Netskope is set to test public markets in a moment when cybersecurity offerings are few and far between, lining up its debut soon after Rubrik and sharing the same heavyweight backer: Lightspeed Venture Partners. According to its latest filing, the cloud security company plans to price shares between $15 and $17, seeking a valuation of up to $6.5 billion—making it one of the most closely watched enterprise listings of the year.

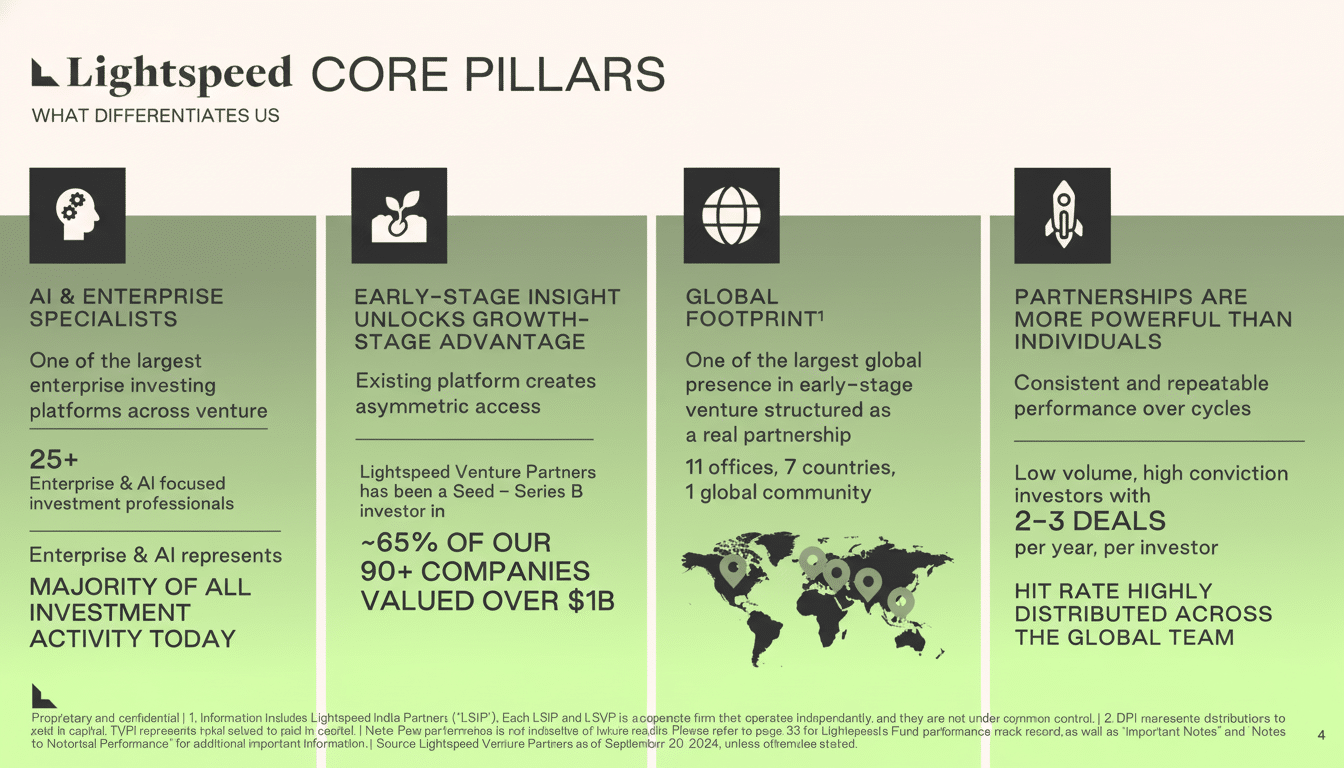

For Lightspeed, which also led early rounds in Netskope, the listing represents a second high-profile outcome in security within a short span. The firm owned roughly 19.3% of Netskope ahead of the IPO, a stake worth around $1.1 billion at the top of the proposed range. The same investor held 23.9% of Rubrik at that company’s market debut, cementing a notable one-two punch in an IPO class many venture firms have struggled to produce.

A scarce window for security IPOs

Despite cybersecurity’s enduring importance, startups in the category have more often exited via acquisition than through public offerings. The recent sale of Wiz to Google underscored that dynamic, while SentinelOne remains a standout from an earlier cycle. Fresh listings have been cautious overall, yet high-quality software names have shown investors are willing to reward durable growth and clear market leadership—Figma and Circle are prime examples of strong receptions.

In that context, Netskope’s move suggests boards and late-stage investors see a narrow but workable IPO window for category leaders with scale, improving efficiency, and credible paths to cash flow breakeven. Public-market appetite has shifted from hypergrowth at any cost to resilient expansion with cleaner unit economics.

Lightspeed’s double bet in enterprise security

Lightspeed first backed Netskope early in its life and continued to support the company through successive rounds, a long-duration stance that mirrors its role at Rubrik. At Rubrik’s listing, the firm’s ownership translated into a multibillion-dollar outcome on paper; Netskope’s proposed range positions Lightspeed for another significant mark-up, even as markets remain choosy on pricing.

The dual exposure is notable because the two companies address different layers of enterprise risk. Rubrik focuses on data security, backup, and recovery, while Netskope sits inline between users and cloud resources, enforcing policy and preventing data loss in real time. For a single venture platform to land meaningful stakes in both is uncommon—and speaks to an investment thesis built around cloud-first security architecture.

What Netskope sells—and who it faces

Netskope is best known for Secure Access Service Edge, or SASE, a framework coined by Gartner that unifies network and security controls delivered from the cloud. Its stack includes secure web gateway, data loss prevention, firewall-as-a-service, and Zero Trust network access—capabilities that protect users and data wherever they work.

That puts the company squarely against formidable incumbents, notably Zscaler and Palo Alto Networks, which have been converging network and security functions to win platform share. The competitive advantage in this arena comes from global cloud reach, latency, breadth of controls, and data protection depth. Customers prize integrated policies across web, SaaS, and private apps, which is why SASE and the closely related Security Service Edge remain board-level priorities, according to analyst commentary from firms like Gartner and IDC.

By the numbers: momentum with tightening losses

Netskope’s latest S-1 shows revenue of $328.5 million for the first half of the year, up from $251.3 million in the comparable period. Net loss narrowed to $169.5 million from $206.7 million, indicating improving operating leverage. The company previously raised a large late-stage round at a $7.5 billion private valuation and later issued a sizable convertible note, underscoring investor willingness to fund scale.

At the midpoint of the proposed price range, the offering implies a high-single-digit to low-double-digit forward revenue multiple—roughly in line with cloud security peers that pair solid growth with progress on efficiency. Major shareholders include ICONIQ Growth at 19.2% and Accel just under 9%, alongside Lightspeed’s 19.3% position.

If the deal prices near the top, Netskope would still be another case of a company listing below its last private valuation. That trend has become more common as the market prioritizes liquidity and disciplined pricing; other recent offerings such as Chime and Hinge Health also went public at levels beneath their peak private marks. On the flip side, several newly public names have traded strongly out of the gate, reminding founders that quality can overcome macro jitters.

What to watch on day one

Key signals will include the final pricing versus the initial range, first-day trading stability, and any early read-through on expansion economics from management’s commentary. Investors will also gauge how Netskope’s valuation stacks against Zscaler and platform security vendors on a growth-adjusted basis.

Whatever the first print, Netskope’s arrival alongside Rubrik marks an inflection point: selective but reopening capital markets for cybersecurity leaders. If performance holds, it could nudge more late-stage security companies—especially those with clear SASE or data security narratives—toward ringing the bell rather than selling to strategic buyers.