Nvidia, the world’s most valuable company, reported record earnings this week as the demand for its AI chips shows no sign of waning. In its latest quarterly report, the business said it generated $46.7 billion in revenue, a 56 percent year-over-year jump, driven largely by its fast-growing data center business.

Data Center Sales Lead Growth Data center sales leads optimal outcomes

Nvidia said that $41.1 billion of its revenue came from data center sales in all, a 56% year-over-year increase. A significant portion of that growth was driven by its newest generation of G.P.U.s, called Blackwell, which drove $27 billion in the quarter’s sales.

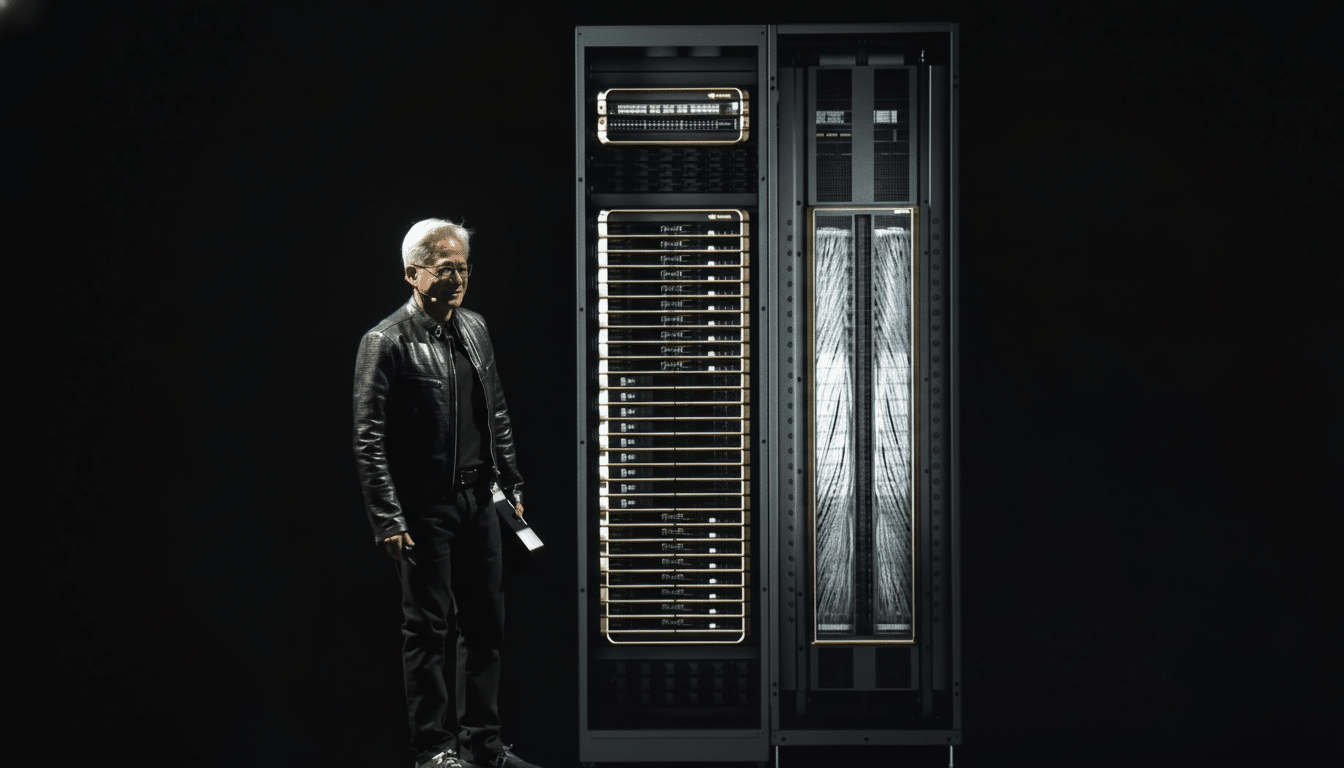

CEO Jensen Huang called Blackwell “the AI platform the world has been waiting for,” perhaps underlining the importance of Blackwell in the world’s global AI race. Nvidia thinks that AI infrastructure spend could top somewhere between $3 trillion and $4 trillion by the end of this decade — it is an investment level that, Huang observed, “is fairly sensible for the next five years.”

Net Income Surges

In addition to its growing revenue, Nvidia’s net income also took off to $26.4 billion, a 59 percent rise from the same period the prior year. The results solidify Nvidia as one of the key suppliers to companies creating large-scale AI models and services.

The company also boasted that its technology powers the recently released open-source (gpt-oss) Open AI models trained on the Blackwell GB200 NVL72 that has an “automated deployable model … able to process 1.5 million tokens per second.”

China Market Challenges

While Nvidia posted records, it faced headwinds in China. The company also reported zero sales for last quarter of its H20 chip, which is geared for the China market. Though it did sell $650 million of H20 units to a non-Chinese customer, geopolitical tensions remain a significant impediment.

Advanced GPUs are currently banned by the U.S. government for sale to Chinese customers. Nvidia is free to sell chips to China so long as it pays a 15% export tax to the U.S. Treasury, under a controversial arrangement introduced by President Trump. But uncertainty around the legality of the deal has caused the shipments to be held up, according to Nvidia Chief Financial Officer Colette Kress, during the earnings call.

China’s government has also discouraged domestic companies from using Nvidia hardware, prompting the company to reportedly halt production of its H20 chip earlier this month.

Looking Ahead

For the next quarter, Nvidia forecast revenue of $54 billion, plus or minus 2 percent. The estimate doesn’t have any H20 shipments to China, indicating the geopolitical wildcard will continue to be a major risk for the company.