Chai Discovery, an AI-native biotech backed by OpenAI, has raised $130 million in a Series B round that values the company at $1.3 billion—and underscores investor belief that large-scale models can condense timelines and costs associated with drug R&D.

The funding deepens Chai’s bet to create a software-and-science stack for designing new drugs, with the company already claiming swift dividends from its newest system for de novo antibody design—making entirely new molecules, as opposed to tweaking ones that are known quantities.

Funding round details and the investors backing Chai

General Catalyst and Oak HC/FT led the round, with participation from existing investors Menlo Ventures, OpenAI, Dimension, Thrive Capital, Neo, and Yosemite, as well as Lachy Groom and SV Angel; they were joined by new backers Glade Brook and Emerson Collective. The new funding brings Chai’s total financing to over $225 million.

Menlo Ventures led Chai’s Series A and described the company as developing foundation models optimized for biochemical interactions—software that can predict how proteins, antibodies, and small molecules would bind and act. The new capital further establishes Chai in a crowded group of AI-first drug discovery unicorns looking to forge pharma partnerships and compete for limited computational biology talent.

Chai’s AI platform and its scientific ambitions explained

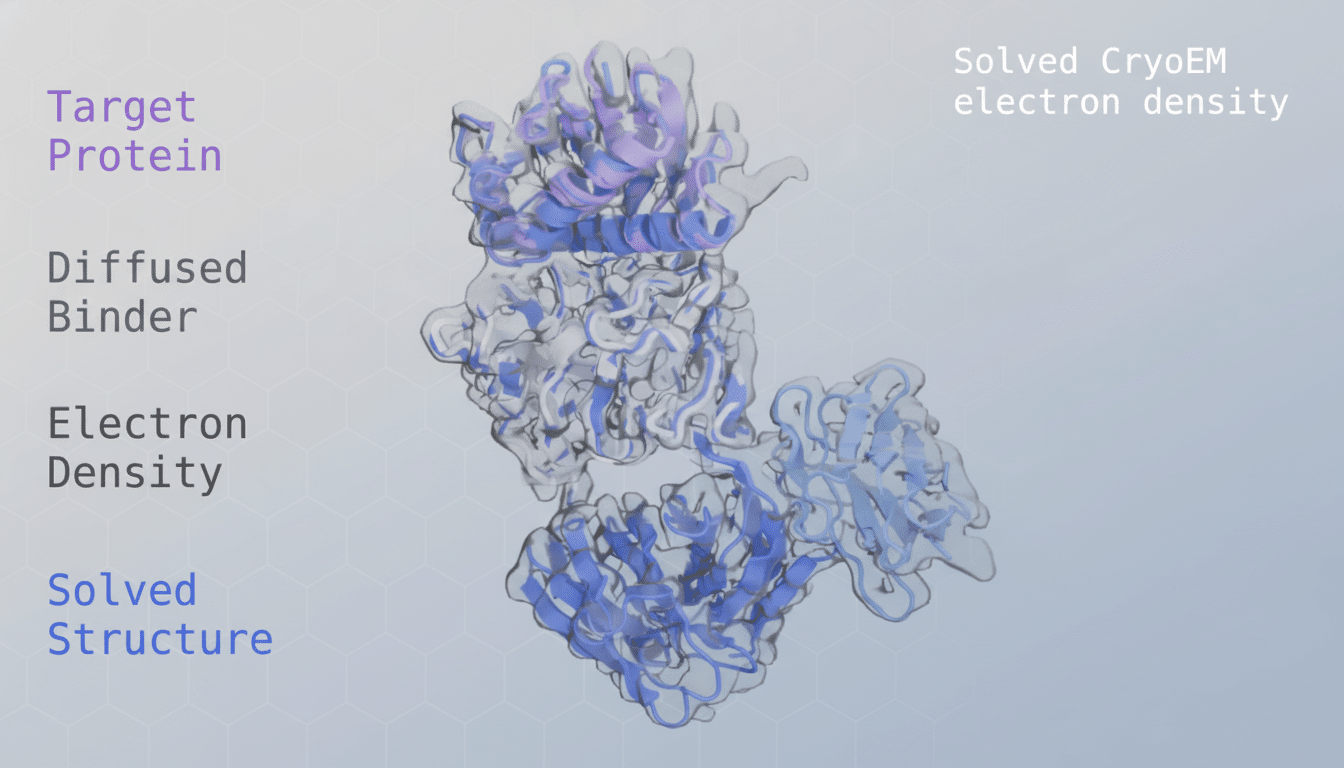

Chai describes its mission as a “computer-aided design suite for molecules,” in the same way that chip and architecture designers work out their product’s CAD schematics before beginning fabrication. The company released its first model, Chai 1, and has since moved on to selling Chai 2, which it says boosts success rates compared with conventional methods in key steps within the field of antibody discovery.

The specifics are under wraps; however, this approach is consistent with recent advances in learning representation from protein sequences, structures, and assay data that are then optimized toward multiple drug-like objectives: affinity, developability, and immunogenicity. CEO and co-founder Josh Meier, a former machine learning researcher at OpenAI as well as Facebook’s research organization, says the platform is starting to surface “hard targets” that have defied discovery via traditional means.

It means, in the very practical sense of drug development, fewer wet-lab iterations and higher hit rates before costly preclinical work even gets started. This isn’t trivial: The Tufts Center for the Study of Drug Development has put the fully loaded cost of bringing a new drug to market in the multibillion-dollar range, and end-to-end development usually takes a decade or longer. BIO’s analysis of past pipelines had overall clinical success rates at about 10% from first-in-human to approval, which just goes to show you how much value there is in more accurate early prediction.

The Broader Context in AI Drug Discovery

Pharma’s AI race is accelerating. DeepMind and Isomorphic Labs made progress in PPI prediction with the new AlphaFold, and Recursion received a strategic investment from Nvidia to accelerate model training on multimodal biological data. Companies including Exscientia, Insilico Medicine, Insitro, Generate:Biomedicines, and Absci, among others, are proving that integrated model-and-lab systems can drive candidates into preclinical and early clinical testing.

The stakes are high, consultants say. McKinsey has estimated that in pharma and medtech alone, AI could contribute an annual impact of $60–$110 billion through enhanced discovery, more efficient clinical trial execution, and optimized commercial performance. The distinctions tend to be proprietary data, tight integration between in silico design and automated wet-lab validation, and the ability to translate model scores into molecules that satisfy concerns of real-world manufacturability and safety.

Why this funding round matters for AI drug discovery

Chai’s cap table mixes top-tier venture firms with key AI actors, a mixture that may speed its access to compute, data partners, and enterprise buyers.

For biopharma partners, the pitch is a faster path to a development candidate: more shots on goal, guided by knowledge of the right epitopes or binding pockets, and triaged by models that optimize for developability from day one.

Still, the burden of evidence is high. The field is now emerging from benchmark leaderboards to reproducible wet-lab validation, preclinical package quality, and ultimately clinical outcomes. Firms that can demonstrate that AI-designed antibodies remain potent, specific, and stable in relevant models—and do so at scale—will command bigger discovery deals and downstream economics.

What to watch next as Chai scales its AI platform

With fresh capital, Chai will grow high-throughput lab capacity, hire protein engineers and ML researchers, and dive into pharma collaborations on de novo biologics. Key near-term checkpoints to monitor include:

- Peer-reviewed benchmarks for Chai 2

- Independent validation of antibody hits

- Early preclinical data illustrating feasibility beyond in silico predictions

If Chai can make model outputs reliably translate into clinic-ready prospects, the company’s “CAD for molecules” vision goes from pitch deck to practice—and the most recent funding round indicates that investors believe that inflection may be within sight.