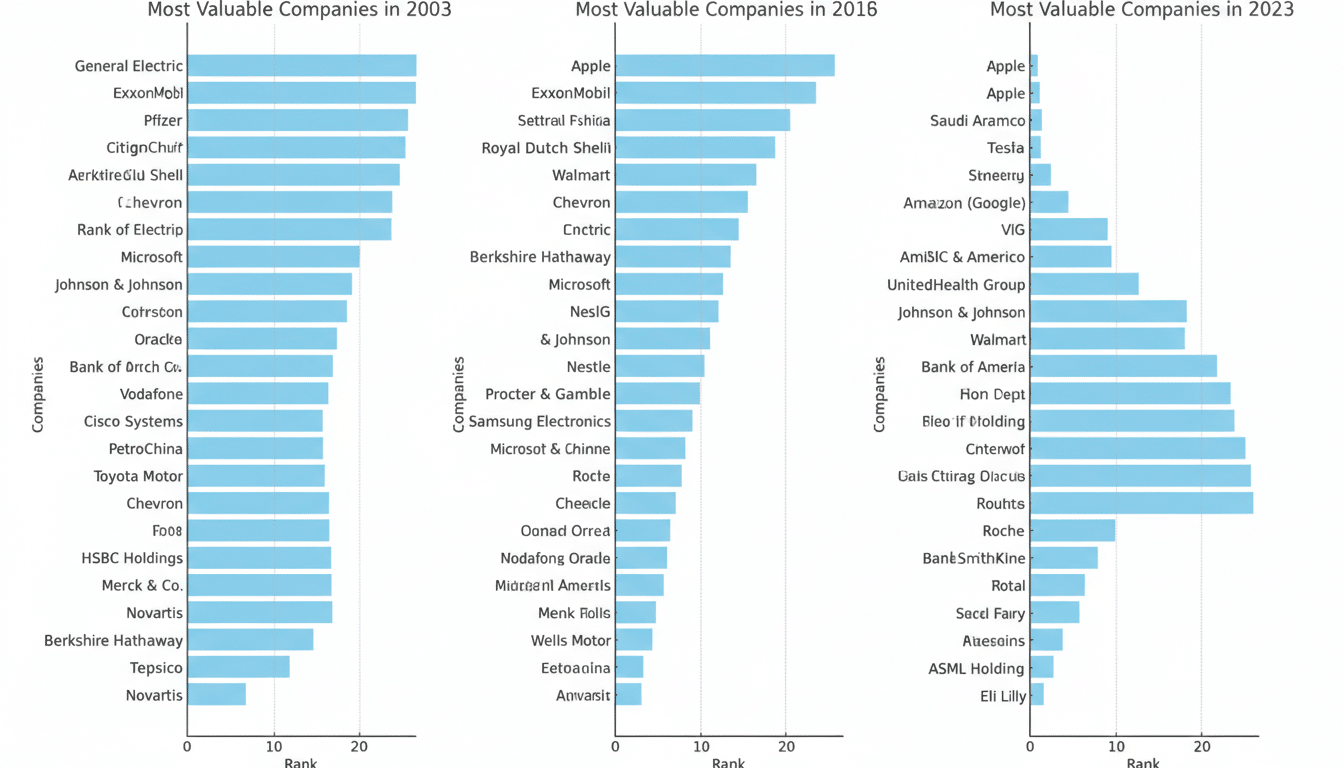

The contrast is stark: GE split its businesses, Johnson & Johnson separated its consumer unit, and numerous industrials have trimmed portfolios. In parallel, personalities are consolidating economic power around themselves, not legal entities.

The Musk Test Case For Personal Conglomerate Power

One high-profile example is the ecosystem orbiting Elon Musk. The network spans electric vehicles, rockets, satellite communications, AI, neurotech, tunneling, and social media. Beyond shared ownership and leadership, ties are tightening — AI models showing up in cars, energy storage feeding data centers, and co-investments across entities. Multiple reports have suggested that deeper consolidation among key companies has been explored.

What matters isn’t just the headline businesses. It’s the operating system: the ability to direct capital at will, move talent across companies, and deploy attention as a strategic asset. Bloomberg’s wealth rankings routinely place Musk near the top, underscoring the firepower individuals can wield compared with many public companies.

Creators Are Building Mini Empires With Real Scale

Personal conglomerates aren’t only for tech tycoons. The creator economy has matured from sponsorships to ownership. Ryan Reynolds parlayed his audience into Aviation Gin (sold in a deal worth up to $610 million) and Mint Mobile (acquired by T-Mobile in a deal valued at up to $1.35 billion), among other holdings. Kim Kardashian’s Skims has been valued around $4 billion, accompanied by ventures in beauty and a private equity firm. Logan Paul and KSI’s Prime reported over $1 billion in annual retail sales. MrBeast’s portfolio now spans consumer goods, media, and tech investments.

This is no niche phenomenon. Goldman Sachs has estimated the creator economy could approach $480 billion within a few years, while YouTube has disclosed paying creators and partners tens of billions over recent periods. As creators convert audience into equity, the personal conglomerate becomes the default path.

The Finance Angle And The Conglomerate Discount

Classic corporate conglomerates often trade at a discount — commonly cited in the 10% to 15% range in corporate finance research — because investors struggle to price disparate businesses under one ticker. That’s why breakups can unlock value.

Personal conglomerates sidestep the discount by keeping assets in separate entities while coordinating at the individual level. Capital can be allocated privately; synergies can be captured via partnerships, licensing, or related-party deals; and public investors can still buy the specialized companies they prefer. It’s a have-your-cake-and-eat-it setup — at least while the flywheel spins.

The Risks Regulators Are Watching In Personal Empires

Power concentrated in a person can be harder to scrutinize than power concentrated in a corporation. Antitrust agencies have sharpened merger guidelines, and the EU’s Digital Markets Act has expanded gatekeeper oversight. Securities regulators have tightened beneficial ownership disclosures and related-party transaction scrutiny. Political influence adds another layer: OpenSecrets has chronicled surging contributions by top individual donors, increasing public attention on how wealth shapes policy.

Governance is the near-term friction. Boards must police conflicts when a founder sits across the table on both sides of a deal. Creditors will ask how cross-entity dependencies are managed. And if a personal brand sours, everything tied to it takes a reputational hit simultaneously — a risk classic conglomerates dull with institutional distance.

What To Watch Next As Personal Conglomerates Evolve

Signals worth tracking include consolidation moves that formalize personal empires, cross-entity contracts that shift value, and capital raises that bundle assets under a holding structure. Expect more creator-led CPG brands, more founder-owned AI and media mashups, and more private vehicles that resemble 21st-century versions of family offices with operating arms.

Corporate conglomerates aren’t disappearing — defense and industrials still reward scale — but the center of gravity is moving. The next generation of empires will look less like a single monolith and more like a constellation, with a person at the core pulling the stars into alignment.