Meta is preparing to pilot premium subscriptions across Instagram, Facebook, and WhatsApp, introducing paid features while preserving the core apps for free use. The company plans to experiment with multiple bundles and app-specific perks, signaling that the tiers will not be one-size-fits-all. Early tests are expected to emphasize user control, creative tools, and AI-powered capabilities.

The strategy underscores Meta’s push to diversify revenue beyond advertising, which still accounts for roughly 98% of sales according to recent annual filings. As privacy changes and regulatory scrutiny reshape digital ads, subscriptions offer a way to monetize utility and advanced functionality rather than attention alone.

Why Meta Is Chasing Subscriptions Across Its Apps

Consumers are showing a willingness to pay for enhancements in social and messaging apps despite subscription fatigue. Snap’s Snapchat+ has topped 16 million subscribers and starts at $3.99 per month, demonstrating steady demand for exclusive features. Telegram has also reported tens of millions of paying users for its premium tier, and YouTube says its Premium and Music offerings together exceed 100 million subscribers globally. While conversion rates for consumer apps often sit in the low single digits, that can still translate into significant recurring revenue at Meta’s scale.

For Meta, subscriptions also hedge against volatility in ad markets and give the company permission to build features that are valuable to smaller, more engaged audiences—features that may not make sense to fund with advertising alone.

What Early Tests Could Include Across Meta’s Apps

Meta says each app will get its own slate of premium perks. On Instagram, early clues from feature sleuth Alessandro Paluzzi point to tools for power users: unlimited audience lists for targeted sharing, a view of followers who don’t follow back, and the ability to watch Stories without showing up in the viewer list. These are the kinds of nuanced controls that creators and socially active users have been asking for.

Paid add-ons for Facebook and WhatsApp are less clear, but precedents elsewhere hint at possibilities. Telegram Premium’s larger file uploads and faster downloads, Discord’s Nitro personalization, and cloud backup enhancements in messaging apps offer a template for value. On WhatsApp, advanced admin controls, expanded backup limits, or richer multi-device features could be logical candidates if Meta follows the market’s lead.

AI at the Center of Meta’s New Premium Pitch

AI will anchor much of the offering. Meta plans to scale Manus, an AI agent the company recently acquired for a reported $2 billion, across its apps while also selling Manus as a standalone subscription for businesses. Internal builds have already surfaced a Manus shortcut inside Instagram, suggesting a tight consumer integration is coming.

Meta will also trial paid access to Vibes, its short-form, AI-driven video creation experience. Vibes has operated as a free playground, but the company is testing a freemium model that could include a monthly allotment of video generations with a subscription unlocking more. That approach aligns cost to usage—AI video generation is compute-intensive—and makes premium tiers feel directly tied to creative throughput.

Expect AI to show up not just as a creative engine but as a personalization layer: smarter audience management on Instagram, proactive content planning tools for Facebook, and possibly AI-assisted messaging workflows for WhatsApp’s small-business users.

Lessons From Meta Verified and Competing Rivals

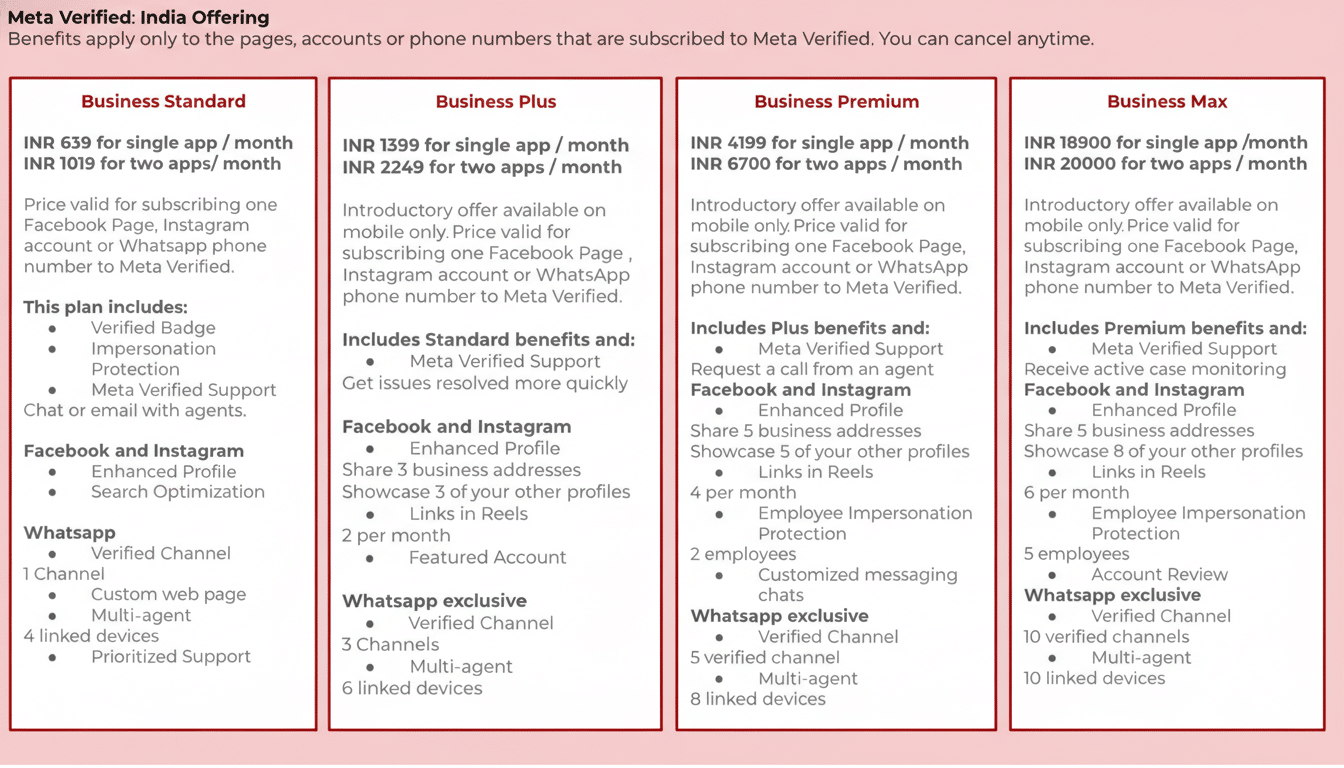

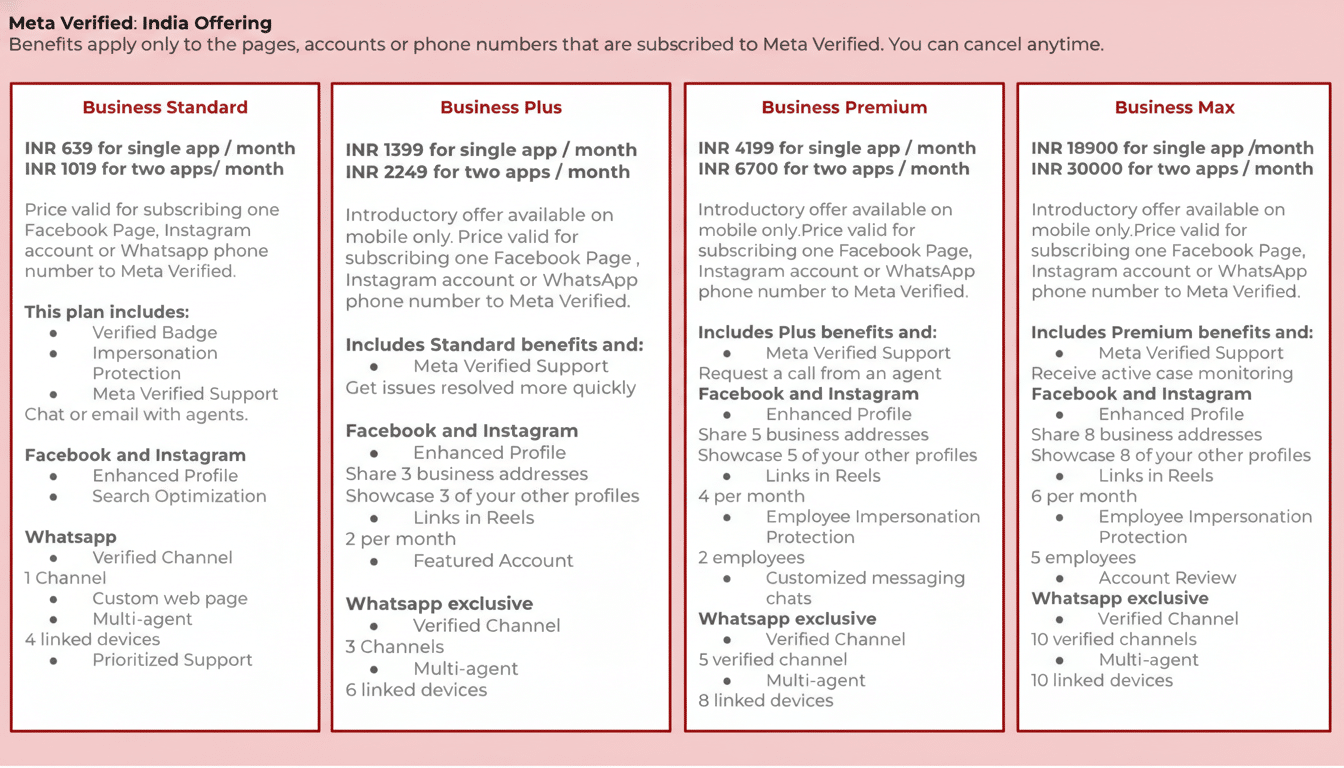

Meta emphasizes these new plans are distinct from Meta Verified, which targets creators and businesses with a verified badge, direct support, impersonation protections, and discovery boosts. The premium tests are designed for a broader set of everyday users who want more control and capability without pursuing a public “verified” identity.

The company will have to calibrate carefully. Features that feel like quality-of-life improvements or productivity boosts tend to sell; locking privacy-sensitive controls behind a paywall, by contrast, risks backlash. Regulators will also watch whether paid tiers confer advantages that materially disadvantage non-paying users in markets where competition and neutrality concerns are high.

What to Watch in the Rollout of Meta’s Premium Tests

Meta plans a gradual release, gathering feedback and iterating on price, bundles, and feature mix. Key signals to track include whether subscriptions are per-app or discounted in a cross-app bundle, how heavily AI features are gated, and whether business-focused capabilities—particularly around WhatsApp—are split into separate tiers.

If Meta nails the balance, subscriptions could lift average revenue per user without compromising the free experience that keeps billions engaged. The litmus test will be simple: do the new tools save time, unlock creativity, or deliver measurable advantages? If yes, Meta’s premium experiment could become a durable line of business rather than just another upsell.