Meta is pivoting its flagship virtual world, Horizon Worlds, away from virtual reality and refocusing it as a mobile-first platform, formally decoupling it from the Quest VR ecosystem. The move effectively parks the long-touted metaverse vision and aims Horizon at the far larger smartphone audience, signaling a pragmatic reset after years of heavy VR investment.

Why Meta is recasting Horizon Worlds for a mobile future

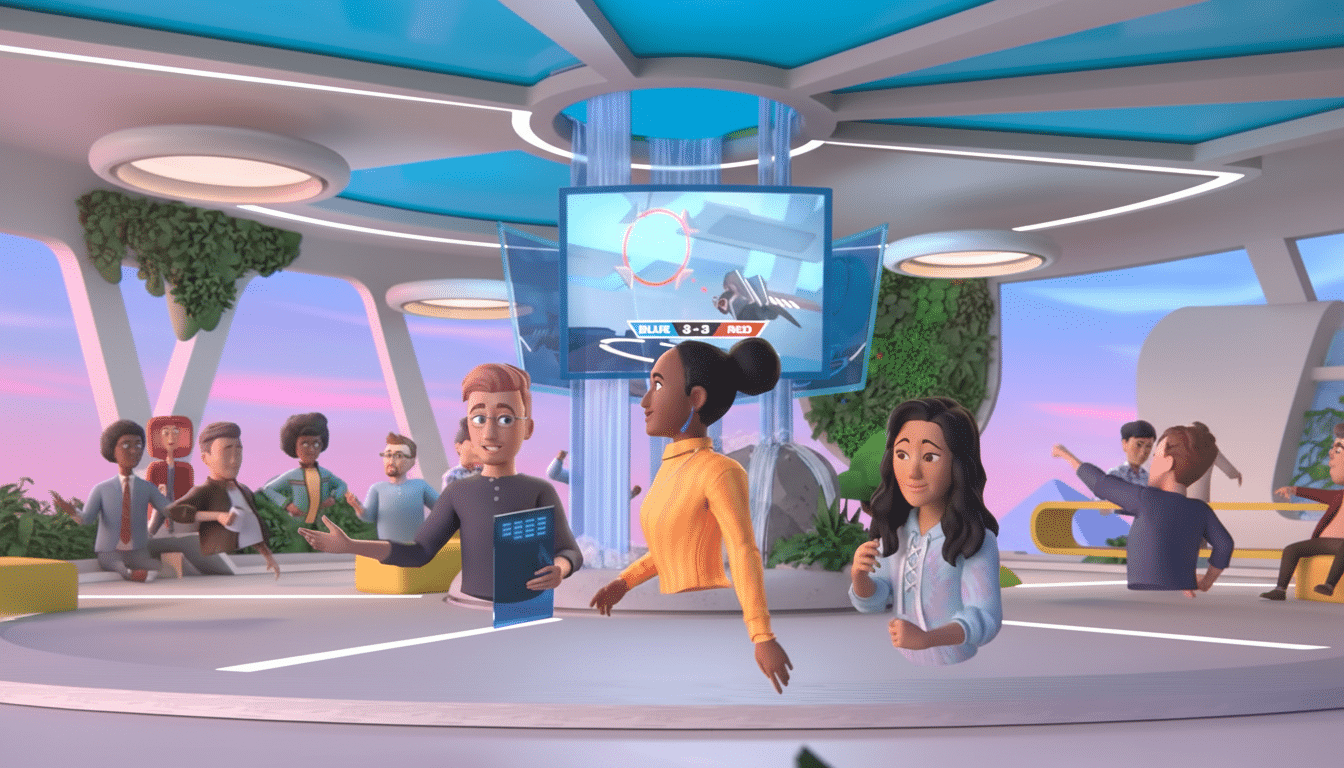

The strategic logic is straightforward: phones deliver instant reach measured in billions, while the VR installed base remains comparatively small and volatile. By taking Horizon Worlds fully to mobile, Meta is placing it in the same arena as dominant user-generated game platforms like Roblox and the social gaming universe around Fortnite, where synchronous play, creation tools, and creator monetization drive massive engagement.

Meta’s own financials underscore the urgency to rethink. Reality Labs, the unit behind Quest headsets and immersive software, has amassed cumulative operating losses approaching $80 billion since 2020, according to company filings. Shifting Horizon to mobile reduces platform friction, speeds iteration cycles, and positions Meta to tap distribution across Facebook, Instagram, and WhatsApp—an advantage few rivals can match.

Scale matters in this race. Roblox reports over 70 million daily active users in recent disclosures, while Epic Games routinely draws tens of millions into Fortnite’s live events. Horizon will need more than slick graphics; it will need low-latency networking, high creator payouts, and viral loops that convert social reach into sustained play sessions.

What changes for Quest and VR as Horizon pivots to mobile

Meta says it is explicitly separating the Quest platform from Horizon Worlds. Practically, that means Quest continues as a VR hardware and content ecosystem, while Horizon becomes a mobile-first social gaming product that may coexist with, but not depend on, VR. It’s a notable turn from the “everything in VR” thesis that once sat at the heart of the metaverse pitch.

The reorientation follows a series of belt-tightening moves inside Reality Labs, including staff reductions of roughly 1,500 roles—about 10% of the unit—studio closures, and the transition of Supernatural, a VR fitness app acquired by Meta, into maintenance mode. Streamlining VR content bets and decoupling Horizon helps concentrate resources where near-term user growth and revenue are more achievable.

Still, Meta insists VR isn’t being abandoned. Executives point to a multi-year Quest hardware roadmap targeting different segments as the market matures. Expect a barbell approach: leaner first-party VR software, heavier third-party enablement, and a stronger push to justify headsets with productivity, mixed reality, and fitness use cases—areas where daily utility could counteract churn.

AI wearables and models move to center stage at Meta

Beyond the Horizon pivot, Meta is reweighting its future bets toward AI wearables and foundational AI models. On a recent earnings call, CEO Mark Zuckerberg described a world where most glasses people wear are AI-enabled—a vision consistent with Meta’s Ray-Ban smart glasses, which saw sales reportedly triple year over year. Bundling AI assistants into familiar form factors could deliver the ambient computing that VR alone has struggled to mainstream.

This reframing aligns with a broader industry shift: instead of chasing a single, all-encompassing metaverse, companies are threading AI into everyday devices and social surfaces. For Meta, that means using AI to recommend games, moderate communities, boost creator tools, and personalize in-world experiences on mobile—while also preparing glasses that bring those assistants into the real world.

Can Horizon Worlds compete on mobile against entrenched rivals?

Mobile-first Horizon will compete head-on for time and wallets with entrenched ecosystems. The opportunity: Meta can fuse gameplay with the distribution muscle of Facebook and Instagram, enabling instant identity, friend graphs, and discovery. That baked-in audience and ad infrastructure could accelerate creator earnings and lower acquisition costs relative to standalone platforms.

The risks are real. UGC-heavy platforms live and die by moderation and trust. Regulators are scrutinizing teen safety and monetization mechanics across social and gaming apps. Meta will need rigorous safeguards, transparent creator economics, and clear cross-app data boundaries to avoid friction that could stall growth before network effects kick in.

What to watch next as Meta shifts Horizon to smartphones

Key signals of traction will include daily active users, average session length, creator retention, payout ratios, and gross bookings growth. On VR, watch for third-party developer sentiment, attach rates of productivity and mixed reality apps, and whether new headsets broaden the audience beyond enthusiasts.

The metaverse as a VR-first product may be receding, but Meta’s pursuit of large, social, synchronous worlds is not. By liberating Horizon from the constraints of headsets and threading AI across devices, Meta is betting that the future of immersive play arrives not through goggles alone, but through the phone in your pocket and the glasses on your face.