The food-waste startup Mill recently signed a high-profile deal with Amazon and Whole Foods that puts its sensor-laden dehydration bins at the center of grocery operations. The move lifts Mill’s status from consumer gadget producer to commercial operator charged with reducing waste, cutting costs and providing data that helps stores sell more of what they stock.

Whole Foods intends to deploy Mill’s commercial system chainwide, converting produce-department scraps into a stable, transportable material that the grocer can direct toward egg producers in its supply chain. The deal provides scale for Mill across a network of more than 530 stores while giving Whole Foods a means to avoid landfill fees and complete the circle on protein feed.

Why Whole Foods Said Yes to Mill’s Waste Tech Deal

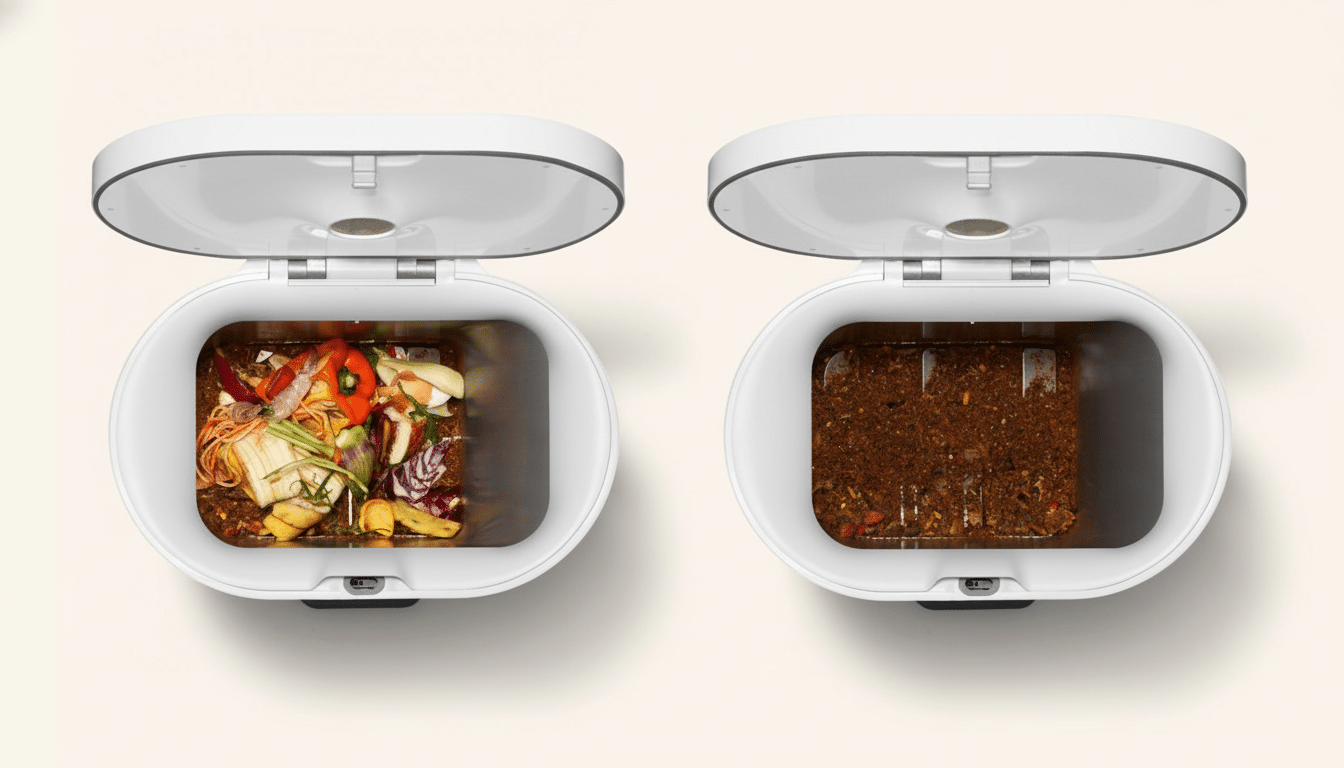

For a grocer with a freshness message to sell, discarded food is both an expense and a lost sale. Mill’s pitch zeroed in on two levers: shrink reduction and disposal savings. By dehydrating waste on site, stores reduce the mass and volume of discarded food by as much as 80 percent, cutting how often it must be hauled away and tipping charges for storage. It’s also used for feed, so that expense is able to be diminished by turning something that would otherwise be garbage into value.

Just as crucially, Mill’s bins are also instruments of data. They monitor what gets thrown out, when and in what quantities, a feedback loop that can help make ordering — and merchandising, and labor — more precise. In internal tests, which put consumer units in stores, Whole Foods teams observed the way waste signatures correlated with forecasting opportunities, according to those who worked on the pilots.

The AI Edge in Shrink Minimization for Grocers

Mill’s commercial system stacks computer vision and other sensors to evaluate the items that have been discarded, flagging patterns indicative of preventable shrink — think produce that might otherwise have stayed on the floor or been routed earlier to prepared foods. New large AI models allow a small engineering team to quickly train robust classifiers, the company says — a contrast with earlier efforts in smart homes that took much more time and headcount.

For grocers, small victories can have an outsize impact. FMI data indicates that shrink can hit mid-single digits in fresh categories, and ReFED estimates 30%-40% of the U.S. food supply is not consumed. By turning that waste stream into structured data, it provides buyers and department heads with a practical tool to adjust ordering up or down in order to improve recovery programs.

From Homes to Stores: The Trojan Horse Tactic

Mill was not a cold knock at the grocer’s back door. The company began by focusing on homes, creating a brand and data set while proving its hardware could be clean, quiet and reliable — qualities that are important in a retail backroom. And potential enterprise accounts’ executives were prompted to take the device home and try it out — a bottom-up approach that paid off by turning curiosity into internal champions.

Whole Foods subsequently beta tested the consumer model at a small number of locations, and brought real-world feedback back to the commercial redesign: greater capacity, an easier-to-clean design, and software engineered for store operations rather than nightly kitchen routines.

Economics and Scale of Store Waste Dehydration

Landfill and hauling fees are still stubborn line items for retailers. Industry reports from the Environmental Research & Education Foundation peg average municipal solid waste tipping fees in excess of $60 per ton in a number of areas, with denser urban markets commanding more. Both weight and volume lose their value in dehydration, enabling stores to renegotiate prices and schedules they pay for collections.

The supply-chain angle matters, too. Stabilizing organics means Mill keeps more nutrient value for use in feed, consistent with Whole Foods’ care standards for animals and sourcing values of ingredients. A rare case of sustainability, compliance, and unit economics all pointing in the same direction.

What Amazon Brings to Retail Waste and Forecasting

Amazon’s interest also situates the technology within a broader retail and logistics ecosystem. Although terms weren’t disclosed, the partnership paves the way to integrate waste data with forecasting systems, inventory tools and last-mile routines — all places where Amazon’s scale and software stack can compound gains made at store level.

The agreement also aligns with Amazon’s Climate Pledge, which commits the company to cutting waste and emissions throughout its operations. Reduced landfill disposal of organic waste reduces methane risk, a climate lever recognized by EPA guidance and corporate sustainability frameworks.

Beyond a Single Channel: Diversifying Mill’s Markets

For Mill, the partnership not only represents a reprieve in terms of revenue diversification beyond home subscriptions but also validation about a potential product that could be sold into grocery, foodservice and other high waste verticals. Company executives have also expressed interest in municipal programs, to which co-located dehydration could be a boon if it can mitigate contamination and logistical issues currently hampering curbside organics collection.

The approach is an echo of a lesson from consumer tech: don’t rely on one leg of the stool. In Amazon and Whole Foods, Mill adds another leg to that stool — one supported by quantifiable shrink reduction, lower disposal costs, and data that helps fresh departments operate like the profit centers they’re supposed to be.