Oracle is in the process of selling about $15 billion of debt in the investment‑grade bond market, Bloomberg reported on Tuesday — a multi‑part offering that might include an unusual 40‑year piece. The potential sale would give the company long‑dated capital as it ramps up spending on cloud and artificial intelligence infrastructure.

Fueling AI infrastructure ambitions with new funding

The financing talk comes after word surfaced earlier today that Oracle has closed a sweeping compute agreement with OpenAI while also discussing large‑scale capacity deals with Meta. Details are private, but the trajectory is plain: hyperscale AI is eating capital. Constructing and operating clusters of next‑gen GPUs, adding and securing power, and standing up new campuses can run into the billions per site, and those costs scale with every model upgrade and customer ramp‑up.

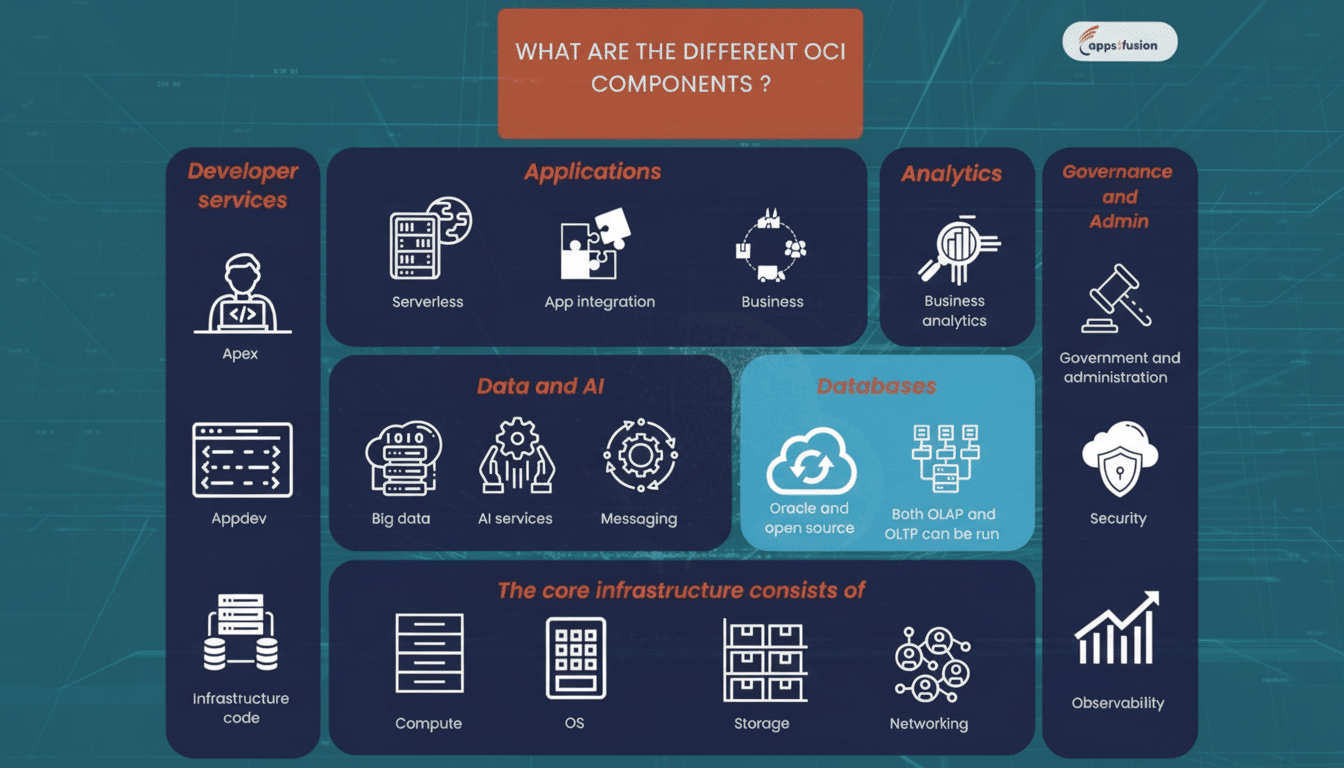

Oracle Cloud Infrastructure has been about key specialized AI workloads — high‑bandwidth networking, accelerated compute provisioning, and bare‑metal performance, where early capacity can yield long‑life, high‑margin contracts. Tapping the bond markets enables Oracle to lock in multiyear funding that corresponds with the life of these assets and long‑term commitments with marquee customers.

Deal structure and investor demand for Oracle bonds

Bloomberg’s reporting indicates as many as seven tranches, a textbook approach for an issuer looking to attract the widest investor base. A 40‑year “long bond” would be aimed at life insurers and pensions that want to extend duration, while 5‑ and 10‑year notes typically lure core investment‑grade buyers like mutual funds and bank portfolios. It is true that recent primaries have rewarded high‑quality issuers with deep order books, and tech names influenced by AI capacity have been in particularly strong demand.

Count on pricing to be set versus U.S. Treasuries, with a nominal new‑issue concession, adjusted for ratings, leverage evolution, and proceeds deployment. If Oracle indicates monies are destined for peripherals like capex and refinancing rather than buybacks, that usually is a shot across the bows of spreads, given we are in a market still straddling uncertainty over inflation versus yield.

Balance sheet and ratings comparison for Oracle debt

Oracle is still an investment‑grade issuer at the major agencies, but it has spent years on the lower end of that spectrum due to substantial acquisitions and shareholder returns. With its acquisition of Cerner, for example, it took on a big slug of debt and acquired an entirely new revenue stream. So a $15 billion raise might be in line with the staggered maturities and liquidity cushioning to get ahead of more challenging AI build‑outs and refinancings.

Ratings agencies will track two metrics closely: net leverage as well as the speed at which new cloud and AI investments turn into recurring cash flow. If utilization ramps as we forecast (largely based on long‑term customer contracts and an expansion of GPU fleets), free cash generation could offset higher interest costs and lead to stable or improving outlooks.

Why long‑dated debt now for Oracle’s AI expansion?

AI data centers and long‑term power purchase agreements are multi‑decade initiatives. Bonds with long tenors match repayment to the useful lives of networking, real estate, and energy infrastructure, lowering refinance risk. They also diversify the creditor base beyond short‑tenor buyers, a plus in cycles. For Oracle, the longer duration now creates optionality — fund hyperscale growth, opportunistically refinance near‑term debt maturities, and remain flexible for selective M&A related to cloud and industry verticals.

Leadership change highlights cloud focus

Oracle has recently announced a change in its leadership, with Safra Catz moving from CEO to serving as executive vice chair of the board, and Clay Magouyrk and Mike Sicilia serving as co‑CEOs. Magouyrk, who helped build Oracle Cloud Infrastructure, and Sicilia, who runs industry solutions, add operational depth in precisely the places that the company is pushing into. For creditors, the main plot of the bond story will be around consistency in cloud execution and discipline around capital allocation.

What investors will watch as Oracle sells new bonds

Key signposts are final deal size by tranche, order‑book strength from syndicate desks, and pricing versus the technology peer group. Anything disclosed on use of proceeds — capex, refinancing, or general corporate purposes — will set the spread result. The market will also seek further visibility on AI partnerships and capacity expansion at the margin, as these contracts serve as the vehicle for demand into Oracle’s next wave of infrastructure spend.

A $15 billion print, if it happens, would be one of the larger investment‑grade technology offerings and would secure that strategy for Oracle: scale up AI‑ready infrastructure rapidly, finance it with long‑dated paper, and turn demand from headline customers into durable cash flows.