One startup is taking an unconventional approach in the race to develop practical fusion power: construct a model of a tokamak, the most common form of confinement device, on a ship and use it as… Maritime Fusion, led by chief executive Justin Cohen, is betting that high‑temperature superconducting magnets and smarter controls will make compact fusion a reality at sea significantly sooner than on crowded, regulation‑bound grids.

Why Pursuing Fusion Power at Sea Could Make Sense

Shipping burns the dirtiest of fuels, heavy fuel oil, and contributes about 3 percent of total global greenhouse gas emissions, according to the International Maritime Organization. Options like green ammonia and hydrogen are being developed, but they’re expensive to produce and not an easy fit for the network of pipelines needed to transport the gas. In that niche, a first‑of‑a‑kind fusion plant — expensive at least as a rule of thumb and not cost‑competitive with cheap, onshore wind or solar — might be competitive against fuels that already are at a premium.

There’s precedent for nuclear propulsion at sea: U.S. Navy subs and carriers have run on fission for decades, and civilian experiments like the NS Savannah proved it out in the 1960s. Fusion offers such durability with neither chain‑reaction meltdown danger nor weapons‑grade material nor long‑lived waste — in fact, without producing any kind of nuclear waste at all — although it still generates neutrons and entails robust shielding and the handling of tritium.

Engineering Challenges of a Shipboard Tokamak Reactor

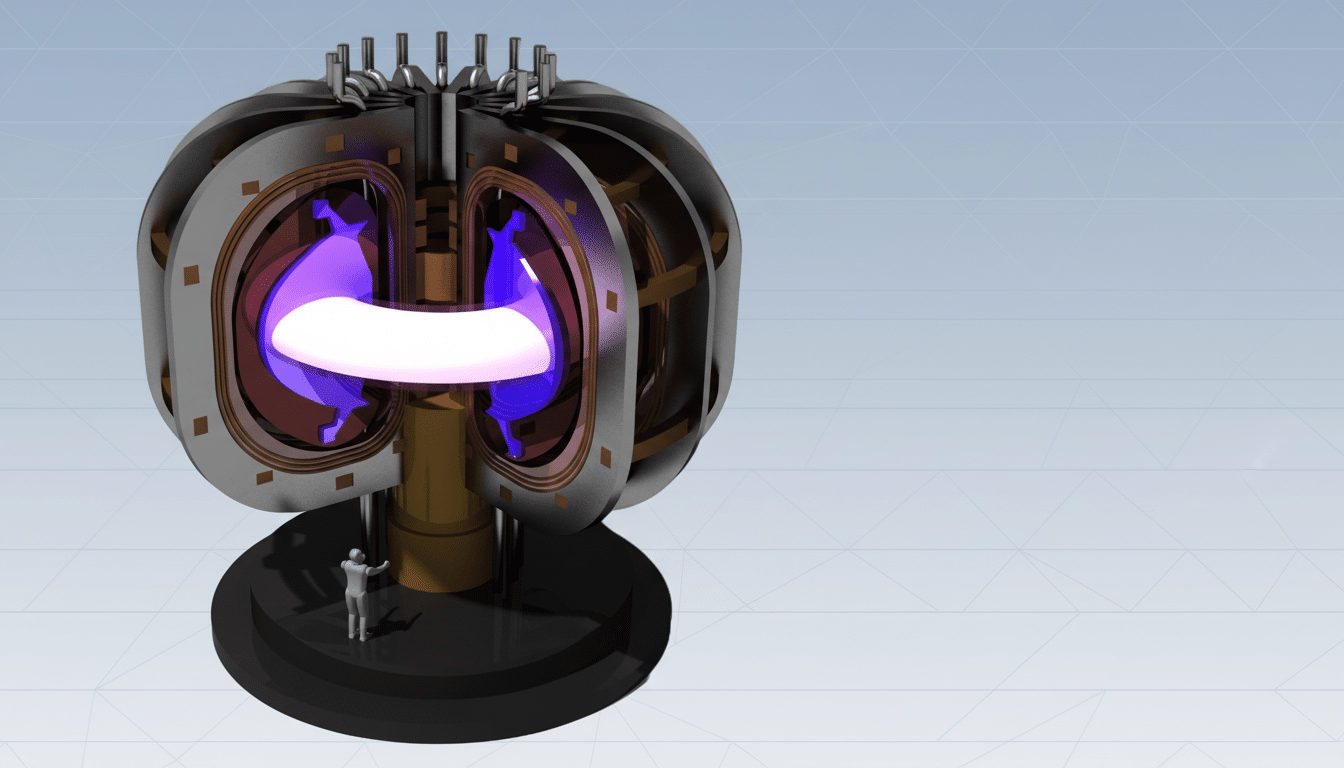

Maritime Fusion’s concept is based on a compact tokamak surrounded by high‑temperature superconducting (HTS) magnets made from REBCO tape. HTS enables stronger magnetic fields in a smaller area — a leap that was affirmed when scientists showed off a 20‑tesla large‑bore magnet last year. The company is making HTS cables from supplier tape, much of it purchased from Japanese firms, both for its own machine and to sell in the emerging magnet market, says Cohen.

Deploying a tokamak on a moving vessel only complicates the matter further. Plasma is fickle about vibration and motion; cryogenic systems require unwavering temperature control and efficiency; and neutron shielding material, as well as thermal blankets to cover the body of the vessels, contribute mass that naval architects need to balance for stability. The company will aim to retain some ancillary functions — including certain aspects of fuel processing — onshore to streamline shipboard systems and maintenance.

The fuel cycle is still a major issue. The majority of near‑term designs use the deuterium‑tritium reaction, but tritium is relatively rare, with global stock typically in the hundreds of kilograms. Tritium breeding from lithium in blanket modules is a goal for the industry, but doing so at sea will require careful regulatory synchronization and nailing logistics.

Business Case and Target Timeline for First Unit

The project’s first unit, named Yinsen, aims to produce around 30 megawatts of electric power. The tokamak would be around eight meters in diameter, with the company targeting operation by the early 2030s and expecting a capital cost of around $1.1 billion. That level of power won’t move the world’s largest container ships, which can require 60 to 80 megawatts at the shaft — but it could drive midsize vessels, icebreakers, or offshore service ships and generate floating clean electricity for ports and remote operation.

Fundamentally, Cohen intends to sell an energy system on day one rather than build a pure science demonstrator. That strategy exchanges technical risk for a more transparent path to revenue — and one that also reflects the calculus of buyers facing the IMO’s ambition for net‑zero GHG by mid‑century, with checkpoints to cut total GHG emissions by at least 20% by 2030 and 70% by 2040.

How Maritime Fusion’s Concept Compares With Rivals

The fusion field is crowded. Commonwealth Fusion Systems is working on a sub‑five‑meter tokamak called SPARC, which aims to demonstrate net energy gain from the plasma, and plans to build a larger plant called ARC in the early 2030s. Tokamak Energy is focused on spherical tokamaks with HTS — but private enterprises such as Helion also have major milestones in their sights, including commercial deals by the late 2020s. A megaproject in France, ITER, resorted to a recent schedule reset that highlighted how difficult traditional paths can be.

One facility has leapfrogged its headline parameter: the National Ignition Facility at Lawrence Livermore National Laboratory achieved scientific ignition in multiple shots, releasing more fusion energy from the fuel capsule than was delivered by the impinging laser. Because that’s inertial confinement, not a power plant, and the wall‑plug efficiency is nowhere near break‑even — but it has changed the feelings on fusion inevitability and timing.

What Regulators and Sailors Will Be Looking For

Deploying in the marine environment might simplify siting battles, but it won’t escape oversight. Hull, vibration, fire, and radiation safety will be the target of DNV/ABS‑type classification societies to look into. Flag states and port states will require emergency shutdown procedures, containment of activated materials, and tritium accounting according to IAEA guidance. Q‑values won’t be the only factor in requirements; crew training and remote maintenance will be just as much, if not more, of a factor.

Then there’s the energy conversion chain — pulling heat from a small blanket, creating high‑efficiency turbines, and connecting to electric propulsion or port microgrids with the minimum of size and weight permitted by naval factors. Endurance will make or break the concept at sea, where service intervals are long and weather is unforgiving.

The Bottom Line on Maritime Fusion’s Shipboard Plan

Maritime Fusion is betting that the high cost of early fusion is feature, not bug, in a market desperate for zero‑carbon endurance. If HTS tokamaks perform as promised and regulators accept the safety case, a 30‑megawatt reactor on a ship might be fusion’s first customer. It’s a high‑risk venture, but if it holds, the future of clean baseload power could come by sea before it docks on land.