Netflix’s agreement to acquire Warner Bros.’ storied film and TV studios — including HBO and HBO Max — marks the most consequential reshaping of Hollywood in a decade, uniting a century of Warner storytelling with the world’s largest streamer and its 325 million-plus subscribers.

Valued at roughly $82.7 billion, the all-cash offer instantly places franchises like Game of Thrones, Harry Potter, and DC under Netflix’s umbrella, raising urgent questions about market power, creative autonomy, and the future of theatrical windows.

- What Netflix Is Buying From Warner Bros., HBO, And HBO Max

- How The Bidding Unfolded Between Netflix, Paramount, And Comcast

- Regulatory Hurdles And Antitrust Risks Facing The Netflix–Warner Deal

- Labor And Creative Fallout For Writers, Actors, And Producers

- What Subscribers Should Expect On Pricing, Apps, And Content Timing

- Why This Deal Is Different From Recent Media Megamergers

- Timeline And The Road Ahead For Approvals, Closing, And Integration

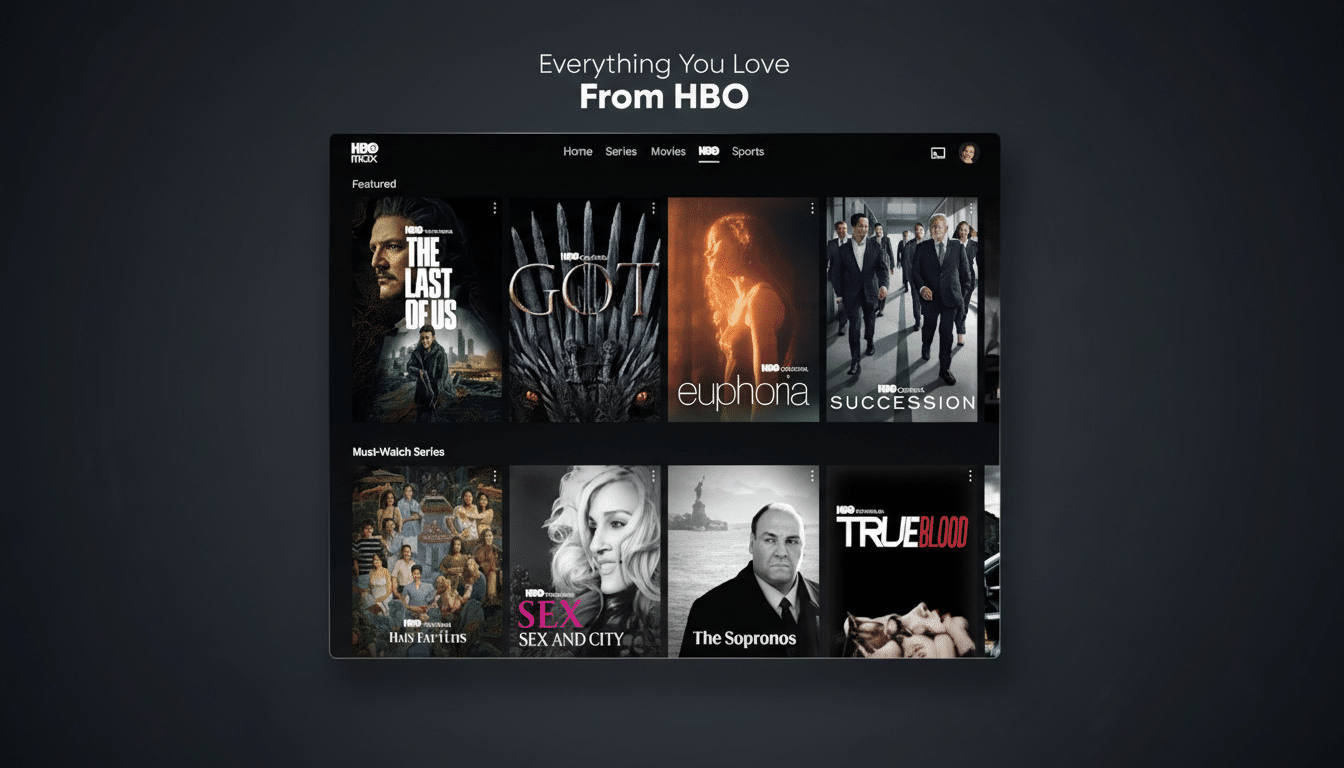

What Netflix Is Buying From Warner Bros., HBO, And HBO Max

The deal covers Warner Bros.’ film and TV production engines, HBO’s premium cable operations, and HBO Max’s streaming footprint, alongside deep libraries stretching from classic Warner pictures to modern global hits. The strategic prize is dual: enduring IP with global resonance and a pipeline of prestige television that complements Netflix’s scale-driven slate.

Library integration won’t be instantaneous. Existing licensing contracts, territorial rights, and output deals will stagger availability, meaning some titles remain on third-party platforms for months or years. But over time, Netflix gains clearer control over release sequencing and exclusivity — a cornerstone for subscriber retention and advertising growth.

How The Bidding Unfolded Between Netflix, Paramount, And Comcast

Warner Bros. Discovery began exploring a sale after prolonged debt pressures and erosion in linear-TV revenue. Interest poured in. Paramount and Comcast emerged as serious contenders, with Paramount at one point deemed the favorite.

Paramount proposed about $108 billion in cash for the entire company. Netflix, by contrast, bid specifically for the film, television, and streaming assets, ultimately amending its offer to an all-cash proposal at $27.75 per WBD share. Directors favored Netflix’s structure, citing lower leverage risk compared with a Paramount transaction that, according to WBD’s board, would have saddled a combined entity with approximately $87 billion in debt.

Paramount didn’t retreat quietly. It sought additional deal information in court and dangled a $0.25-per-share “ticking fee” per quarter if closing slipped past year-end 2026, while also signaling it would shoulder a multibillion-dollar breakup fee if Netflix walked. The persistence underscored how singular Warner’s assets are in a consolidating market.

Regulatory Hurdles And Antitrust Risks Facing The Netflix–Warner Deal

Scrutiny is intense. Netflix co-CEO Ted Sarandos is slated to appear before a U.S. Senate committee as lawmakers probe the deal’s implications. Senators Elizabeth Warren, Bernie Sanders, and Richard Blumenthal have urged the Justice Department’s Antitrust Division to examine potential harm to consumers and rivals, warning of higher prices and fewer choices.

The merger blends the dominant global streaming distributor with one of Hollywood’s premier content factories — a mix regulators may view as both horizontal (content scale) and vertical (distribution plus production). If blocked by authorities, Netflix would owe a breakup fee reportedly pegged at $5.8 billion, a financial sting that nevertheless pales against the strategic upside if the deal clears.

Labor And Creative Fallout For Writers, Actors, And Producers

Guilds and creators are wary. The Writers Guild of America has urged regulators to stop the merger, citing concerns over bargaining power, wages, job cuts, and an already tightening market for original pitches. Consolidation historically narrows the number of active buyers, and a combined Netflix–Warner could centralize greenlight decisions for tentpoles and prestige TV in unprecedented ways.

On theatrical strategy, Sarandos has said Warner’s planned cinema releases remain intact in the near term, though windowing could compress over time to speed streaming availability. Expect case-by-case experimentation: franchise installments may preserve longer theatrical runs, while mid-budget titles could pivot faster to home viewing.

What Subscribers Should Expect On Pricing, Apps, And Content Timing

In the short run, operations at HBO and HBO Max are expected to stay largely status quo. Netflix has signaled no immediate pricing changes during regulatory review, and there are no firm plans yet for app consolidation or bundles. The longer-term play likely involves smarter cross-promotion, unified discovery, and windowing designed to maximize both box office and streaming engagement.

Price dynamics bear watching. Netflix has a track record of periodic rate increases, particularly as content investments rise and ad tiers mature. Combining a premium brand like HBO could justify new bundles or tiers once approvals land, but specifics will depend on regulatory constraints and integration timing.

Why This Deal Is Different From Recent Media Megamergers

By sticker price, the transaction eclipses recent entertainment megadeals, topping Disney’s $71.3 billion purchase of 21st Century Fox and dwarfing Amazon’s $8.45 billion MGM buy. It gives Netflix not just a library, but one of the few remaining global-scale studios with deep, merchandisable IP and a history of franchise creation.

For Netflix, the calculus is offensive and defensive: secure evergreen hits; reduce dependence on third-party licensing; and build stronger event cycles that drive both subscriber acquisition and theatrical cash flow. For the industry, fewer studios with more power raises the stakes — and the risks — for independents and mid-tier players.

Timeline And The Road Ahead For Approvals, Closing, And Integration

A WBD shareholder vote is expected around April. Closing is targeted 12 to 18 months after that, subject to regulatory approvals that could add conditions or force divestitures. If regulators nix the deal, Warner could revisit alternative suitors, but any future path will be shaped by the same debt and distribution headwinds that drove this process.

Bottom line: if approved, Netflix’s Warner Bros. acquisition will redraw the competitive map from Hollywood lots to living rooms worldwide. If it isn’t, the attempt alone signals where entertainment is headed — toward fewer, bigger gatekeepers and a premium on franchises that travel.