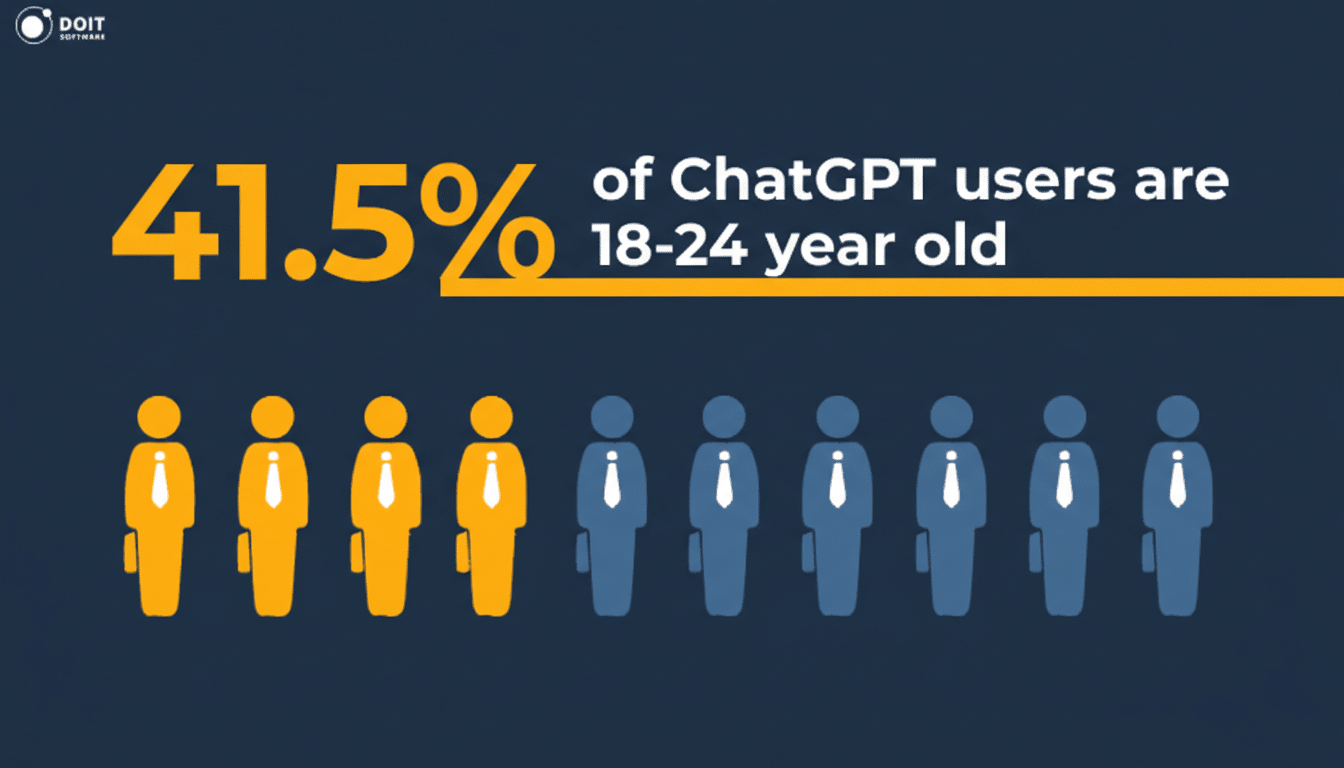

OpenAI says India’s youngest adults are carrying the country’s generative AI boom. Users aged 18 to 24 now account for nearly 50% of ChatGPT messages sent from India, while those under 30 make up about 80% of activity, underscoring a youth-led wave that is reshaping how work, study, and coding get done.

Youth-Led AI Adoption Expands at National Scale in India

India has quickly become OpenAI’s second-largest market, with more than 100 million weekly users, and the composition of that audience skews sharply young. Several forces likely explain the tilt: a vast student population, a deep bench of early-career engineers, low mobile data costs, and campus-first experimentation with AI for assignments, placements, and side projects.

Price sensitivity matters, too. OpenAI has pushed localized pricing in India, including a sub-$5 subscription tier, and has run targeted promotions to accelerate onboarding. That mix, paired with mobile-first access and widespread English proficiency among students and tech workers, helps explain why the 18–24 cohort is punching above its weight in usage.

Work and Code Dominate ChatGPT Queries in India

OpenAI reports that 35% of ChatGPT messages from India are tied to professional tasks, outpacing the 30% global share. The company’s coding assistant Codex is a standout: Indian users are engaging with Codex at roughly three times the global median, and weekly usage jumped fourfold after a Mac app release two weeks ago, according to OpenAI. Users in India are also asking three times as many coding-related questions as the median.

The trend mirrors broader patterns across AI tools. Anthropic recently said 45.2% of Claude’s tasks in India map to software-related use cases. In practical terms, that means developers are leaning on assistants for debugging Python, writing SQL queries, scaffolding microservices, and explaining unfamiliar libraries—often in the flow of work and late-stage test prep.

Outside of work, OpenAI says 35% of Indian messages seek guidance—think career planning, exam strategy, learning roadmaps—while 20% center on general information and 20% involve drafting or editing text. That blend reflects how young users move fluidly between study, internships, freelance gigs, and job hunts, often in the same chat session.

OpenAI Deepens Its India Bet With New Partnerships

OpenAI is matching usage momentum with local investments. The company plans new offices in Mumbai and Bengaluru and has inked a major partnership with Tata Group to secure about 100 megawatts of AI compute capacity and roll out ChatGPT Enterprise within Tata Consultancy Services. That distribution muscle could put enterprise-grade AI in front of hundreds of thousands of consultants and clients.

OpenAI has also signed agreements with fintech platform Pine Labs, travel leaders Ixigo and MakeMyTrip, and food and grocery delivery company Eternal. On the education front, partnerships aim to provide tools to more than 100,000 students over the next six years—another signal that campuses will continue to be ground zero for AI adoption.

Framing the push, OpenAI’s chief economist Ronnie Chatterji said the company’s new Signals initiative is intended to ground India’s AI debate in measurable evidence. His message: adoption is moving faster than traditional metrics can capture, so policymakers and businesses need fresher, real-world data to guide decisions.

Why the 50% Matters for India’s AI Trajectory

A user base dominated by 18 to 24-year-olds has immediate consequences for India’s talent pipeline. Employers can expect new hires to arrive with hands-on AI habits, from code generation and unit tests to data analysis and content drafts. That puts a premium on governance—organizations will need clear policies on accuracy checks, data privacy, and IP safeguards alongside productivity gains.

For policymakers, the surge raises familiar twin challenges: ensuring broad access while minimizing harms. As India operationalizes its data protection regime, standardizing expectations for AI use in classrooms and workplaces—transparency, attribution, and safe handling of sensitive data—will matter as much as scaling digital literacy.

For competitors and startups, the signal is equally clear: India’s fastest-growing AI segment is young, mobile-first, and intensely pragmatic. Tools that ship reliable coding help, exam-ready explanations, and localized pricing are likely to win share. With enterprise channels opening via large IT services firms and consumer channels buzzing on campuses, the market is entering a phase where distribution and trust—not just model quality—will decide the leaderboard.