Meta is acquiring Manus, the Singapore-based artificial intelligence startup that has been the talk of the industry since it made its spring debut, in a deal that’s worth roughly $2 billion, reports The Wall Street Journal. The acquisition provides Meta with a fast-growing AI agent product that has actual, living and breathing customers and revenue — two things that are particularly hard to come by in the overheated generative AI market.

Why Manus matters to Meta’s broader artificial intelligence strategy

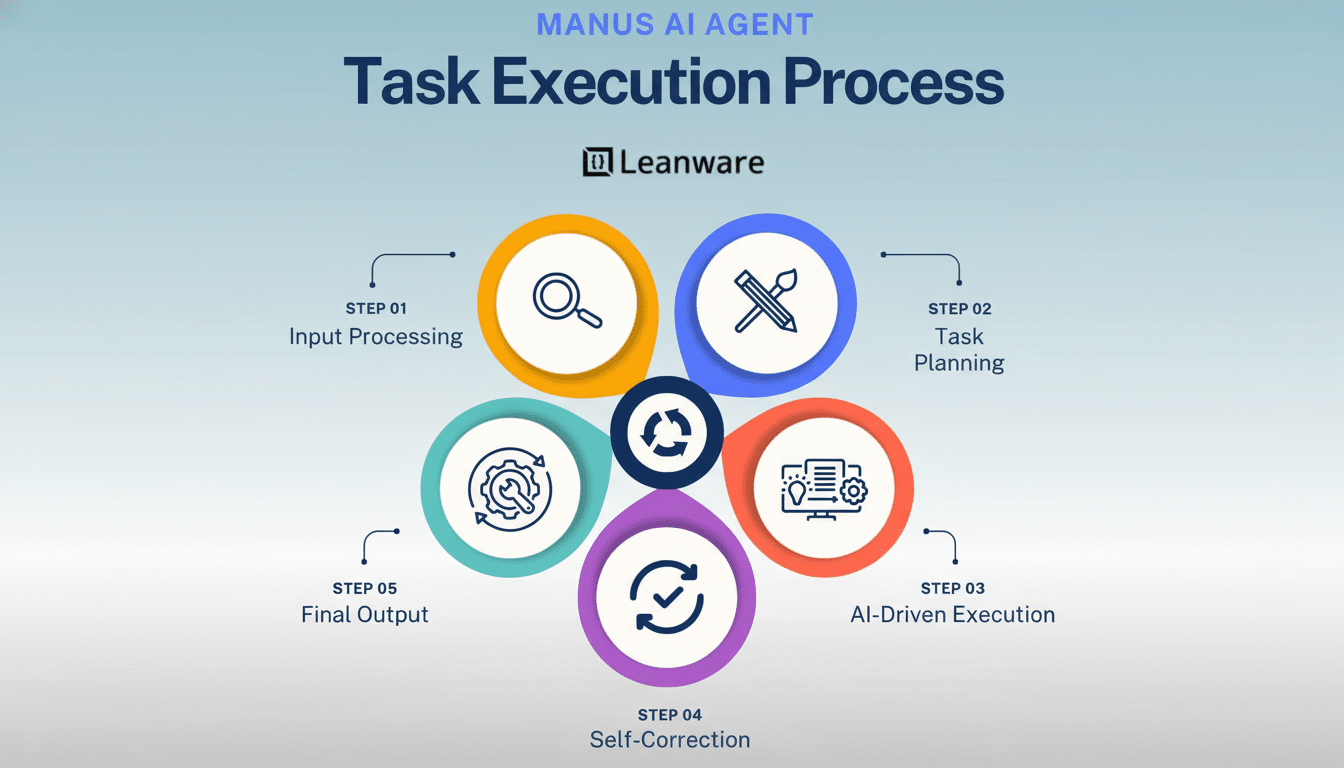

Manus came on the scene with an AI agent that could handle multi-step tasks — screening job candidates, arranging travel plans, synthesizing research compounds — not just answer prompts. Early tests had beaten OpenAI’s Deep Research at the time, and it depicted a departure away from chatbots in particular toward action-oriented agents capable of executing workflows autonomously.

- Why Manus matters to Meta’s broader artificial intelligence strategy

- The price tag and Manus’s growth and funding trajectory

- Integration plans and product fit across Meta’s platforms

- Investors, venture funding, and the AI spending backdrop

- Geopolitics, regulatory questions, and Manus’s China ties

- What comes next for Meta, Manus, and AI agent integration

Importantly, Manus is more than a demo. The startup has said it attracted millions of users and disclosed annual recurring revenue above $100 million. That traction gives Meta something its in-house AI efforts have so far lacked: a revenue-generating, user-vetted agent product it can plug into Facebook, Instagram and WhatsApp, where Meta’s AI already appears to some degree.

The price tag and Manus’s growth and funding trajectory

The $2 billion number would imply a circa 20x multiple on Manus’s claimed ARR, high but not unheard of for a high-growth AI asset with an apparent technological edge.

The company has flown to this position: Benchmark led a $75 million round at a $500 million post-money valuation mere weeks after startup, while prior funding is said to include Tencent, ZhenFund and HSG (previously known as Sequoia China) investing in a $10 million close.

The calculus is simple for Meta. After years of investment in base models like Llama and feeding resources into its AI infrastructure, the company’s ready to pay a premium for a product that has some relatively real scale with paying customers — and can be distributed across an audience that numbers in billions on its social and messaging platforms.

Integration plans and product fit across Meta’s platforms

Meta says Manus will continue to work as a solo, independent company even as its agent tech becomes integrated into Meta’s consumer apps. Expect first-mover integrations quickly across messaging surfaces: An agent that can transact within WhatsApp or Messenger would turbocharge business messaging, automate customer support and simplify commerce flows end to end — from discovery to purchase to follow-up.

On Instagram and Facebook, Manus’s planning and research abilities could also become creator tools that help draft collaborations, plan campaigns or surface performance insights. For users, the practical lure is straightforward: agents that take care of labor-intensive multi-step chores with as little handholding as possible.

Investors, venture funding, and the AI spending backdrop

The deal lands as investors puzzle over Meta’s heavy spending on infrastructure — what analysts describe as a $60 billion spending spree on AI-ready data centers and compute. Purchasing a premium AI agent with some real revenue also helps counter the narrative that Meta’s AI effort is all cost, no cash flow — and it diversifies its range of AI beyond foundational research and chatbots.

The monetization of Manus also provides a template for how AI features could generate real money across Meta’s apps, including paid productivity tools and premium business automation. If Meta can goose Manus’s conversion rates with social-scale distribution, the deal might quickly become accretive.

Geopolitics, regulatory questions, and Manus’s China ties

Manus’s creators set up a holding company, Butterfly Effect, in Beijing in 2022 before relocating the business to Singapore in mid-2025. Washington hawks have already taken note of that history. Senator John Cornyn has assailed U.S. support for China-linked AI-related projects, and policy toward China remains one of the rare bipartisan through lines on Capitol Hill.

Post-deal, Manus will be independently operated beyond the influence of Chinese investors and without operations in China, Meta told Nikkei Asia. Even still, a deal of this size from Meta is all but certain to attract antitrust and policy scrutiny in the United States, where regulators have been monitoring consolidation around AI infrastructure, data and talent. The main watchpoints: data handling, access controls, and whether Manus’s independence isn’t just branding.

What comes next for Meta, Manus, and AI agent integration

“Watch three signals,” he said.

- The speed of technical integration into Meta’s messaging stack — WhatsApp alone provides Manus instant access at massive scale.

- The developer story: will Meta open APIs that allow businesses to stitch Manus agents into custom workflows?

- Talent; the founders and lead researchers are the asset in a market where top-agent teams are fiercely recruited.

For now, Meta has purchased more than a startup. It’s bought a ticket to the race among AI agents, a credible revenue engine and a product with definite usefulness within the world’s most prevalent social platforms. If the company delivers without raising regulatory hackles, this could be one of those rare AI acquisitions that pays off rapidly.