Microsoft and OpenAI have signed a new agreement that significantly changes the terms of their existing expansive partnership and allows for fresh outside investment. The new contract, which marks a major reset for OpenAI’s ambitious efforts and its links to Microsoft’s cloud infrastructure business, also offers a blueprint for the next phase of increasingly capital-intensive AI growth.

The new agreement cements Azure as OpenAI’s primary compute backbone, vastly expands Microsoft’s economic upside, and establishes what happens when either organisation reaches artificial general intelligence, resolving a question that has hung over their relationship for many months. Microsoft will ultimately keep a modest stake in OpenAI — around 27% is explicitly stated — and receive 20% of OpenAI’s revenues on an ongoing basis. These terms are on top of Microsoft’s previously reported $13 billion in capital injection since 2019 and formalise their collaboration.

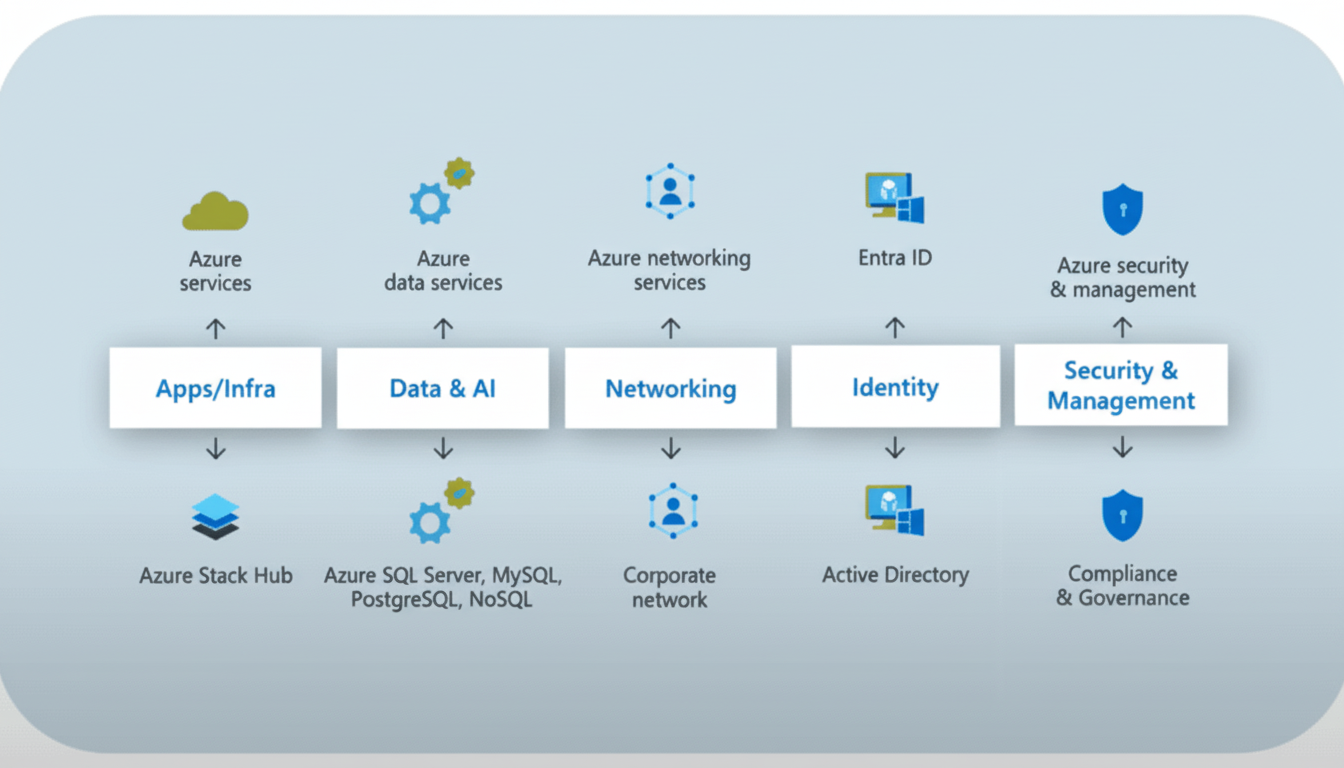

OpenAI, in exchange, commits most of its future compute procurement to Azure, a sum predicted to exceed several hundred billion dollars. That ensures Microsoft has cloud infrastructure, GPUs, and networking hardware for many years to come, with OpenAI gaining preferential access as it trains ever-larger models. Microsoft and OpenAI will have more knowledge about OpenAI’s model pipeline and performance, which will enable them to integrate products more tightly, including Copilot and Dynamics.

OpenAI also gets more strategic autonomy to reorganise as a for-profit enterprise and pursue external device partnerships, as long as the resulting services are created and provided on Azure. This preserves hardware returns for Microsoft while letting OpenAI play a role in new digital hardware and experience possibilities.

Approach to AGI development and governance

Both companies have also taken on the thorniest question directly: what if one of them actually develops AGI? The agreement ensures that both have rights to pursue it autonomously. If one of them develops AGI, the day-to-day partnership almost entirely unravels across the AGI layer. Although Microsoft has the right to access the models, the AGI nucleus is kept separate to avoid fuzzy ownership questions close to the edges of the AI methods.

Both sides argue that creating a clear “beachhead” on governance decreases key sector risk for both organisations and addresses the research and financial sectors’ fears about dominance of foundation models. For example, US and European competition authorities have long been investigating cloud connections in deep learning models. The agreement is predicated on a clearer division of responsibility in the AGI zone, allowing both companies to claim they will not cut off innovation or customer service due to this partnership.

Operational impacts and challenges

- OpenAI achieves operational independence and a clearer way to raise capital, partner broadly, and extend its product surface area. The company also has the flexibility to collaborate with third-party device makers and service vendors but maintains Azure as the primary engine it uses to scale its API and research computation. The agreement also removes uncertainty — at least for programmers and enterprise buyers — about the long-term future. OpenAI can now secure its business success without negotiation, and Azure can invest in model dependability, financial savings, and comprehensive enterprise products with cost and cloud supply in mind. Financial press has forecast that OpenAI could be eligible for hundreds of billions of dollars under alternative regulatory policies. However, establishing governance and cloud supply is a necessary first stage.

- There are challenges in the implementation of the agreement. Infrastructure is essential. The International Energy Agency has warned that data centers’ energy consumption is growing faster than all other sectors’, and public utilities throughout North America and Europe are amending their infrastructure growth plans in the face of AI loads. Microsoft’s protracted Azure engagements with OpenAI will have cascading effects in terms of land, power, and chip procurement. The combination of Azure and OpenAI is projected to compete for supply from the most coveted processor manufacturers. This will reduce latency and cost, especially as model penetration grows. Both firms already have partnerships with the top processor producers, Nvidia and AMD.

What to watch next: scale, devices, and regulation

- How fast Azure expands AI capacity to hit OpenAI’s timetable.

- Whether OpenAI introduces device or partner solutions that broaden distribution while keeping workloads on Azure.

- Whether there is any regulatory reaction to this modified approach.

The summary is that Microsoft receives durable economics and cloud demand, OpenAI gets tactical versatility and access to cash, and the market learns how AI’s two dominant players can share a future stage of the boom at the edge of AGI.