Lidar-maker Luminar has filed for Chapter 11 bankruptcy protection, bringing to a head months of tumult that involved layoffs, executive departures, loan defaults and a breakup with its largest customer, Volvo. The company said it would continue to operate during the court proceedings, and it expects to market its lidar business for sale and then wind down operations in line with when the sales close.

The filing comes in stark contrast to a once high-flying sensor supplier, which went public in 2020 through a SPAC at a value of over $3 billion and pitched itself as the linchpin for consumer-grade autonomy. Instead, Luminar faces a crowded market, automaker adoption that is lagging — in some cases far behind what was hoped for — and a capital cycle gone cold.

- Operations to Proceed as Assets Are Sold

- Volvo Split Sets Off a Legal Crossfire for Luminar

- A Year of Turmoil Inside Luminar’s Operations and Leadership

- Balance Sheet Reality: Assets, Liabilities, and Creditors

- Shakeout Hits the Lidar Market and Reshapes Competition

- What Comes Next for Luminar’s Assets, Customers, and Staff

Operations to Proceed as Assets Are Sold

In court papers, Luminar said it has made a deal to sell off one semiconductor subsidiary and is preparing for an overall auction of its lidar assets. Management was quoted noting that operations would continue on a day-to-day basis during the sale process so as to disturb suppliers and automaker programs as little as possible.

Paul Ricci, the CEO, cast a court-supervised sale as the quickest way to extract value and maintain service quality for its installed base of existing customers. The case was filed in the U.S. Bankruptcy Court for the Southern District of Texas, a jurisdiction popular with tech and energy companies in their complex restructurings.

Volvo Split Sets Off a Legal Crossfire for Luminar

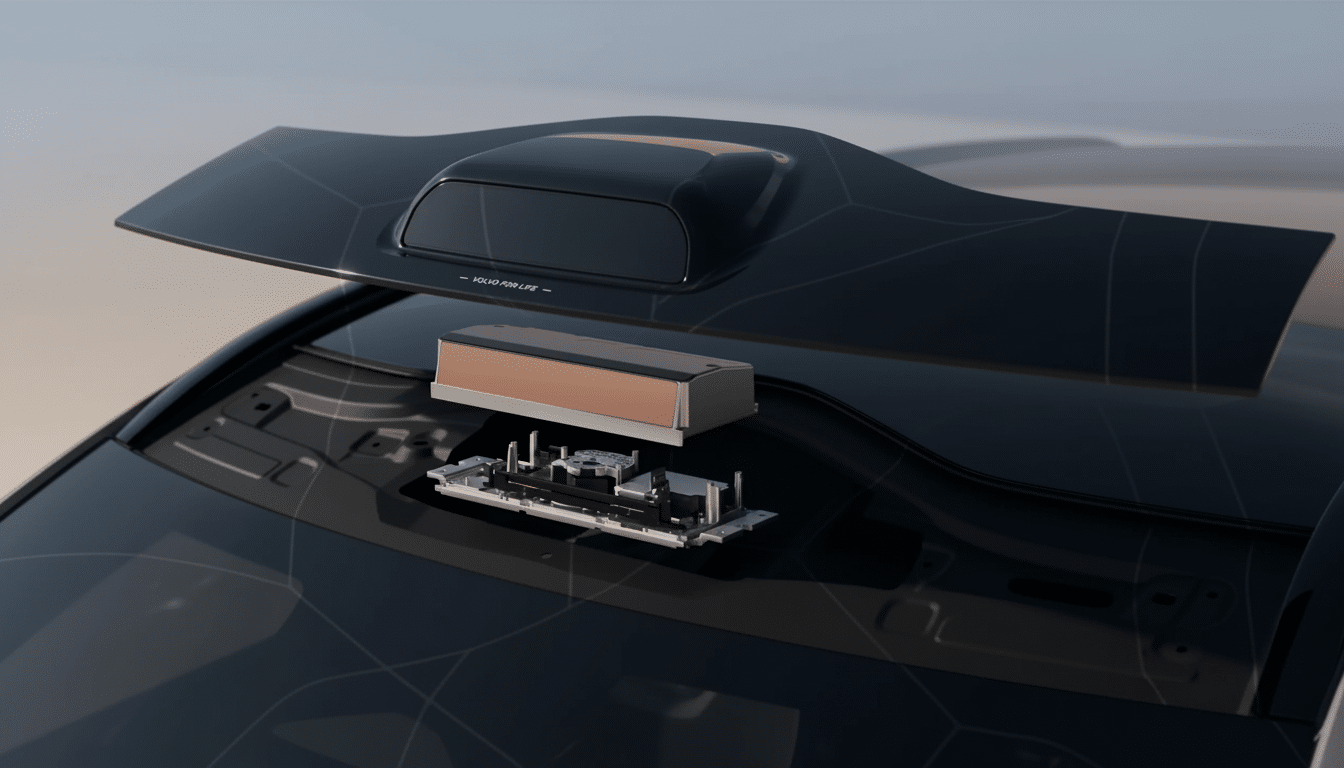

One of the costly blows was when Volvo, a significant investor and Luminar’s biggest potential customer, ended a multiyear supply contract. Luminar has filed a lawsuit in response to the cancellation, and a contract manufacturer who was helping to produce the sensors has filed its own suit against the company, according to filings.

The Volvo deal was seen as a marquee validation for Luminar’s Iris sensor on forthcoming vehicles like the EX90. With that pipeline ruptured, the near-term picture for revenues has darkened and litigation risk has grown — two factors that would typically upend liquidity and customer faith.

A Year of Turmoil Inside Luminar’s Operations and Leadership

First, CEO and co-founder Austin Russell resigned earlier this year in the wake of a code-of-conduct investigation and left to start other things including Russell AI Labs with plans to have Luminar acquire it. It was not immediately clear whether he would seek to acquire assets through the Chapter 11 process.

Within Luminar, 25 percent of the staff was laid off, its chief financial officer left, the Securities and Exchange Commission began to investigate, and the company defaulted on loans. Filings also include mentions of landlord disputes and lease exits — the classic indicia of a balance sheet under pressure.

Balance Sheet Reality: Assets, Liabilities, and Creditors

According to bankruptcy records, there are between $100 million and $500 million in assets and $500 million and $1 billion in liabilities. Those loans were made to fund the loanee’s cash obligations and not, for example, existing debt payments or exclusionary executive pay. Luminar owes $10 million to Scale AI for data-labeling services and more than $1 million to Applied Intuition among other lenders or manufacturing partners.

Recoveries will depend on what the auctions produce and how much value buyers attach to Luminar’s IP, software stack, supply chain tooling and customer programs. Trade creditors usually do better than equity in that situation; tech hardware liquidations tend to leave the common stock with little or no recovery.

Shakeout Hits the Lidar Market and Reshapes Competition

Luminar’s decline is an example of a larger shakeout rippling through the lidar industry. Ouster swallowed Velodyne in an all-stock deal, just as both were pursuing scale. Quanergy underwent bankruptcy and asset sales. AEye pursued court-supervised restructuring. Meanwhile, Hesai, a China-based supplier, has delivered hundreds of thousands to countrymen EV makers moving with speed faster than their global peers and utilizing the twin bows of cost and volume.

Analysts at S&P Global Mobility and Yole Intelligence have cautioned that even though volumes of lidar will ramp up through the decade, adoption is coming off a small base and many suppliers are in an aggressive battle for limited near-term programs. Average selling prices are falling from five figures to the low hundreds as automakers drive for cost parity with camera- and radar-heavy safety suites.

There are some bright spots: Mercedes-Benz has rolled out Level 3 Drive Pilot with Valeo’s Scala lidar in a few markets, and several Chinese brands include lidar as standard equipment on their most premium trim levels. In North America and Europe, however, program delays, software integration challenges and budgeting cycles have extended the timeline and compressed capital-intensive sensor startups.

What Comes Next for Luminar’s Assets, Customers, and Staff

The auction serves as a test of interest among potential buyers in Luminar’s technology portfolio, which includes long-range lidar designs, software perception tools and silicon assets. Strategic bidders could range from established sensor producers interested in acquiring IP or customer relationships to automakers or Tier 1 suppliers looking for vertical integration on key components.

For automakers, the most pressing questions are continuity of supply and software support. Most of these critical sensors are dual-sourced by OEMs, and plans may already be under way to look at alternative suppliers, such as Ouster, Innoviz, Valeo or Hesai to protect programs.

For investors, Luminar’s Chapter 11 is a sobering coda to the age of autonomy SPACs. The big case for lidar in ADAS is still on, but the spoils will probably be won by a smaller field of scale players who have diversified revenue streams, disciplined cash burn and tight ties to Tier 1 manufacturing.