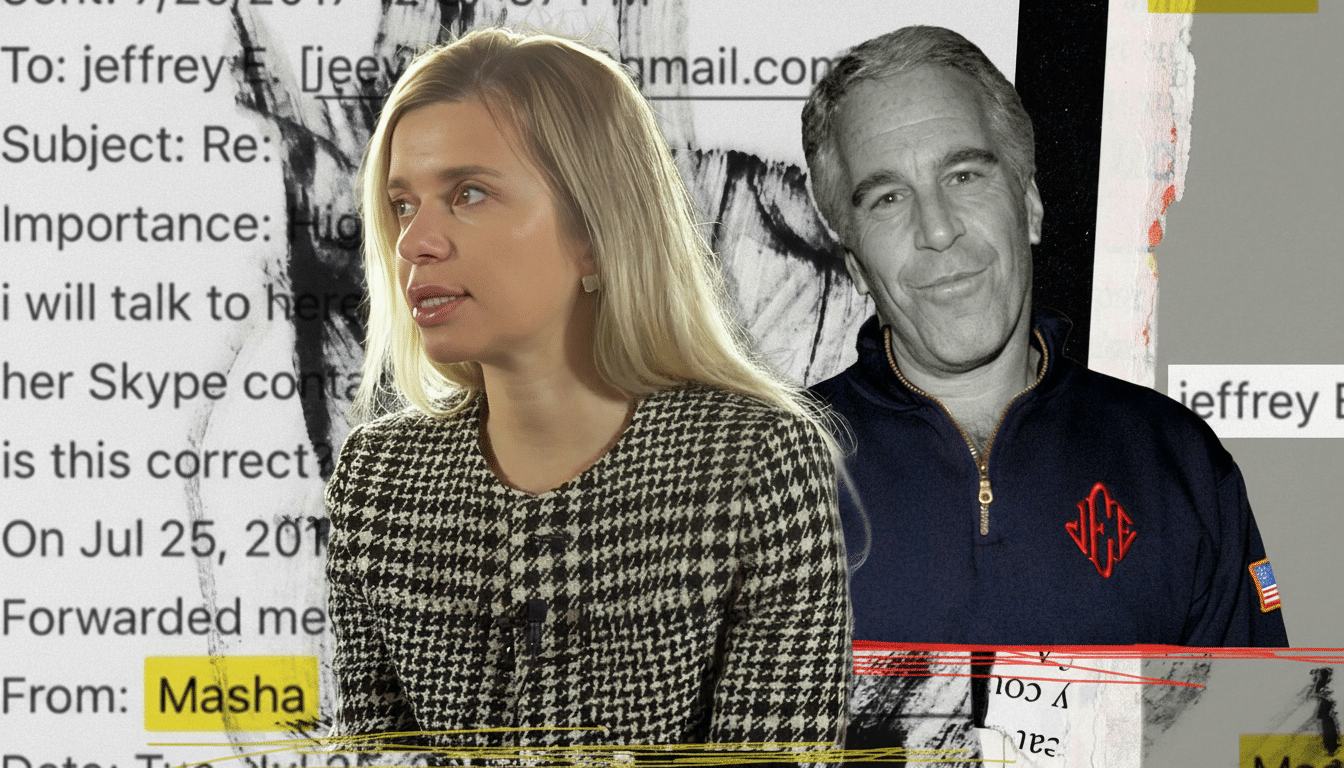

Day One Ventures founder Masha Bucher spoke out on X, addressing reports that detail her business and personal ties to Jeffrey Epstein and her role in efforts to rehabilitate his image. Her statement followed renewed attention after public records and correspondence linked to Epstein showed her name surfacing repeatedly, sparking questions about judgment, disclosure, and the optics for a VC known for PR savvy.

What Bucher Says Now About Her Epstein Involvement

In a series of posts, Bucher — who previously went by her maiden name, Masha Drokova — framed her involvement as a grave mistake born of naiveté and fear. She said she believed Epstein’s narrative about his earlier conviction, trusted the endorsements of prominent investors and scientists, and felt he could offer protection as she distanced herself from Russia. She apologized to founders, her team, and investors for the pain caused, and said she has since denounced Vladimir Putin, relinquished her Russian passport, and met with some of Epstein’s victims.

- What Bucher Says Now About Her Epstein Involvement

- Emails and Reported Interactions With Jeffrey Epstein

- Day One Ventures and the Optics for Its Portfolio

- Past Political Ties in Russia Resurface for Bucher

- Legal Exposure and Industry Response to the Fallout

- What Founders and LPs Will Watch Next at Day One

Emails and Reported Interactions With Jeffrey Epstein

The San Francisco Standard reported that Bucher’s name appeared more than 1,600 times in the latest cache of Epstein-related materials. Forbes has reported that she agreed to act as Epstein’s publicist years after his first conviction, arranging meetings with journalists as part of a push to refashion his reputation. SFGate described emails that referenced gifts, including money and a Prada bag, and one exchange in which Epstein requested nude photos; the coverage noted there is no indication she complied.

Forbes also reported that Bucher’s correspondence with Epstein remained cordial up to 11 days before his arrest. The documents reviewed by multiple outlets do not indicate she broke laws. Still, the scope and tone of their communications deepen the reputational fallout now confronting her and her firm.

Day One Ventures and the Optics for Its Portfolio

Bucher’s brand in Silicon Valley has long blended investing with communications expertise. That positioning is now under the microscope. Day One Ventures has backed startups such as Superhuman, Remote, Worldcoin, and Truebill, which later sold to Rocket Companies in a multibillion-dollar acquisition. The firm has also invested in Valar Atomics and other early-stage bets.

Reputation is a core asset in venture capital. Limited partners often evaluate managers on pattern recognition, networks, and perceived integrity. Industry groups like ILPA routinely urge robust background checks and conflicts disclosures. In practice, founders also watch signals: which investors they invite onto boards, whose names appear on cap tables, and whether a fund’s partners reflect the values they claim to champion.

Past Political Ties in Russia Resurface for Bucher

Bucher’s earlier public life in Russia has reemerged alongside the Epstein revelations. She once took part in Nashi, a pro-Kremlin youth movement, and was featured in the documentary Putin’s Kiss, as reported by CNN. In her recent X posts, she emphasized that she has since broken with the regime and publicly condemned it. The juxtaposition underscores a broader theme now dogging her narrative: how formative affiliations can shadow a career, even as personal views evolve.

Legal Exposure and Industry Response to the Fallout

While the documents cited by outlets do not allege criminal conduct by Bucher, the fallout is acute. Associations with Epstein have already complicated reputations across finance, academia, and tech. Communications experts note that effective remediation typically requires full transparency, independent review, and tangible accountability measures. In VC, that can extend to updating LP advisory committees, clarifying any compensation or benefits received, and outlining governance steps to prevent future lapses.

What Founders and LPs Will Watch Next at Day One

Founders may seek assurances about Day One’s internal policies, including conflict-of-interest rules and crisis protocols. LPs will scrutinize whether the firm pursues an external audit of the episode, discloses findings, and commits to concrete standards for diligence around relationships that could pose ethical or reputational risk. Industry precedent suggests that early, comprehensive disclosure can limit long-term damage, while piecemeal responses prolong uncertainty.

Bucher’s explanation attempts to balance contrition with context. The question now is whether action follows words — and whether her investors and portfolio companies decide that the path she lays out is sufficient to rebuild trust.