Nothing is hitting pause on its flagship ambitions. In a recent company video, co-founder and CEO Carl Pei confirmed there will be no top-tier Nothing Phone launching this year, with the brand instead channeling resources into the Phone 4a lineup and new audio hardware. The move reflects mounting pressure in the smartphone supply chain and a recalibration after the mixed reception of last year’s Nothing Phone 3.

The Phone 3, despite its playful design and signature Glyph lighting, struggled to justify its asking price. A non-flagship chipset paired with an $800 tag left many fans questioning the value proposition. Internally, that feedback appears to have landed. Externally, the broader market is entering a period where premium components are harder to secure and more expensive to buy.

Why Nothing Is Pausing Its Flagship Ambitions

Pei points to intensifying competition for critical components as a key driver of the decision. As data centers race to build AI infrastructure, semiconductor capacity and advanced packaging are being diverted toward high-margin accelerators. Industry trackers such as TrendForce have repeatedly flagged capacity bottlenecks in leading-edge nodes and packaging, while analysts at IDC and Counterpoint Research have highlighted rising average selling prices across smartphones as OEMs grapple with higher input costs. In short, getting the best chips, cameras, and displays is costlier and less predictable.

For a challenger brand, that environment compounds risk. A true flagship likely demands a next-gen Snapdragon, premium camera sensors with advanced stabilization and periscope optics, and top-tier OLED panels—all products facing supply prioritization. Skipping a flagship cycle allows Nothing to avoid chasing components at any price and potentially launching a device that overreaches on cost but underdelivers on value.

Midrange Takes Center Stage With Phone 4a

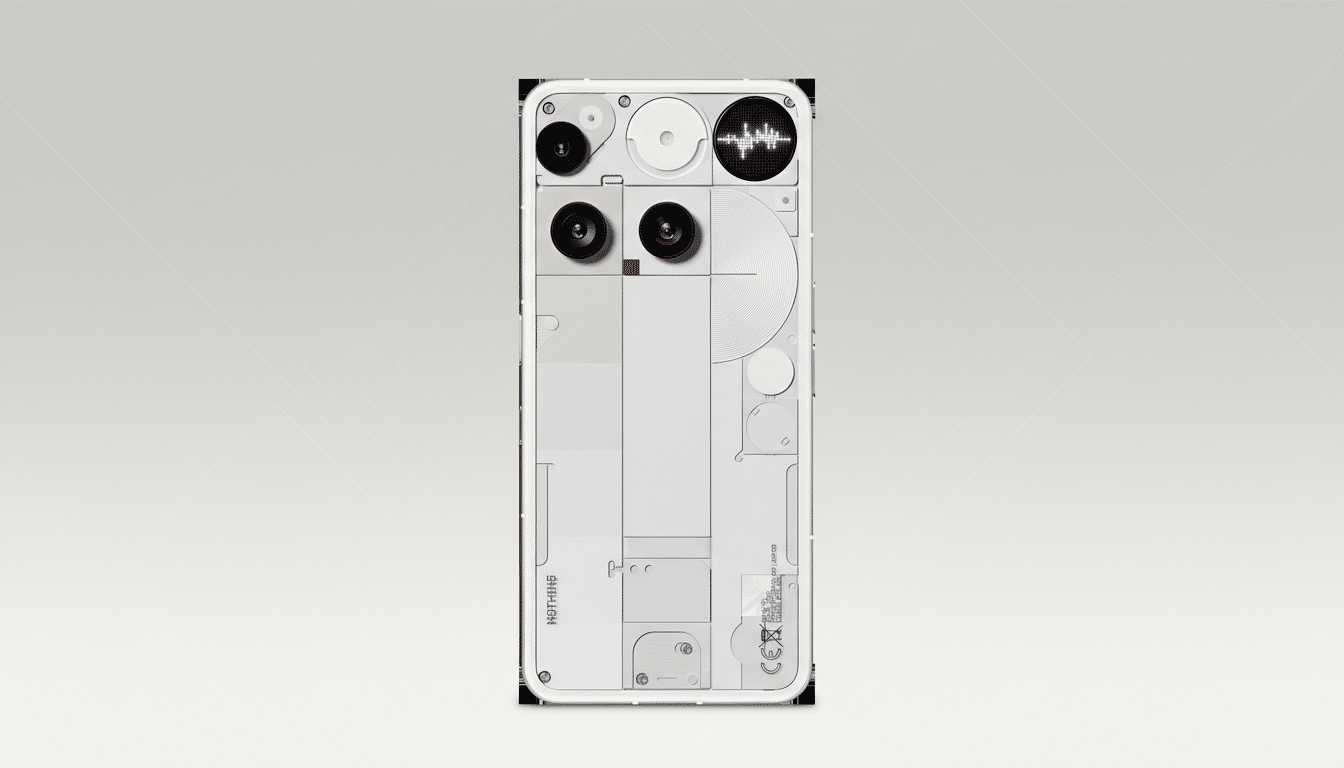

Instead, Nothing is doubling down on its 4a series. The company already signaled its intent with the Phone 3a Pro, which introduced a periscope telephoto camera—rare in the midrange. Recent leaks suggest the Phone 4a may step up durability with a higher IP rating, squeeze out better battery life, and push camera hardware further, albeit with a likely uptick in price. If that holds, Nothing will try to turn the midrange into a showcase for features that typically require moving upmarket.

Software will be part of the lift. Pei has teased broader access to in-house AI agents within Nothing OS, an area where the brand can differentiate without being beholden to component allocation. If executed well, AI-driven features—context-aware assistants, smarter camera processing, on-device utilities—could deliver tangible benefits on hardware that remains sensibly specced and priced.

Audio And Ecosystem Strategy Fill The Gap

Beyond phones, Nothing plans to expand its over-ear headphone lineup, likely with a more affordable A-series model. Building out an ecosystem keeps the brand in the conversation during a flagship hiatus. It also plays to Nothing’s design-first ethos, where striking hardware and clean software can cultivate loyalty even when a halo phone is absent. This approach mirrors how other upstart manufacturers have maintained momentum—by deepening their accessory portfolios and elevating midrange devices while waiting for component markets to normalize.

The Supply Chain Squeeze Behind The Decision

Nothing’s calculus is not happening in a vacuum. Foundry allocation for top-tier mobile chipsets remains tight as chipmakers prioritize AI accelerators, and advanced camera modules and periscope assemblies command higher lead times. Market researchers have noted that even large OEMs are refining product mixes to protect margins. For a lean brand, chasing parity with the biggest players in a constrained year is a quick route to sticker shock—or to compromises that undermine a flagship’s purpose.

What It Means For Buyers Waiting On A Flagship

If you were waiting for a Nothing Phone 4-level flagship this year, the answer is simple: it’s not coming. The spotlight shifts to the Phone 4a series. Expect a tighter focus on durability, battery, and camera flexibility, along with more meaningful software features inside Nothing OS. Also expect prices to reflect the realities of stressed supply chains. For many buyers, that could still net out to better value than a premium-tier device forced into the market under unfavorable conditions.

Strategically, skipping a flagship can be a reset rather than a retreat. Some Android brands have paused product lines or specific variants to regroup on design and cost structure, then returned stronger when the supply landscape improved. If Nothing uses this window to refine its midrange play, expand its audio lineup, and mature its AI software, the eventual comeback to the flagship tier could be more compelling—and more competitive—than forcing a release now.

For now, the message is clear and unambiguous from the top: no flagship this year. Midrange and audio take the lead, with software intelligence as the connective tissue. Whether that bet pays off will be measured in how convincingly the Phone 4a family delivers—and how effectively Nothing keeps fans engaged while the flagship sits out.