There is a new litmus test for foundation model startups, and it asks a blunt question few pitch decks answer directly. Are you even trying to make money? In an industry where celebrated researchers and ex-tech executives can raise staggering sums on vision alone, a simple way to gauge commercial intent is overdue. The proposed framework is a five-level profit ambition scale that measures whether a lab is organized to generate revenue, not whether it already does.

The Five-Level Profit Ambition Scale Explained

Level 1 signals pure research. The lab optimizes for scientific progress, publishes frequently, and resists product timelines. Funding arrives from deep-pocketed backers who value influence and optionality more than near-term returns.

Level 2 is research with a hint of application. There may be demos, an API in closed beta, or exploratory pilots, but no clear ideal customer profile, pricing, or sales motion. The lab keeps commercial pressure at bay.

Level 3 means intent without commitment. The team talks about product categories and customer pain points, hires a design lead, and courts design partners, yet avoids concrete roadmaps and P&L ownership.

Level 4 shows a go-to-market spine. There is a named ICP, published pricing, a quota-carrying sales org, enterprise security artifacts, and contracts that extend beyond pilots. Product velocity is measured in releases, not papers.

Level 5 is scaled commercialization. Multiple products, durable distribution, and real revenue with improving gross margins. Partnerships, compliance, and post-GPU cost strategies are all operational, not aspirational.

Why This Matters For Investors And Customers

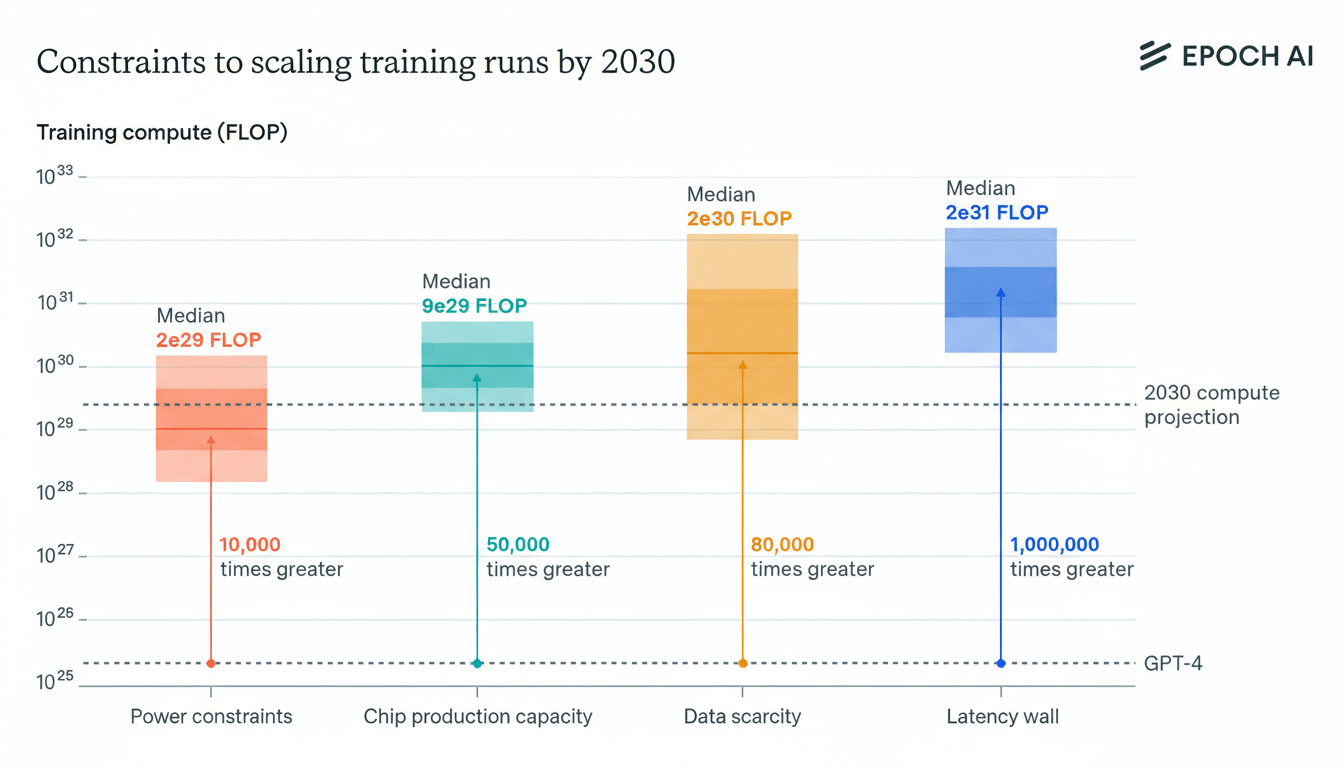

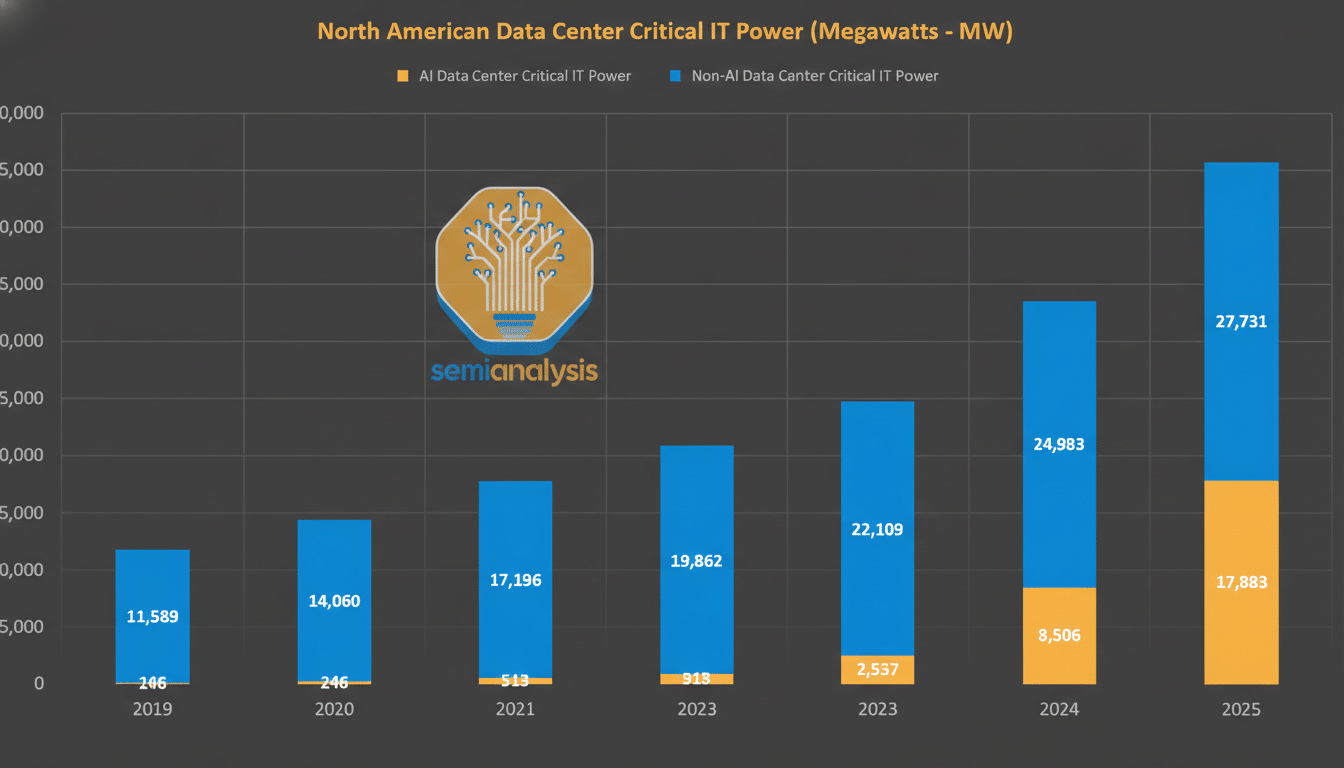

Foundation models are capital intensive. Industry estimates put frontier training runs in the tens to hundreds of millions of dollars, while inference burn can swamp early revenue if usage spikes ahead of pricing discipline. Stanford’s AI Index and company disclosures highlight rising compute footprints, and widely cited figures peg top accelerators costing tens of thousands of dollars each.

Meanwhile, demand is real but uneven. McKinsey estimates generative AI could add $2.6T to $4.4T in annual economic value, yet CIOs still wrestle with compliance, latency, and accuracy. Many find today’s wins in retrieval-augmented workflows, agentic automation for back-office tasks, and domain-tuned models that cut costs by 20% to 40% for specific processes. Those outcomes require mature buyer enablement, not just novel demos.

Capital has flowed freely. PitchBook and CBInsights have documented tens of billions of dollars into model companies since 2023, with strategic cloud credits masking true cash burn. Revenue is growing at the leaders, with media reports placing top labs at multibillion-dollar run rates, but margins hinge on model efficiency, caching, and custom silicon roadmaps. A lab’s level on the scale is a practical proxy for whether its economics can improve with scale.

How Leading Labs Map To The Profit Ambition Scale

Level 5 includes the usual suspects. OpenAI, Anthropic, and Google’s Gemini operate full product stacks, enterprise channels, and ecosystem partnerships. They publish pricing, ship on cadences customers recognize, and increasingly emphasize cost control through model families, distillation, and optimized inference.

Humans& has pitched a reimagined workplace built around communication and coordination rather than sheer model scale. The company’s funding and founding team signal ambition, and public comments point to replacing or redefining staples like chat, docs, and issue trackers. Yet specifics on pricing, ICPs, and deployment remain deliberately soft. On this scale, that looks like Level 3 intent.

TML, founded by a former ChatGPT leader and reportedly backed with a multibillion-dollar seed, initially projected Level 4 confidence. Recent executive departures and strategy questions, as reported in industry media, suggest the roadmap is still being recalibrated. That places TML straddling Level 3 and Level 4 until it publishes pricing, customer references, and a repeatable sales motion.

World Labs, led by Fei-Fei Li, surprised skeptics by shipping a spatial world-model and a commercial layer serving gaming and visual effects. With visible products and signs of paid demand in content-heavy industries, World Labs reads as Level 4 and is flirting with Level 5 if distribution broadens.

Safe Superintelligence, founded by Ilya Sutskever, is explicitly insulated from commercial cycles. By design, SSI is Level 1, although public remarks from its founder leave the door open to a pivot if timelines lengthen or if the most capable models need real-world feedback to be safe. Level changes can happen quickly when research trajectories shift.

Signals An AI Lab Is Trying To Make Money

- Stated ICPs and buyer personas that match a sales plan rather than a research agenda.

- Transparent pricing, contracts beyond pilots, and security documentation aligned to enterprise standards.

- Named customer logos and quantified outcomes such as cost-to-serve reductions or workflow throughput gains.

- A compute strategy that tackles unit economics, such as smaller task-optimized models, caching, or custom hardware.

- Distribution leverage through cloud marketplaces, SI partners, or embedded integrations, not just an API page.

The Bottom Line On AI Labs’ Profit Ambition Scale

In a market awash with capital and charismatic founders, ambiguity about commercial intent fuels confusion and drama. A simple five-level scale helps founders set expectations, helps customers pick credible partners, and helps investors price risk. Not every lab must be Level 5, but every lab should be legible. Before you marvel at the demo, ask the only question that changes incentives. Are you even trying to make money?