OnlyFans is facing a new class-action lawsuit in California that accuses the subscription platform of luring customers with promises of “full access” while hiding much of creators’ content behind additional paywalls. The complaint characterizes the practice as a classic bait-and-switch and seeks relief under state and federal consumer protection laws.

The case, brought by Los Angeles resident David Gardner on behalf of a proposed class of more than 100 customers, alleges that fans often subscribe after seeing on-screen assurances of comprehensive access and direct messaging, only to encounter teasers, upsells, and mass direct messages pushing more paid content.

What the OnlyFans bait-and-switch lawsuit alleges

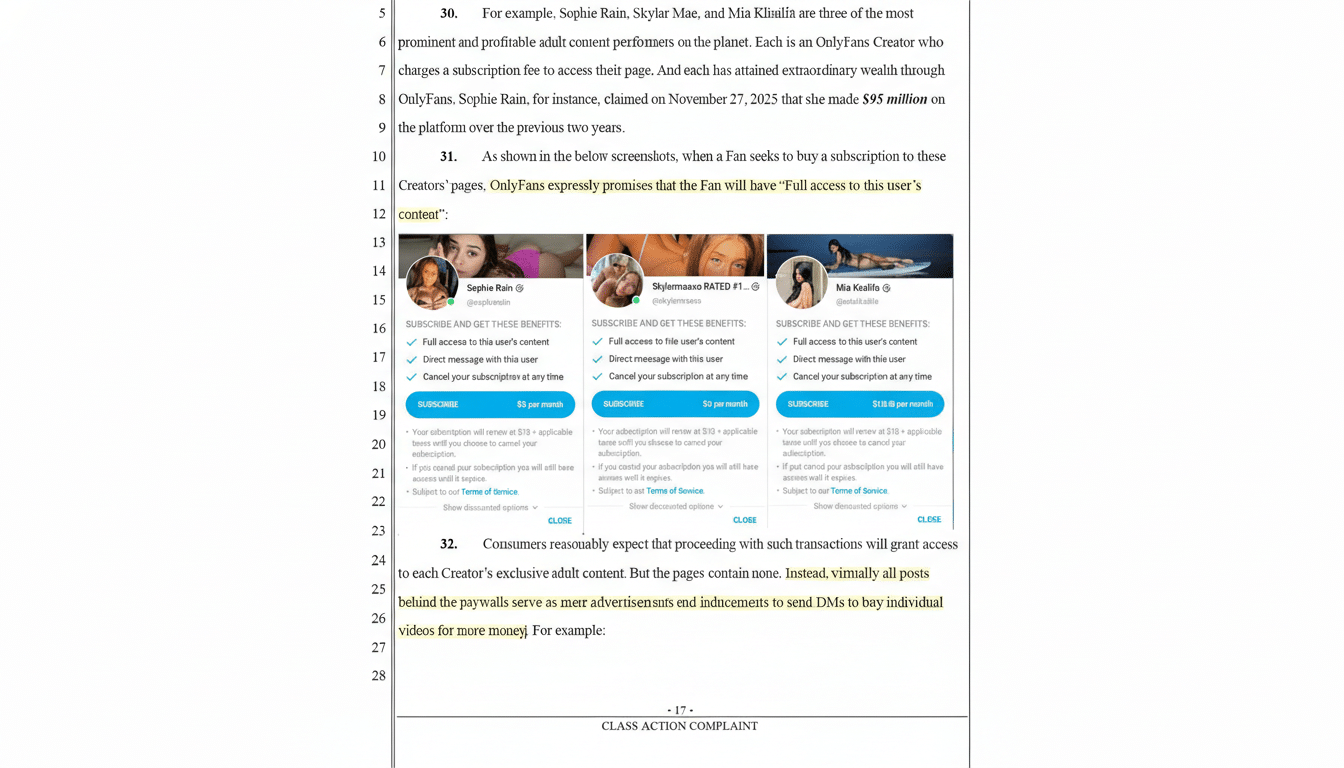

According to the complaint, OnlyFans markets paid subscriptions as a gateway to a creator’s content and one-to-one interaction. But once inside, many subscribers find that the bulk of photos and videos sit behind additional fees, with initial posts serving primarily as previews. The filing contends that subscribers are sold an all-you-can-eat promise that turns out to be à la carte.

Gardner says he subscribed to two creators he discovered on X expecting exclusive material but encountered largely non-explicit teasers. He also alleges he received batch direct messages promoting more pay-per-view content. The suit argues the “sole benefit” of some subscriptions is the barrage of sales pitches for add-ons that should have been included.

The plaintiffs claim the conduct violates California’s Consumers Legal Remedies Act and constitutes deceptive acts under Section 5 of the Federal Trade Commission Act. They are seeking damages, restitution, and injunctive relief that would require clearer disclosures about what a subscription actually includes.

How OnlyFans monetization sets expectations

OnlyFans blends monthly subscriptions with pay-per-view messages, tips, and à la carte bundles. That model is not unusual in adult content, where creators diversify revenue streams and set their own pricing. The friction point, the lawsuit argues, is the platform’s “full access” messaging, which sets an expectation that the subscription covers the core catalog rather than merely unlocking a pipeline for more upsells.

Scale magnifies the stakes. OnlyFans says it hosts more than 3 million creators serving over 200 million registered users, and company filings show annual revenue surpassing $1 billion in recent years. Even modest misalignments between marketing promises and actual access could affect a large share of subscribers—and potentially expose the platform to meaningful legal and reputational risk.

The legal lens on alleged dark patterns in marketing

U.S. regulators have sharpened scrutiny of online sales tactics that obscure price or limit information, often described as “dark patterns.” An FTC staff report, Bringing Dark Patterns to Light, highlights practices like misleading claims about access, drip pricing, and interfaces that steer users into costlier choices. While the court will decide whether OnlyFans’ conduct meets that bar, the framework gives plaintiffs a playbook for arguing that pre-subscription messaging materially misleads reasonable consumers.

California’s consumer protection regime is among the nation’s most aggressive, giving plaintiffs multiple avenues to challenge representations made at checkout. In similar subscription cases, courts have focused on what a reasonable consumer would understand from on-screen statements and whether disclaimers were sufficiently clear and conspicuous.

What happens next in the OnlyFans class action case

The case must clear class certification before proceeding on behalf of a broader group. If it advances, potential remedies could include refunds, civil penalties, and changes to OnlyFans’ interface and copy—such as replacing “full access” claims with more precise language about what is and isn’t included, and separating subscription content from pay-per-view promotions.

OnlyFans has weathered litigation before. A federal judge recently dismissed a separate case involving “chatter” practices, where customers claimed they were misled about who was operating accounts. That outcome underscores how fact-specific and legally nuanced these disputes can be, particularly in marketplaces where creators—not the platform—control pricing and content decisions.

For subscribers, the takeaway is straightforward: scrutinize pre-purchase claims and assume that a monthly fee may not unlock everything. For platforms, the moment calls for tighter disclosures and interface design that aligns with regulatory guidance. Whether a court concludes OnlyFans crossed the line will hinge on a familiar consumer-law question—did the marketing reasonably match what customers actually got?