A global squeeze on memory chips is colliding with the next wave of game consoles, and the fallout could hit both price tags and timelines. People familiar with supply plans tell Bloomberg that Nintendo may lift the Switch 2’s price to offset costlier RAM and storage, while Sony’s PlayStation 6 is tracking later than internal targets as component availability tightens.

Why AI Demand Is Squeezing Console Memory Supplies

The bottleneck starts with artificial intelligence. Training and inference servers are devouring advanced memory—especially high-bandwidth memory (HBM)—at an unprecedented pace. Chipmakers are pivoting capacity toward these premium parts, leaving less wafer space for the DRAM and NAND that power consoles, handhelds, and PCs.

Suppliers have been explicit. SK hynix has said demand for HBM is effectively sold out well ahead, Micron has flagged constrained supply for next-gen stacks, and Samsung is accelerating transitions to higher-margin lines. As a knock-on effect, TrendForce has tracked multiple quarters of double-digit rises in DRAM contract prices and firmer NAND pricing as inventory cleared and output was reined in.

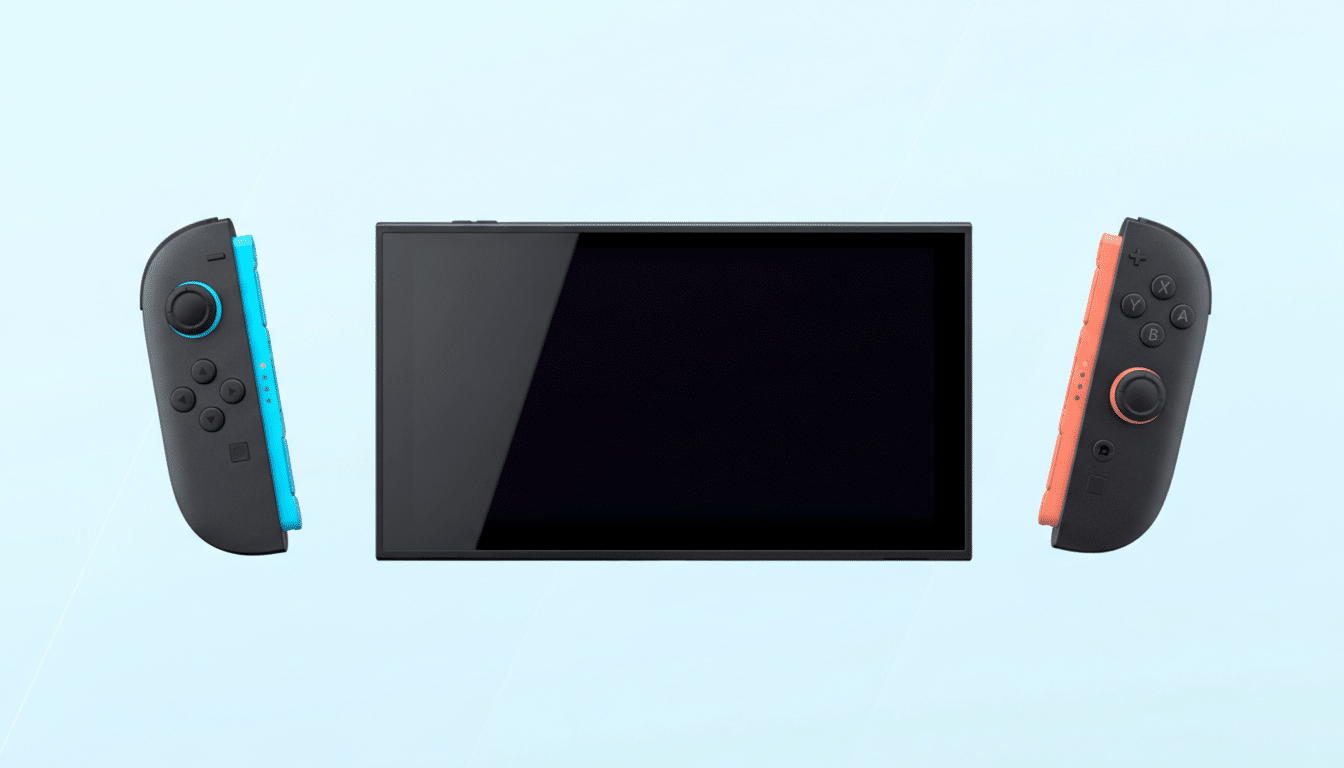

Consoles sit right in the middle of this tug-of-war. Portable systems lean on LPDDR5-class memory and sizable embedded storage; high-end boxes use wide GDDR bandwidth and fast SSDs. When those inputs climb in cost, the bill of materials swells and launch plans get complicated.

What the Memory Squeeze Means for Switch 2 Pricing

Nintendo is historically disciplined on hardware margins, preferring stability over subsidies. With RAM and flash trending higher, even small per-unit increases add up. A double-digit move in DRAM and SSD pricing can translate to tens of dollars on the bill of materials, squeezing room for promotional bundles or aggressive entry MSRPs.

That reality has options but few easy answers. Nintendo can ship a lower base storage configuration, raise the list price, or absorb the hit and recuperate through software attach and accessories. Given leadership’s past emphasis on profitability and the volatile component market, analysts expect pricing flexibility to be on the table rather than deep discounting out of the gate.

The broader consumer backdrop supports the trend. TrendForce expects shoppers to face higher device prices overall, with laptops up around 15% and smartphones near 10%, as memory costs ripple through product lineups. Handheld PC makers have already cited RAM and SSD spikes for abrupt pricing changes and limited runs—an early warning for console planners.

Why the PlayStation 6 Launch Timeline Is at Risk

Sony’s next flagship is more exposed to bandwidth-heavy parts. Modern consoles depend on large pools of high-speed graphics memory and blistering SSD throughput to feed advanced rendering and real-time effects. If suppliers prioritize AI parts or raise minimum order sizes, securing the volumes needed for a global console rollout becomes tougher and pricier.

According to Bloomberg’s sourcing, that combination—tight GDDR supply, pricier SSDs, and a desire to avoid launching into a component peak—has pushed the internal window for PlayStation 6 later than earlier expectations. A longer runway also gives developers time to extract more from existing hardware and lets Sony align launches with friendlier costs and fuller inventories.

The Ripple Effects for Gamers and Developers

For players, the immediate impact is twofold: potential price pressure on new hardware and a longer tail for current consoles. Expect platform holders to lean on mid-cycle refreshes, special editions, and software lineups to keep momentum while they wait out memory normalization.

For studios, prolonged cycles can be a blessing and a headache. Extra time means bigger audiences on mature platforms and better tooling, but it also stretches cross-gen support. Memory budgets, texture quality, and storage footprints remain gated by today’s specs until the next bump arrives.

What to Watch Next in Console Pricing and Timing

- Supplier capex updates: Any acceleration of DRAM and NAND investment aimed at mainstream parts—not just HBM—would ease pressure. Quarterly commentary from Samsung, SK hynix, and Micron is the leading indicator.

- Pricing trackers: Contract and spot price data from TrendForce and other research firms will signal when memory costs crest. A few consecutive declines would strengthen the case for firmer launch plans.

- Component choices: Watch for hints that console makers are adjusting memory configurations or storage tiers to balance cost and performance. A smaller base SSD or alternate RAM speeds often telegraph BOM realities.

The bottom line: AI’s appetite for advanced memory is reshaping the console roadmap. Unless supply broadens or prices cool, Nintendo may have to nudge the Switch 2 price upward, and Sony appears poised to wait longer before unveiling the PlayStation 6. Gamers get more life from current machines—just don’t expect bargains on the next ones until the memory market loosens.