PayPal is introducing a simpler method for sending and requesting money: one-time, customizable payment links that work across chats, texts and DMs. The product, called PayPal Links, is for one-off transactions and will be available to consumers starting next month to send payments with crypto as well as dollars such as Bitcoin, Ethereum or the company’s own PayPal USD (PYUSD) stablecoin in the U.S.

What’s new with PayPal Links

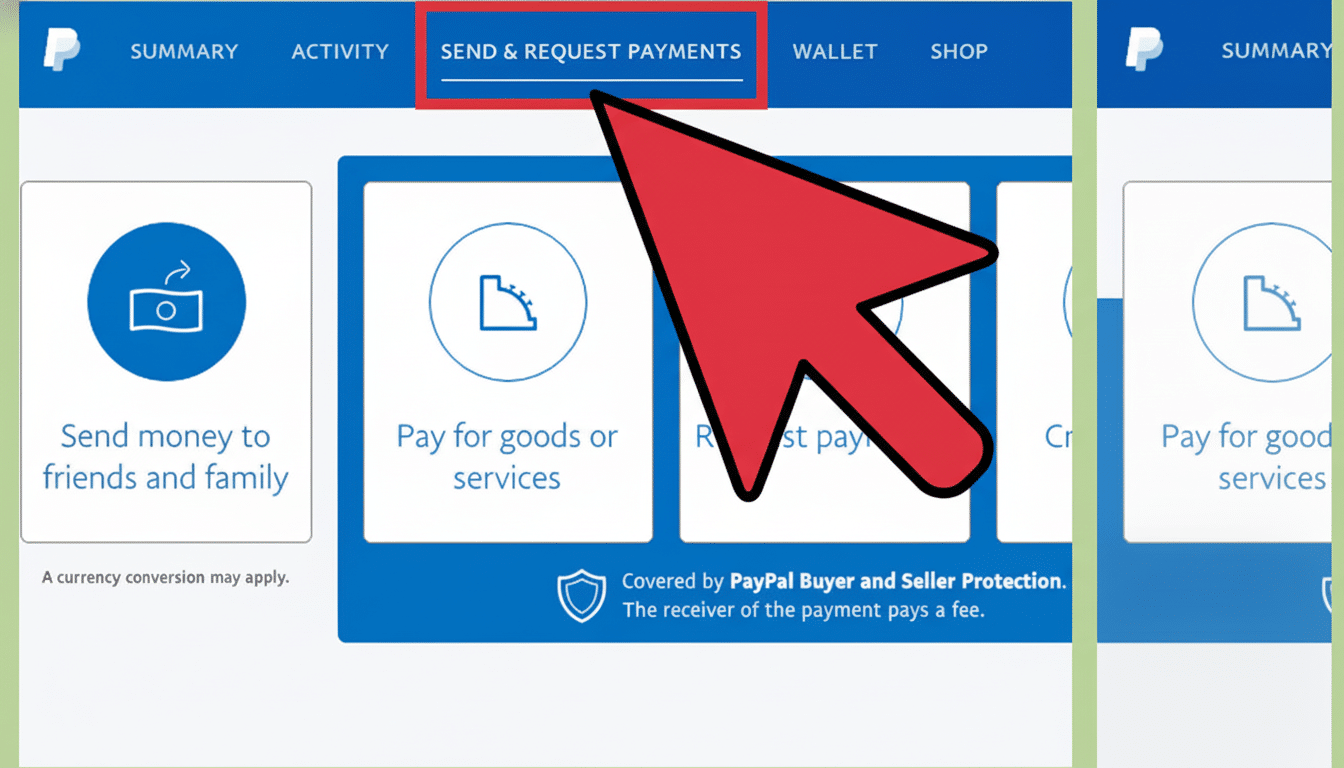

Unlike PayPal. Me—it has a profile-style handle and requires the payer to specify a payment amount—PayPal Links are created in response to an individual payment or request. Users select “link” in the app, pick an amount and paste a unique, one-time URL into any conversation. The recipient taps to finalize payment or accept the money within the PayPal app, and money is transferred in real time once it’s confirmed.

After 10 days, a link expires if left unclaimed. (If you are spending time talking about what they could and could not buy with that money, I wish you much strength.) Senders can cancel or nudge a prompt to remind them, which is helpful for settling up a shared bill or tying a one-off request to a particular dollar amount. The idea was less hunting for usernames and clicks, especially when paying someone you don’t already follow or have in your contacts.

PayPal says PayPal. Me isn’t disappearing; it still functions as a permanent, public alias for getting paid. The new Links feature just layers a bit of additional friction over one-to-one payments where speed and specificity are required.

Crypto support on deck

In the future, PayPal will allow U.S.-based users to pay with crypto via such links — to Bitcoin and Ethereum, for example, or to PYUSD. That means a creator could throw a pay link in their DM and receive a tip in stablecoin, or that someone purchasing an item via OpenSea didn’t have to find the seller’s address manually if settling up through ETH. The company has been building up to this: It already allows for crypto buys and external transfers, and last month it launched PYUSD with Paxos Trust to provide a dollar denominated option suitable for everyday payments.

The crypto-powered features are set to be compatible with PayPal, Venmo and select external digital wallets. For stablecoins an especially, that could eliminate some of the copy-paste mistakes and mismatches that make casual crypto users wary of on-chain transfers but leaving compliance and custody guard rails in the app.

The significance of a link in the P2P crowd

Peer-to-peer payments are huge and only getting more competitive. PayPal processes more than $1.5 trillion in annual total payment volume, according to company filings, and Venmo alone handled about $244 billion in a full recent year. Zelle said it had about $806 billion in transactions over the same period — a measure of how fast instant payments have taken hold throughout the U.S. banking system.

A one-time link is a little UX nudge with an outsize usefulness. It accepts the way humans circulate money — splitting dinner via a group chat, paying a neighborhood vendor, or collecting dues — without forcing you to find a handle there or confirm a profile photo. It also limits misdirected payment, a regulatory bugbear for P2P services. The Consumer Financial Protection Bureau has warned repeatedly about scams involving instant payment apps; expiration and single-use limits narrow the window for abuse.

There’s competitive context too. Cash App made $cashtags part of the vernacular, while Stripe has long had Payment Links for merchants. Move: For PayPal, it’s somewhere between consumer P2P and light commerce — a flexible format for the long tail of transactions would-be notaries and Would I Lie to You hosts, say — where neither party wants to swap (or have swapped) their full account posting.

Taxes, protections, and compliance

PayPal comments that personal payments continue to be excluded from Form 1099-K reporting, in line with the tax regulations that limit application of the form to payment for goods and services and not reimbursements or gifts. That distinction is particularly critical as platforms adapt to changing IRS thresholds and reporting guidance.

For security, the one-time nature, clarity of amount and embedded reminders help to keep transactions transparent. Normal PayPal protections remain in place depending on the type of payment, as do the typical risks and regulatory obligations with crypto. In other words, the link makes the handoff easier; it doesn’t alter how fiat and crypto rails are regulated.

Rollout and availability

PayPal Links are rolling out in the U.S. initially, and with additional markets planned, including the U.K. and Italy next up on the roadmap. The feature operates wherever people are already coordinating money — in social DMs, marketplace chats, email or SMS — and finishes in the PayPal app. Crypto support launches in the U.S., and follows along with existing on- and off-ramps, and is also part of the company’s PYUSD ecosystem.

For a platform with hundreds of millions of active accounts, eliminating even one tap can change behavior. In offering single use links now and eventual crypto compatibility, PayPal is betting that the most universal payments interface isn’t a QR code or a handle, but rather a link you can drop anywhere and everywhere in the digital world.