Meesho’s market debut was one of the most impressive opening sessions in recent months, with its shares rising as high as 46 percent above the issue price as investors rushed into a discount-focused marketplace. Opening at ₹162.50 compared to an offer price of ₹111, the stock reached as high as ₹171.84 intraday, which implied a market value near ₹780 billion ($8.7 billion), according to Refinitiv data. The company, based in Bengaluru, raised $606 million in fresh capital, a sign of revived appetite for India’s tale of ecommerce growth.

A big first-day pop underscores strong investor demand

The first-day surge positions Meesho well above its most recent private valuation of around $5 billion in 2021, aligning public market pricing with the increasing size of the business. Early backers Elevation Capital, Peak XV Partners and Y Combinator sold shares in the offering, and SoftBank, Prosus and Fidelity were among those that held onto their stakes, according to the prospectus.

- A big first-day pop underscores strong investor demand

- A marketplace for value built for price-sensitive shoppers

- Financials display scale and strain across key metrics

- The India e-commerce case for public market investors

- IPO pipeline and competitive stakes in India tech

- What to watch next as Meesho navigates public markets

The pop also mirrors a wider reopening of India’s IPO window for venture-backed businesses, especially those with firm unit-economics stories to tell. Meesho has a pitch that resonates: a low-cost marketplace that leans on supply from small sellers, price-sensitive demand and an essentially stripped-down fee structure that has forced larger rivals to follow suit.

A marketplace for value built for price-sensitive shoppers

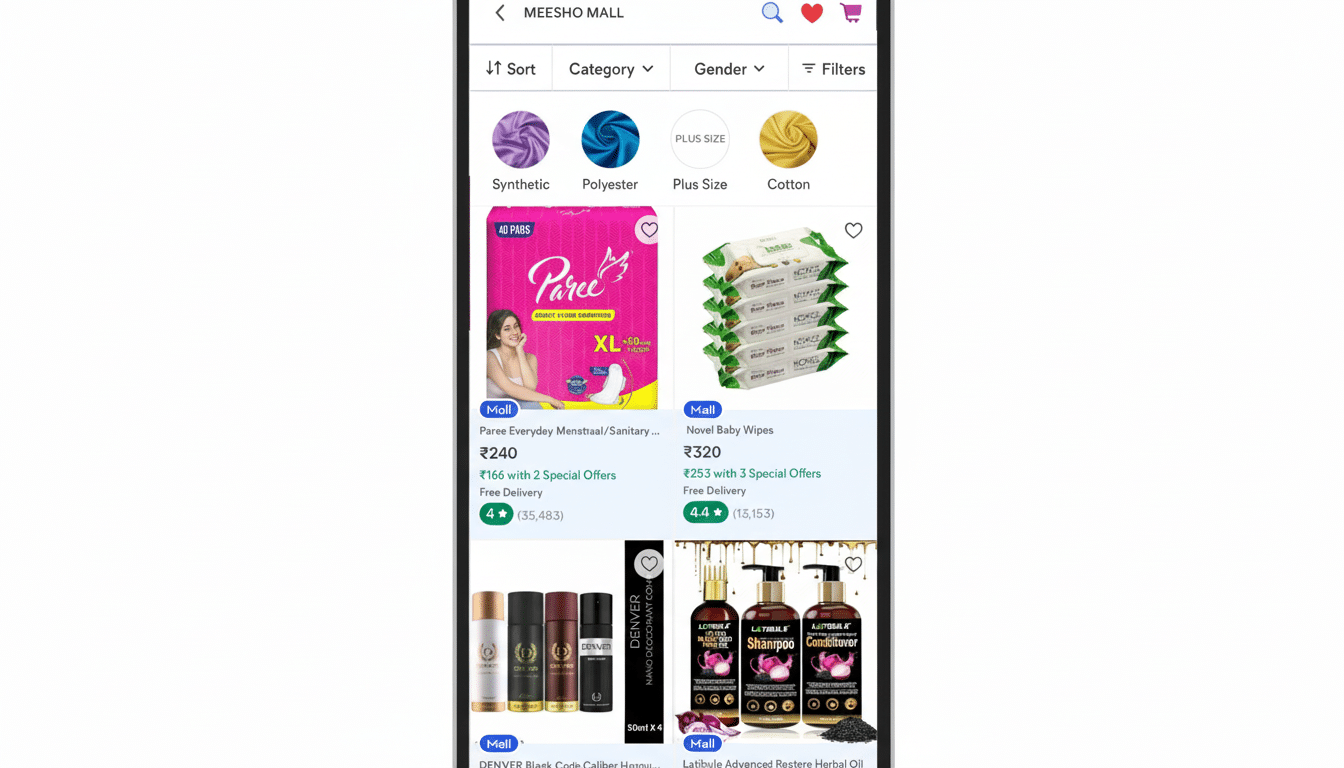

Meesho, founded in 2015, started as a WhatsApp-based social commerce platform targeting new shoppers in smaller towns. Today it has expanded into a mass-market bazaar that is similar in spirit to value-conscious ascendant peers like Pinduoduo in China, Shopee in Southeast Asia and Mercado Libre in Latin America — lean, seller-friendly and programmed for deals.

Scale is now tangible. In the last 12 months, Meesho reported around 234.2 million transacting users with a whopping number of 706,471 annual sellers and over 50,000 active content creators driving their discovery and conversion. That creator-led funnel assists in keeping acquisition costs in check as it on-boards long-tail inventory — an advantage in Tier 2 and Tier 3 markets where price sensitivity is greatest.

Financials display scale and strain across key metrics

Revenue rose to ₹55.78 billion (or about $620 million) in the six months that ended on Sept. 30, from ₹43.11 billion (roughly $480 million) a year earlier, according to company filings. Net goods value grew 44% to ₹191.94 billion, or about $2.14 billion during the same time frame driven by better order velocity and deeper penetration beyond metros.

Losses expanded to ₹4.33 billion (about $48 million) from ₹0.24 billion (about $2.7 million) a year earlier, as the company tried to strike a balance between growth and monetization.

The major peg for new shareholders, in my mind, is whether Meesho can drive up take rates — advertising fees, logistics services and seller tools are all there to be hoisted up — without watering down its low-price promise that drives frequency/retention.

The India e-commerce case for public market investors

Several macro drivers are converging. Payments digitisation through UPI has lowered the checkout friction, logistics are more reliable and have wider reach, smartphone affordability is extending its addressable base. Indeed, industry reports from Bain & Company and RedSeer continue to highlight the fact that online retail is a single-digit percentage of India’s overall retail market — so there is significant runway.

Meanwhile, government-backed programs like ONDC are looking to reduce the barriers for small merchants (which aligns well with Meesho’s seller-first approach). For public investors, that structure provides both secular growth and diversification outside of the premium urban customer base upon which traditional ecommerce cohorts are built.

IPO pipeline and competitive stakes in India tech

Meesho’s debut comes as technology listings continue to drip in India. The window has been kept open by recent listings by Pine Labs, Groww, Lenskart, Physics Wallah and Capillary Technologies among others, and names like Flipkart, Oyo and PhonePe are on watchlists. The strong early trading in Meesho is likely to give others in the queue courage to test market depth.

Competition remains intense. Meesho’s low-commission model has forced incumbents Amazon and Flipkart to make their value propositions more stringent for both sellers and buyers. With platforms competing for customers who may be low income or new to online shopping, the industry can expect intense experimentation around fees, logistics subsidies and ad monetization. The winners will be the ones who convert scale into margins that are hard to attack with well-priced free shipping.

What to watch next as Meesho navigates public markets

What are the key things to look for in the following quarters?

- Operating leverage in fulfillment

- Ad revenue over a share of GMV

- Any changes on take rates

Regulatory attention on discounting, seller parity and data governance will also be critical. Co-founder and CEO Vidit Aatrey framed the listing as a handover of Meesho’s mission to a wider array of public stakeholders — now its job is to deliver profitable growth while maintaining faithfulness to the value playbook that brought it here.