LG has ceased production of 8K LCD and OLED TV panels, drawing a line under a years-long push to turn ultra-high resolution into the next mainstream upgrade. The move leaves Samsung as the lone major brand still building 8K sets, and it underscores a simple truth the market has signaled for a while: resolution alone isn’t moving the needle for premium TVs.

Why LG Pulled the Plug on 8K TV Panel Manufacturing

Reporting from FlatpanelsHD indicates LG Display has wound down 8K panel production for televisions. That decision likely reflects a mix of low demand and brutal unit economics. 8K LCDs require more complex backlights and driver ICs, and 8K OLEDs push power and yield limits—costs that don’t translate into a perceivable benefit for most living rooms.

- Why LG Pulled the Plug on 8K TV Panel Manufacturing

- The 8K TV Market That Never Arrived for Consumers

- No Content Pipeline and Heavy Bandwidth Demands

- Does 8K Matter From the Sofa at Typical Viewing Distances?

- Gaming and PCs Could Not Save It From Niche Adoption

- What Comes Next for High-End TVs After 8K’s Retreat

- The Bottom Line for Buyers Considering Premium TVs Now

Energy-efficiency rules have also been a headwind. European Commission labeling tightened limits that disproportionately affected 8K power budgets, forcing manufacturers to lower brightness or skip certain models entirely. At the panel level, the industry has found a better return by channeling investment into higher-luminance 4K OLED (with micro-lens arrays), QD-OLED, and mini-LED backlights rather than chasing more pixels.

The 8K TV Market That Never Arrived for Consumers

Early projections painted a rosy curve for 8K adoption. Reality didn’t cooperate. Digitimes Asia reports that forecasts once called for several million 8K TVs annually, but actual shipments stalled in the hundreds of thousands and later sank to roughly 136,800 units, falling under 0.1% of total TV sales. That’s rounding-error territory for a mass-market category.

The ecosystem echoes the trend. Ars Technica noted that the 8K Association’s membership has shrunk from a peak of 33 companies to 16, signaling waning industry momentum. Budget leader TCL exited 8K TVs, and Sony stepped back as well. With LG discontinuing panels, Samsung’s 8K lineup increasingly looks like a branding play rather than a volume driver.

No Content Pipeline and Heavy Bandwidth Demands

Content never caught up. There is no 8K physical media standard, and native 8K streaming is a bandwidth hog—often requiring up to 100 Mbps per stream even with modern codecs. Trials by broadcasters such as NHK proved the signal chain is technically feasible, but scaling it for everyday viewers remains costly and constrained by last-mile internet variability and data caps.

Even where HDMI 2.1 can carry 8K video, the bottlenecks shift to decoding horsepower, compression efficiency, and the service-side economics of delivering huge bitrates reliably. Upscaling has improved dramatically, but AI-driven enhancement on 4K sets already yields crisp results with far less overhead.

Does 8K Matter From the Sofa at Typical Viewing Distances?

The other inconvenient factor is human vision. SMPTE and THX viewing guidelines suggest that to fully resolve the added detail of 8K on a 65-inch screen, you’d need to sit far closer than most living rooms allow. At typical viewing distances, 8K’s benefit over a high-quality 4K TV is vanishingly small, while HDR brightness, contrast control, and color volume remain immediately noticeable.

This is why buyers gravitate to improvements they can see every day: higher peak brightness for specular highlights, tighter local dimming grids, better anti-reflective coatings, and wider color gamuts. Those attributes—more than pixel counts—shape the perceived leap in premium picture quality.

Gaming and PCs Could Not Save It From Niche Adoption

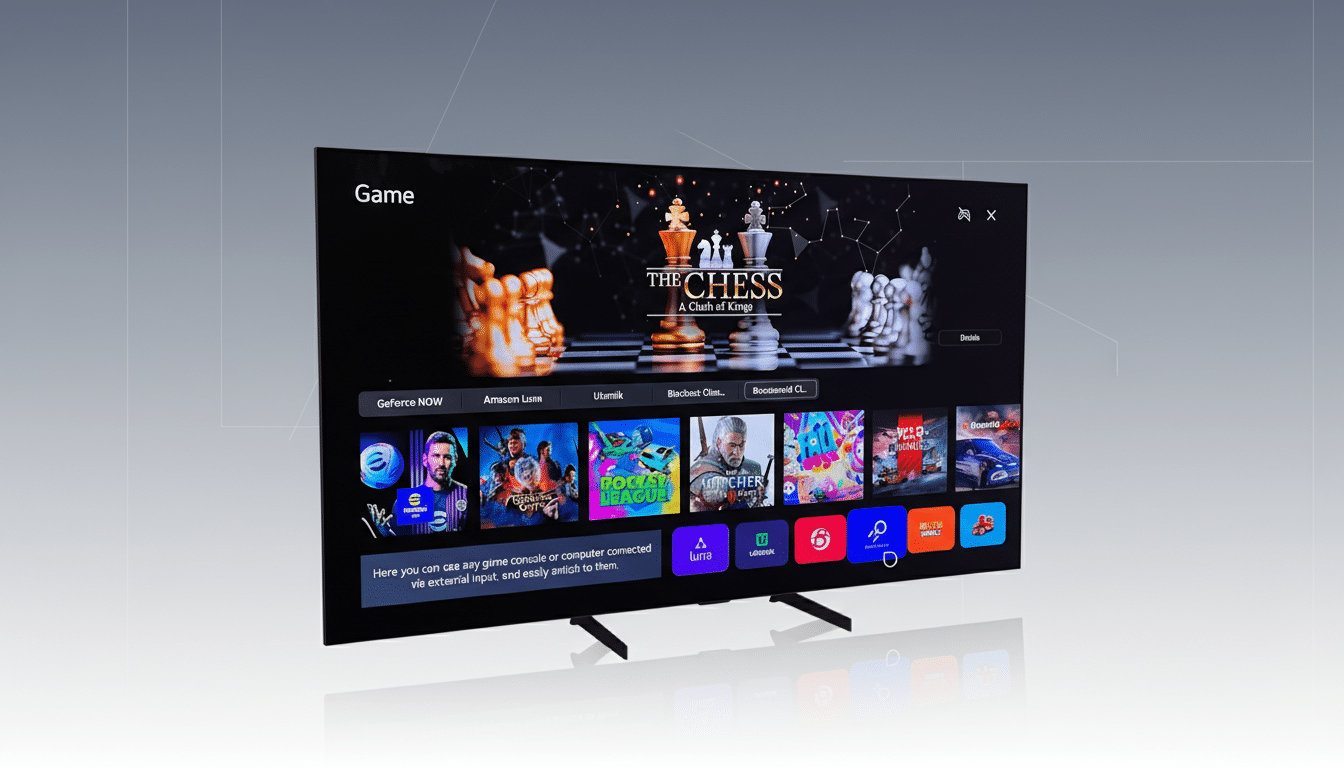

PC gaming seemed like a potential lifeline, but the math is unforgiving. Nvidia marketed flagship GPUs as 8K-capable, yet practical results lean heavily on upscaling and frame generation, and even then performance, VRAM demand, and input lag trade-offs pile up. Steam’s hardware surveys continue to show a majority of players on 1080p, with 1440p and 4K rising—8K barely registers.

On the desktop, ultra-high DPI can boost productivity, but multi-monitor setups, OS scaling quirks, and limited native 8K content keep adoption niche. Monitor makers are prioritizing high-refresh 4K and ultrawide formats where the benefits are obvious in both gaming and work.

What Comes Next for High-End TVs After 8K’s Retreat

With 8K fading, the premium race is shifting to better 4K. Expect more brightness headroom, finer dimming zones, MLA-enhanced OLED efficiency, and next-gen QD-OLED panels. MicroLED remains aspirational but advances each cycle, while “AI” upscalers in TV SoCs and set-top boxes continue to squeeze more detail from 4K and 1080p sources. Broadcast roadmaps like ATSC 3.0, where deployed, focus on robust 4K HDR rather than jumping to 8K.

Upstream, panel makers are reallocating capacity to categories with clearer returns: IT displays, automotive cockpits, and specialty pro panels. For TV brands, the sweet spot is premium 4K with standout HDR and motion at 120–144Hz, plus gaming niceties like low latency and VRR.

The Bottom Line for Buyers Considering Premium TVs Now

LG exiting 8K panels doesn’t kill 8K overnight, but it signals an end to the mainstream push. If you’re shopping, the best picture upgrades now come from top-tier 4K sets with superb brightness, contrast, and processing. Owners of existing 8K TVs will still get 4K content that upscales cleanly, yet native 8K remains scarce. The industry has spoken: better pixels beat more pixels.