Tesla’s car sales are ticking up again, but Elon Musk is engaged in another battle: He wants to amass enough control in order to steer an AI-driven future that will be inhabited by autonomous vehicles and humanoid robots. During the company’s most recent earnings call, Musk fretted out loud about constructing what he described as a “robot army” without rock-solid voting power, despite Tesla reporting a record quarter for deliveries and an anemic sequential profit increase.

Record Deliveries, Soft Margins Amid Higher Costs

Tesla sold 497,099 cars in the quarter, boosted by a late-quarter surge in the United States as windows of eligibility for certain EV tax credits closed. Automotive revenue hit $21.2 billion, its highest level in more than a year. But profit continued to feel the squeeze: Net income of $1.4 billion was 37 percent lower than at this time a year before, according to the company’s shareholder letter.

Operating expenses also spiked 50% from year-ago levels, reflecting significantly heavier investments in AI and R&D as well as approximately $240 million worth of restructuring charges. Tesla also pointed to tariffs as a significant headwind, with CFO Vaibhav Taneja pegging the quarterly hit at roughly $400 million. The combination leaves Tesla in the clasp of a classic growth trade-off: higher near-term costs to win outsized, software-like returns down the road.

Tesla will have to record yet another quarter’s worth of deliveries to equal the delivery totals for the past two years — and get a little push from lower-priced Model 3 and Model Y trims designed to stimulate demand. That said, the company is also well off its prior 50% annual growth pace, a promise that was bold even before price cuts and cost inflation squeezed margins all across the EV space.

The Control Issue Underlying Autonomy and Governance

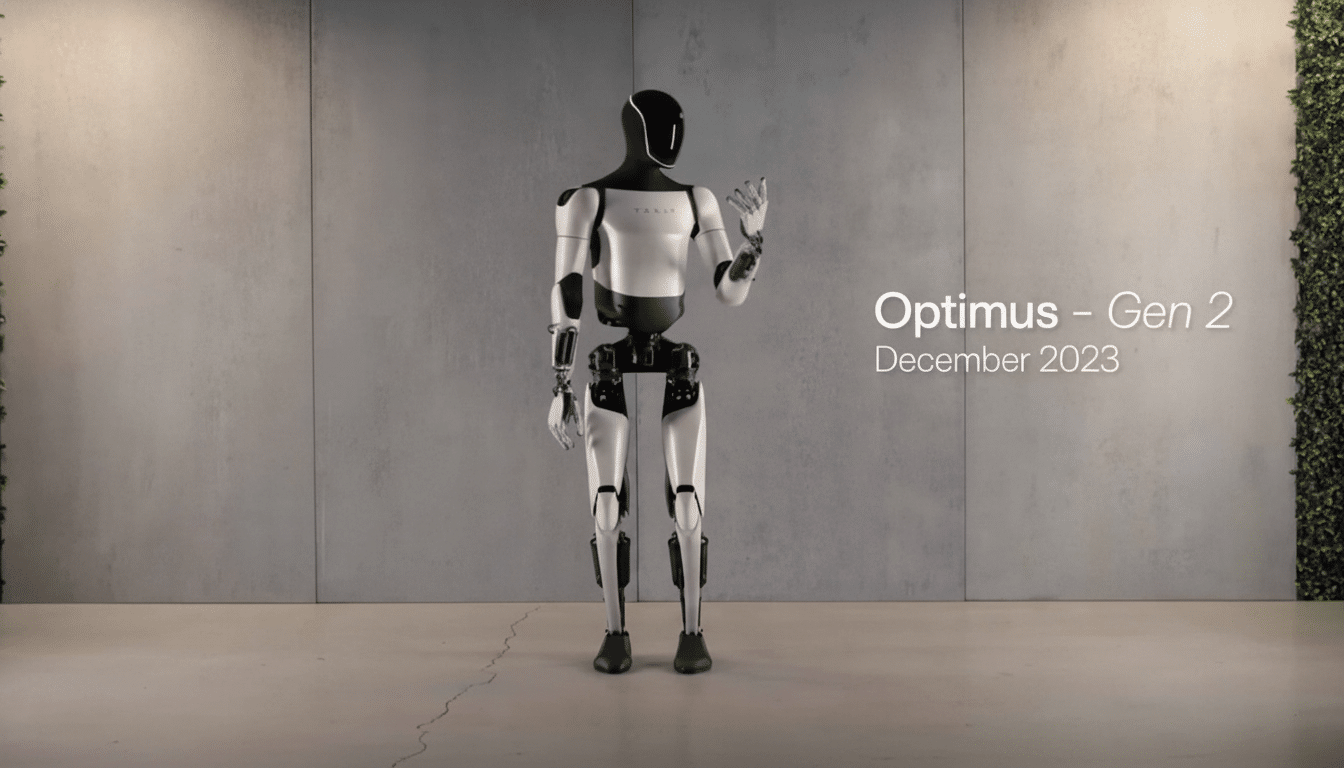

Musk’s immediate problem is governance, not growth. Tesla is lobbying for a large pay plan for its CEO — termed a $1 trillion share award — which would solidify his control of long-horizon bets like Full Self-Driving, robotaxis and the Optimus humanoid robot. Proxy-advisory firms ISS and Glass Lewis have recommended against the package, but Tesla’s heavy reliance on retail investors has usually supported Musk despite misgivings.

Musk argued on the call that without stronger voting control, he could be pushed away before Tesla’s AI aspirations come to fruition. It was a stark acknowledgment: some of the company’s most important projects will demand multiyear execution, and capital discipline, at a time when it must also regain its profitability in its core auto business.

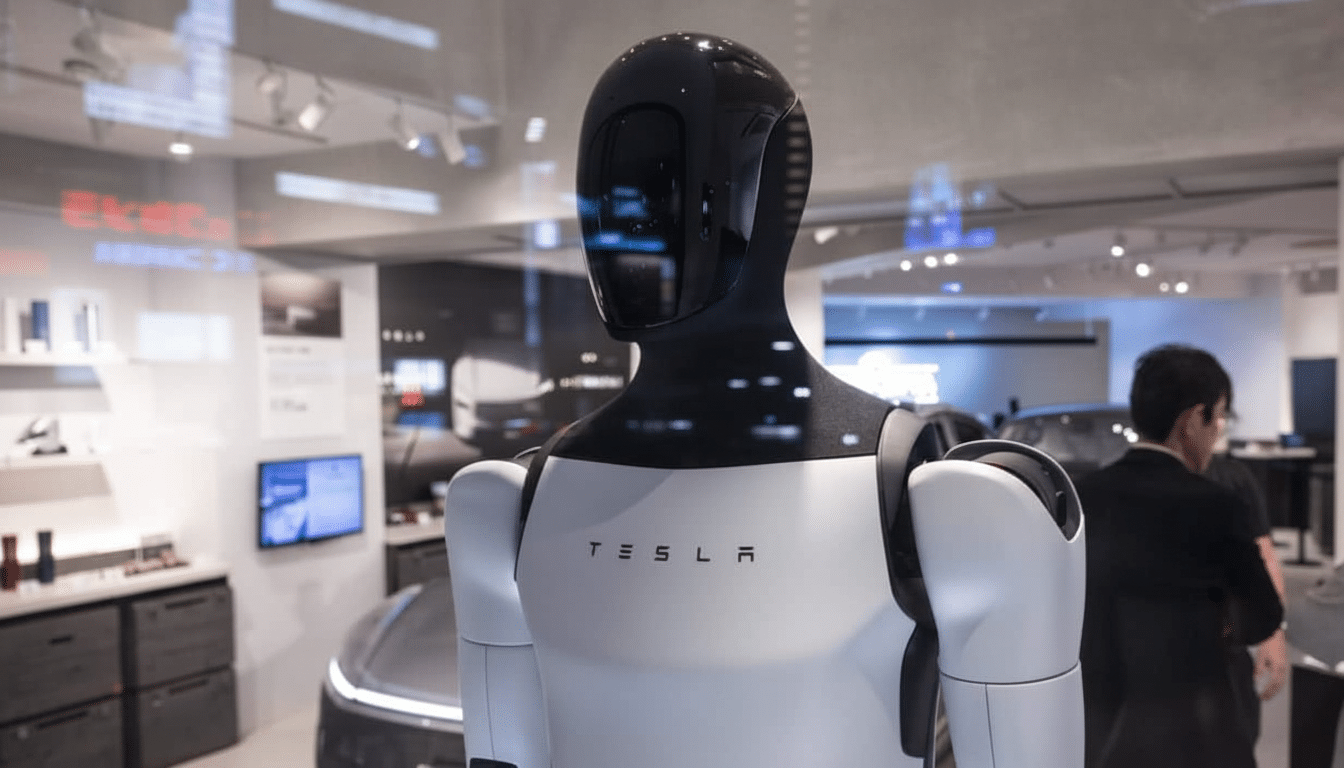

Optimus and Robotaxi Timelines Tightening

Tesla shared scant new information on autonomy milestones. Musk has said a third version of the Optimus could start production by early 2026, revising previous targets calling for thousands of units going into service by now. Early production challenges have been spotted by reports, underlining the jump from lab demos to safe, reliable factory output. Musk admitted that it’s difficult, calling commercialization “insanely hard.”

In vehicles, Tesla keeps discussing Full Self-Driving and an internally named two-seat robotaxi concept called Cybercab. Management telegraphed a significant step-up in capital expenditures in 2026 to fund these programs and called out increasing compensation necessary to compete for AI talent. The math is simple: If the autonomy scales, and Tesla’s revenue mix shifts even slightly toward high-margin software — a phenomenon that Wall Street has long priced into its expectations, as if it were transformative — then my basic bear thesis vanishes in a cloud of hubristic nitrous oxide.

Dojo, Compute, And What The Regulators Will Be Thinking

Tesla’s AI stack is also subject to compute and regulatory limitations. The company incurred restructuring charges this quarter, and some industry whispers have attributed at least a part of that to winding down the Dojo supercomputer effort, forcing Tesla to depend more on external AI infrastructure in the meantime while it reorients itself to focus on model training and data. That fits broader industry trends in which even Big Tech leans heavily on specialized chips and cloud partners to go big.

Regulation remains the wildcard. U.S. safety regulators have stepped up scrutiny of advanced driver-assistance systems in recent years, and while robotaxi services from rivals such as Waymo are growing in some cities, the road to national scale remains patchy. The lesson isn’t that autonomy is held up, but rather that learning curves and policy guardrails will tie rollout speed into Tesla’s monetization timeline.

What Investors Should Watch for in the Next Quarters

The coming couple of quarters will be a test of the mixed track Tesla is running: defend auto margins with disciplined pricing and cost control while funding AI initiatives that may not add meaningfully to earnings until 2026 and beyond. Listen for signals in these three places:

- Mix of vehicles and the elasticity of pricing

- Deployment of capital into autonomy and robotics

- Progress on safety, reliability, and regulatory approvals at higher levels of automation

For now, the numbers are those of a company that can still deliver at scale, with profit margins being held in check by the cost of chasing a leap in capability. Musk’s pursuit of voting control implies he believes these realities are linked — that he wants to take whatever temperature the market is offering and own it, lay the tracks for it himself. And whether investors will sign off on that trade-off will dictate how soon Tesla can transform its “robot army” from rhetoric to revenue.