Nuclear startups are back in the news, as venture capitalists and other money men pile into chip-scale analysis of uranium-heavy processes on the theory that factory-built units will bring low-carbon power without mega-project headaches that dogged the last generation of reactors. The pitch is straightforward: small, repeatable designs on the production line, deployed in groups and scaled up as demand increases. The truth is more complicated, with manufacturing capability, fuel supply, and licensing times having become the new decisive battlegrounds.

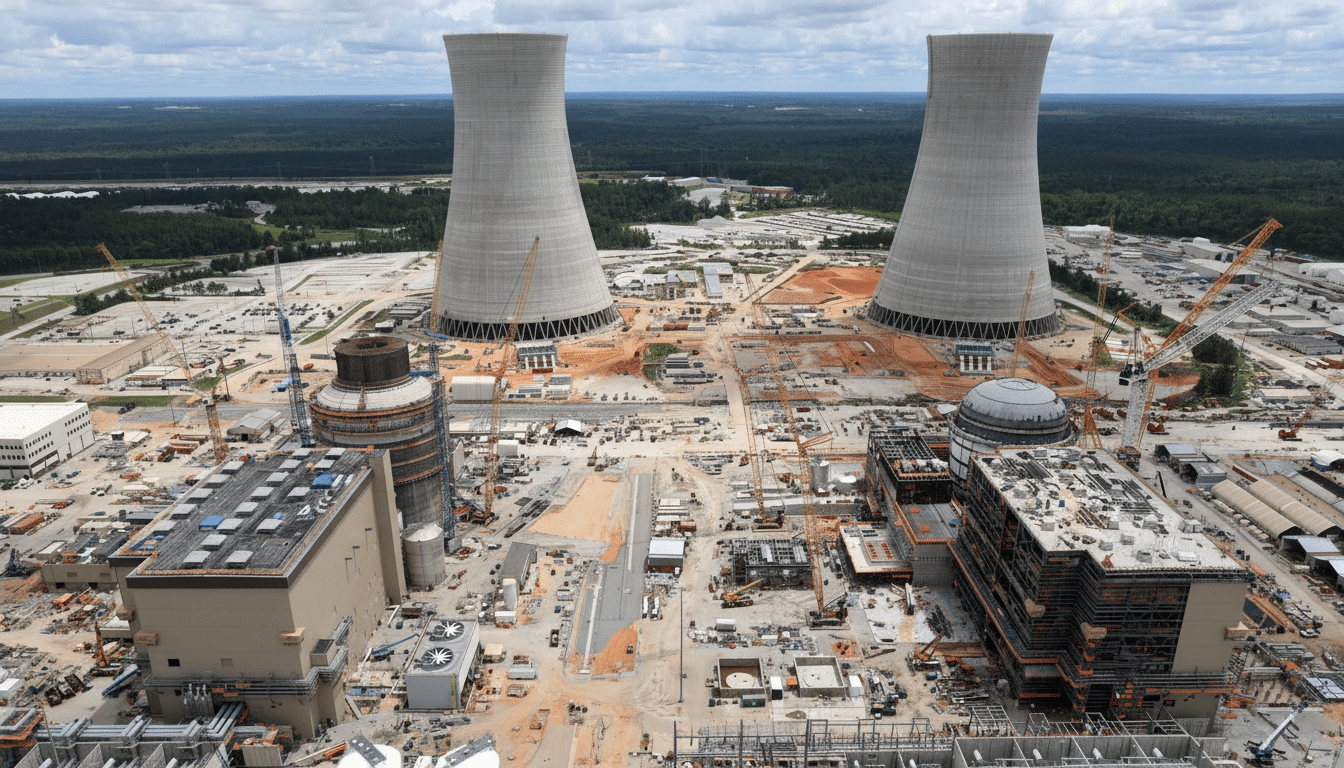

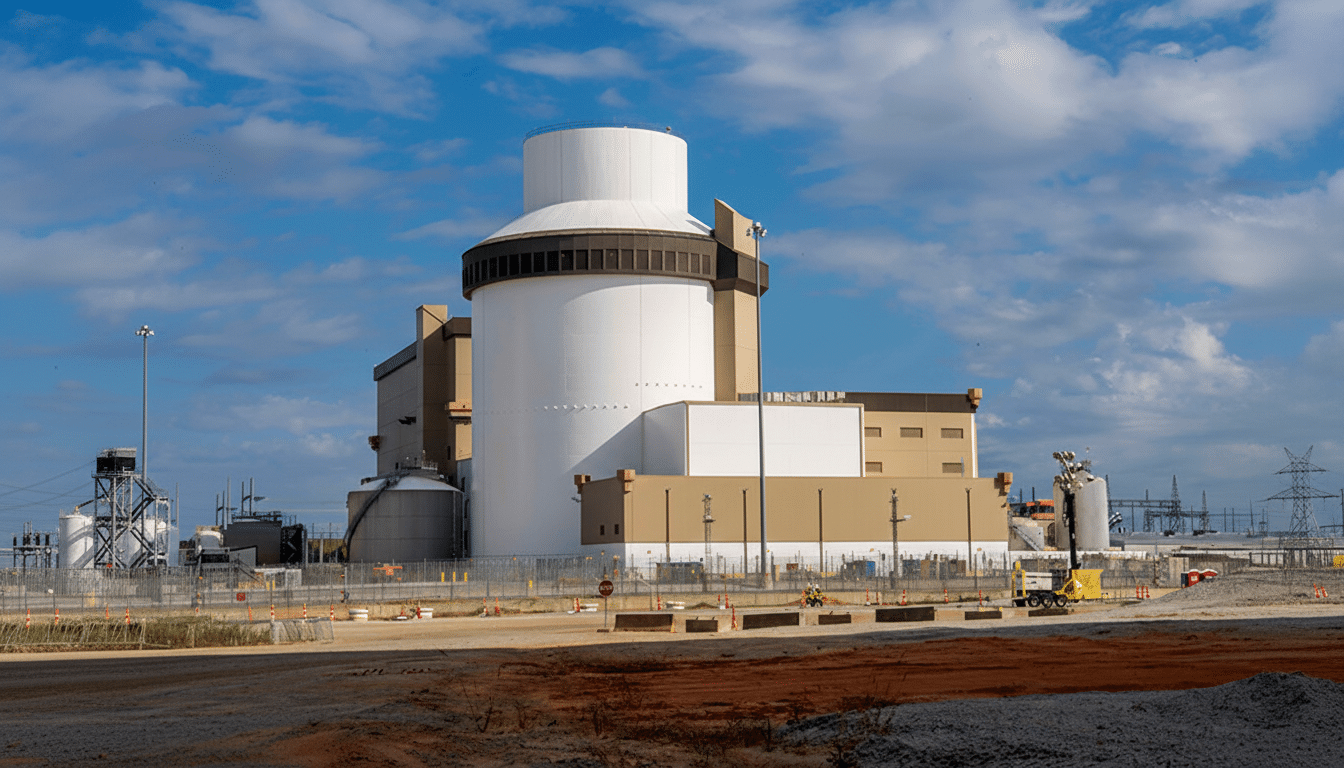

Customer excitement has driven momentum for electromobility, AI data centers, and grid decarbonization. Yet recent history looms large. The most recent U.S. gigawatt-scale units delivered, Vogtle 3 and 4, went into service years behind schedule and more than $20 billion over budget — an object lesson demonstrating why startups are taking a different route.

How Small Reactors Came Back to the Energy Debate

SMRs, which can vary in size from 50 to 300 megawatts each, are intended to help move nuclear reactors away from bespoke construction sites and toward productized systems. Startups contend that mass-produced modules built in factories, and a streamlined learning curve for developers, will mean tighter schedules and cheaper costs — and smaller footprints make it easier to site near industrial loads or even retired coal plants.

Global climate and reliability requirements give the demand side. The International Energy Agency has stated that nuclear additions need to increase significantly to help make net-zero power systems feasible, particularly as variable wind and solar grow. U.S. and European grid planners, in the meantime, are warning of capacity shortfalls later this decade, a gap SMRs hope to feed into with swifter and more modular build-outs.

Manufacturing Is the New Bottleneck for SMR Deployment

But the central question is whether reactor builders can achieve genuine manufacturing discipline. First-of-a-kind units seldom achieve the projected cost; quality, yield, and schedule can only reliably improve with subsequent production runs. Rates of 10–20%/doubling of cumulative output are typical, for example, in industrial manufacturing, but nuclear has not yet shown itself capable of matching that curve in practice.

Two constraints stand out. First, physical infrastructure: The heavy forgings, the nuclear-grade pumps and valves, the ultra-tight tolerances, and the ASME N-stamp quality assurance all require a supplier base here in the U.S. (and Europe) that we partially allowed to atrophy. The second is human capital. After decades of offshoring, the talent pipeline for factory design, qualification, and operations is thin, from welders and inspectors to program managers and CFOs who understand nuclear-grade risk and governance.

Investors with heavy manufacturing experience warned startups to co-locate early pilot lines with engineering teams, ship product faster at low volumes, and instrument everything — cycle times, rework rates, component failure modes — so learning could compound. The payoff is real but slow; even optimistic backers acknowledge it can take close to a decade to reap the full manufacturing gains.

Risks in Fuel and Supply Chain Threaten Early Schedules

More advanced reactor concepts raise the bar even further, calling for high-assay low-enriched uranium (HALEU) ranging from 5 to 20% U-235. Commercial-scale supply outside Russia is currently in its infancy. A pilot production plant is up and running in Ohio, courtesy of Centrus Energy, though volumes are scant. The U.S. Department of Energy’s HALEU Availability Program is intended to stimulate several domestic suppliers; however, new production will be slow and capital-intensive due to the nature of multi-year contracting.

TRISO particle fuel — crucial for various high-temperature gas designs — is constrained in the same way, with domestic production not yet fully ramped up, and sometimes-delayed projects. Without guaranteed, bankable supply of fuel, even the most optimally designed reactors have difficulty securing financing or maintaining credible schedules.

Regulation and Financing Reality Confront New Designs

Licensing remains a heavy lift. The U.S. Nuclear Regulatory Commission has licensed a single SMR design and is developing a performance-based approach for advanced reactors, but applicants continue to confront several years of review times and site-specific challenges. Countries like Canada and the U.K. are smoothing pathways, while first movers everywhere have to contend with safety cases that are novel and supply chain qualification.

On the capital front, the U.S. Loan Programs Office has become an important flamethrower, as have state clean energy standards and federal tax credits that value 24/7 clean power.

Nonetheless, most new reactors would still require long-term offtake with creditworthy offtakers. Utilities remain skittish after cost overruns, but industrials and data center operators are considering 24/7 carbon-free energy contracting, which could be the basis for initial fleets.

Early Projects Offer Warning and Promise

Not all is rosy in small-reactor world. NuScale’s leading municipal utility project was scrapped after costs spiraled, a reminder that smaller doesn’t necessarily mean cheaper. Yet there’s movement still: Ontario Power Generation is pursuing GE Hitachi’s BWRX-300 at Darlington, with further units mooted; Orlen Synthos in Poland has chosen the same for industrial sites; and government support has been promised to Rolls-Royce SMR as it works through its assessments in the U.K.

Outside the grid, the U.S. Department of Defense is developing a demonstration of transportable microreactor power at Idaho National Laboratory to show willpower for remote bases. There, success could de-risk the manufacture of small reactors and broaden the supply base.

What to Watch Next for Small Reactor Progress

Three signposts will indicate whether the SMR thesis is going to stick.

- Fuel: reliable HALEU contracts with non-Russian suppliers.

- Fabs: visible progress on the module fab line, first-pass yield, and schedule success.

- Finance: firm, multi-decade offtake from utilities or corporate buyers that can bear first-of-a-kind premiums.

If startups can turn design wins into repeatable orders for delivery, demonstrate cost and schedule compression with each successive unit, and lock in fuel supply at scale, small reactors could become a reliable corner of the clean-power stack. If not, the sector risks repeating past history — big promises, meager delivery. It will be the next wave of contracts and factory milestones that tells the tale.