Meta is rolling out a sweeping AI infrastructure program called Meta Compute, a move CEO Mark Zuckerberg framed as foundational to the company’s next decade of product development and research. The initiative centers on building and operating compute, energy, and networking capacity at unprecedented scale to support training and serving advanced AI models across Meta’s platforms.

The announcement follows earlier signals from Meta leadership that capital spending would tilt heavily toward AI. Executives have repeatedly argued that owning state-of-the-art infrastructure, rather than relying solely on third-party clouds, is now a strategic differentiator in model performance, cost efficiency, and time-to-market.

What Meta Compute Targets Across the Stack

Meta Compute is designed to unify core elements of the stack: data centers, high-speed networks, custom and merchant silicon, the software toolchain, and developer productivity. The company’s head of global infrastructure, Santosh Janardhan, will lead technical architecture and operations, including the global data center fleet and backbone networks—areas where Meta has decades of scale experience, from open-sourcing server designs through the Open Compute Project to building some of the world’s busiest content delivery systems.

The program points to tighter integration between hardware and software. Meta has already been developing its own silicon through the MTIA program for AI inference, while running training workloads on industry-standard accelerators. Expect Meta Compute to orchestrate a heterogeneous environment that balances cost, latency, and performance across models serving billions of daily requests in Facebook, Instagram, WhatsApp, and Quest.

On the planning and supplier side, Daniel Gross will lead a new group focused on long-range capacity strategy and partnerships. His mandate underscores how AI infrastructure has become an industrial-scale supply chain challenge, spanning advanced GPUs, optical networking, power equipment, and specialized cooling.

Government engagement will be steered by Dina Powell McCormick, who will coordinate with public-sector stakeholders on siting, permitting, financing, and policy. That role is pivotal as hyperscale campuses increasingly hinge on transmission upgrades, water stewardship, land use, and incentives negotiated with cities, states, and national agencies.

A Gigawatt-Scale Bet on AI Data Center Power

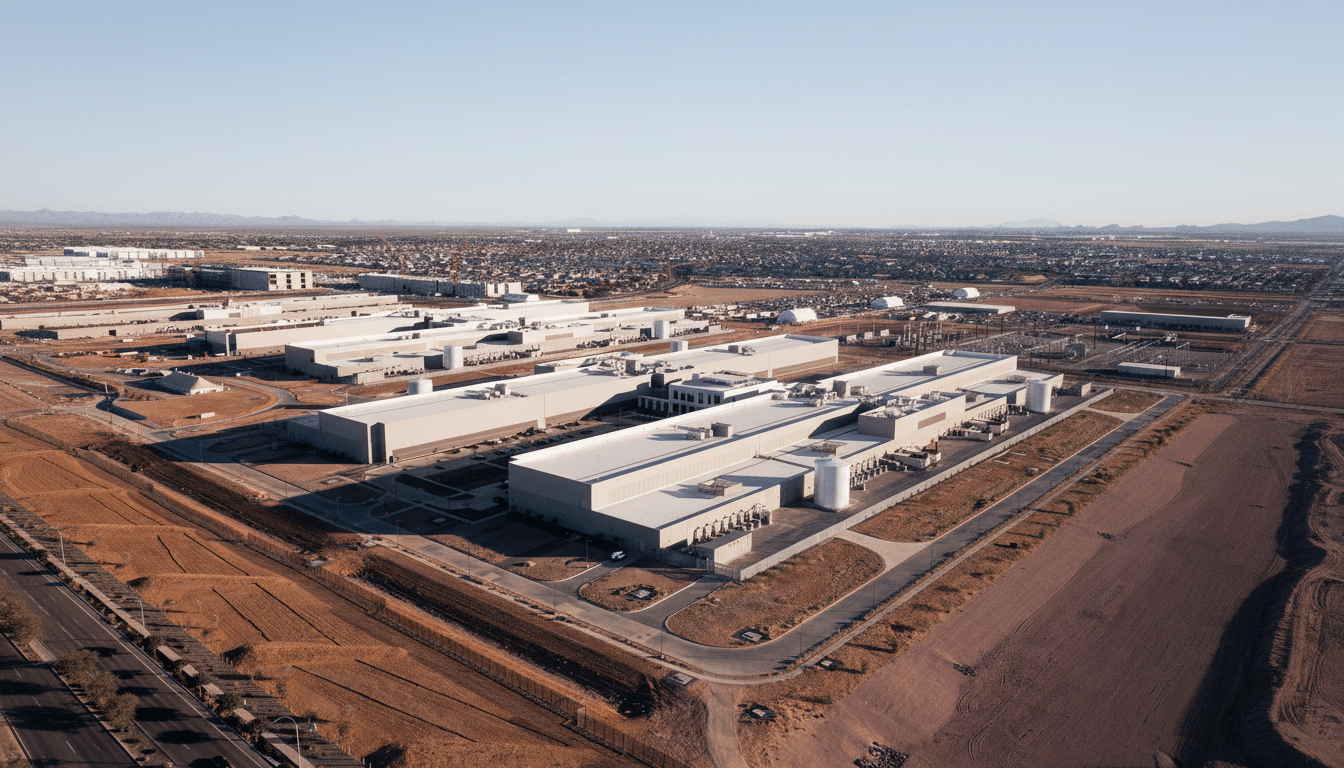

Zuckerberg signaled Meta intends to add “tens of gigawatts” of power this decade, with ambitions for “hundreds of gigawatts” over time. In practical terms, a single hyperscale data center campus can draw 100 to 500 megawatts, depending on design and phase. Tens of gigawatts imply dozens of such campuses worldwide and a long-term shift toward dedicated, contracted energy resources—not spot grid capacity.

The scale aligns with wider industry forecasts. The International Energy Agency has estimated global data center electricity demand could roughly double mid-decade, with AI training and inference a key driver. U.S. grid operators have already reported surging interconnection requests, with multi-year queues becoming a gating factor for large projects. For Meta, securing firm power—paired with fast-track grid connections—will be as strategic as acquiring compute itself.

Expect a diversified energy playbook: long-term renewable power purchase agreements, grid-scale storage to manage intermittency, advanced cooling to curb water use, and potentially new firm power sources. Industry peers have explored next-generation options such as small modular reactors and advanced geothermal, while signing long-dated contracts designed to de-risk both cost and availability.

Why Owning the Stack Matters for AI Efficiency

Beyond raw horsepower, control over infrastructure translates into model velocity. Training frontier-scale systems demands predictable access to accelerators, optimized interconnects, and software tuned from kernel to framework. Meta’s open-source Llama models and the company’s AI features in feeds, ads, and messaging depend on cost-efficient inference at staggering scale—where even single-digit efficiency gains compound into major savings.

Meta previously guided that capital expenditures would rise significantly to support AI. That trajectory mirrors moves across Big Tech: Microsoft’s multi-billion-dollar AI buildouts with OpenAI, Google’s expansion of TPU-based clusters, and Amazon’s push with Trainium and Inferentia. As Nvidia’s next-generation platforms enter production, hyperscalers are racing to lock in supply while advancing their own silicon to balance vendor risk and total cost of ownership.

Execution Risks and Community Impact for Meta

Delivering gigawatt-scale capacity is as much a regulatory and community challenge as an engineering one. Interconnection queues, transmission bottlenecks, and construction labor shortages can delay timelines. Water usage, heat reuse, and local environmental impacts are under greater scrutiny, especially in established hubs like Northern Virginia and fast-growing markets in the Southeast and Midwest.

Meta’s approach will likely emphasize distributed siting near generation, grid reinforcement partnerships with utilities, and efficiency gains at the chip and data center level. Transparency on energy sourcing and community benefits—jobs, tax base, infrastructure—has become table stakes for securing public support.

The Bottom Line on Meta’s AI Infrastructure Plans

Meta Compute marks a decisive turn toward owning the full AI infrastructure agenda—from chips and silicon programs to power procurement and policy. If the company delivers on its gigawatt ambitions, it will not only shape the performance curve of its models, but also influence how the next wave of digital infrastructure is financed, permitted, and integrated into power systems worldwide.