Monzo’s board has asked its chief executive, TS Anil, to stand down after a clash over the digital bank’s timing for going public and concerns about his commitment post-listing, according to reports by the Financial Times. The decision follows a boardroom push to postpone an IPO and use the proceeds to expand internationally, while Anil had favored an earlier float, which would have increased the possibility of his exit shortly after listing. The former Google executive Diana Layfield has been appointed to succeed him in the coming months.

The alleged break sheds light on October’s unexpected announcement of a leadership transition, which nobody else in the single-party state appeared to see coming. Directors sought more time to scale outside the UK and work toward a higher valuation, while the outgoing CEO urged a shorter-term window out of the gate. Monzo was valued at around $5.9 billion in an October 2024 secondary sale that was backed by GIC and StepStone Group, a benchmark that defied expectations of what the listing could clear. The board seems to be aiming to multiply that number with more broad-based geographic revenue before testing the public markets.

How the Timing of Monzo’s IPO Became a Flashpoint

IPO timing isn’t just a function of market mood; it stakes out strategic sequencing, leadership stability, and the valuation narrative. Boards generally desire CEOs to stay through lock-up and a few earnings cycles in order to avoid post-IPO drama. Moving the float back can also help underpin the equity story insofar as management can demonstrate momentum into new markets and diversified income lines. For a consumer fintech company, becoming less dependent on domestic net interest income and demonstrating fee-based and international growth can matter for multiples.

Market context matters too. Investor appetite for P&L-positive fintechs has returned compared to the 2022–2023 doldrums, but investors are increasingly focused on the durability of margins as rates normalize. With a later listing, these could include more predictable credit analytics (the ability to forecast and adjust for loan losses), better cohort-level profitability analysis, and a clear glide path to reach the agreed-upon external expansion—important elements of pricing and aftermarket stability.

Monzo’s Performance and Milestones Under TS Anil’s Tenure

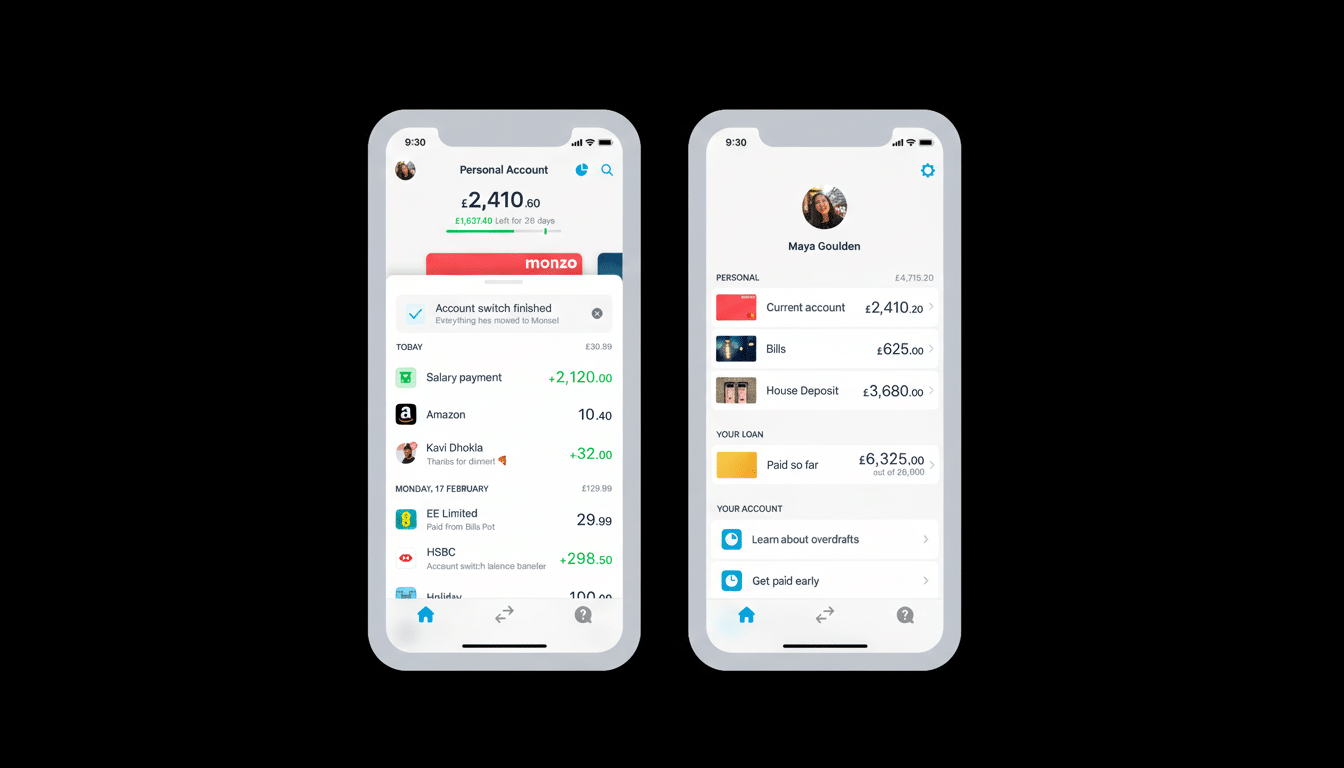

Anil was appointed in 2020 and led a period of rapid expansion. Monzo was said to have tripled its customer base, with 13 million users, and to have achieved a record pre-tax profit of £60.5 million. The product base at Monzo broadened out from there to include current accounts, savings, lending (yes), business banking, and subscription products, including the paid-for packages the neobank offers around its core card-based account offering, as well as investment offerings. Higher rates lifted net interest income, and better risk management and unit economics contributed to the shift toward profitability.

The Achilles’ heel remains concentration. The company’s customer base remains largely in the UK, after a campaign into the US stalled last year amid regulatory and partnership challenges. That domestic bias leaves earnings exposed to UK macro and competition from incumbents and other challengers. Showing traction in at least one other profit pool outside the UK could be crucial to recalibrating valuation expectations prior to a listing.

Layfield’s Directive and Strategic Growth Choices Ahead

Layfield comes with a blend of both tech and banking credentials, having spent nine years at Google and having held senior positions at Standard Chartered. Her mandate is twofold: relaunch Monzo’s international expansion and ready it for public markets. That will likely include prioritizing a capital-efficient market entry, heightening regulatory engagement, and driving product localization that can scale without dramatically increasing cost to serve.

At a strategic level, options might include a return to a US play (albeit with much better-tailored tech) which slows down the one-way deckchairs shuffling on British banking’s very own Titanic, or achieving sufficient European reach via passporting into the sort of markets Sunak shrugs at, like Ireland and Lithuania—complemented by selective partnerships in non-core but potential high-growth locations where Monzo’s app-led roadmap UX can leapfrog what is already old stream.

Each approach has trade-offs in licensing, compliance build-out, capital requirements, and time-to-revenue. The path will not only determine how fast the company can grow, but also where it eventually lists and who its investors will be.

Weighing a London Versus Overseas Listing for Monzo

Where Monzo lists will be dissected. London has overhauled its listings regime, including by offering flexibility around dual-class structures and free float, to keep high-growth companies from seeking a listing in other markets. Peers are sending mixed signals: Wise chose a London direct listing, while some other fintechs have been considering North American markets for liquidity and sector comps. A London float may highlight Monzo’s UK brand strength, while a US listing could provide more tech-focused interest and potentially higher revenue multiples—especially if international contributions pick up.

What to Watch Next as Monzo Navigates IPO Timing Choices

Investors will want to see a clear IPO timetable, leadership commitment through and beyond the float, and non-UK growth and diversified revenue milestones. Longer-term profitability, disciplined credit performance, and consistent customer engagement metrics will be key to the equity story. The readiness of the board to act shows how fast it thinks Monzo needs to move: build a bigger, more international Monzo first, then list on terms that match (and reward) such scale. The challenge for Layfield will be whether she can dictate that sequence to come quickly.