Intuit has reached a more than $100 million multiyear deal with OpenAI to make its products — including TurboTax, Credit Karma, QuickBooks, and Mailchimp — available within ChatGPT, deepening the software maker’s use of large language models and providing yet another avenue to distribute its finance tools.

It will let users ask ChatGPT to calculate their tax refunds, consider credit options, reconcile books, send reminders about an unfinished invoice, or compose marketing e-mails, with systems that pull from a customer’s authorized data for grounded responses and to complete tasks. The company said the data access will be permissioned and limited to each action.

- What the integration enables for ChatGPT and Intuit users

- Why it matters for fintech, accuracy, and AI compliance

- Intuit’s AI strategy and its expanding OpenAI footprint

- Competitive landscape and industry precedents to watch

- Questions of data governance, consent, and liability

- What to watch next as rollout timing and scope emerge

What the integration enables for ChatGPT and Intuit users

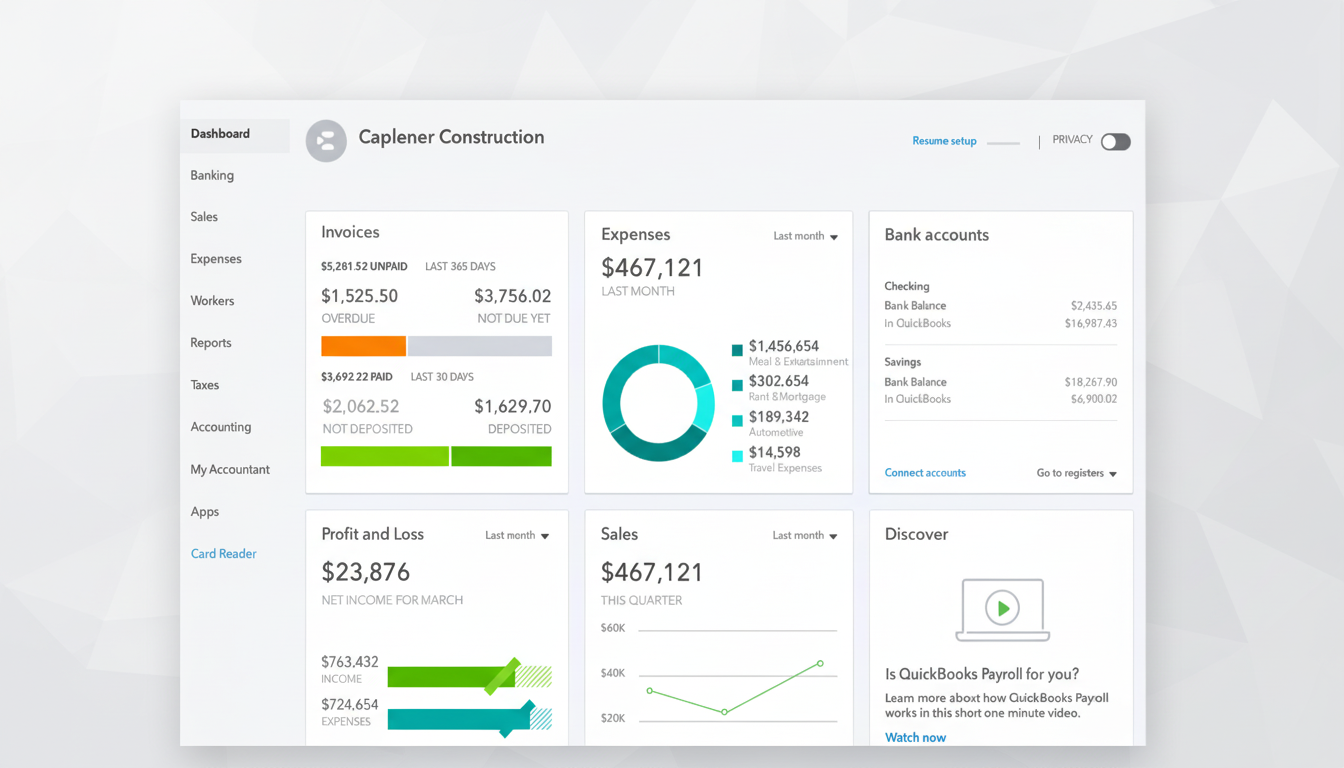

One minute, within a ChatGPT chat, a QuickBooks customer might ask for a summary of last quarter’s cash flows; the next they could schedule reminders for overdue invoices and then create an e-mail marketing follow-up sequence in Mailchimp. A TurboTax user might request a customized estimate for a refund based on prior filings and current-year income and deductions, for example, while a Credit Karma member could weigh credit cards or loan offers matched to the person’s profile.

Unlike previous plug-ins, which didn’t actually embed tasks into the experience and simply handed a user off to an external website, these experiences are designed to keep task flows inside ChatGPT. With permission, Intuit’s back end shares just the right, limited data to fuel the answer, perform the action, and then report back in chat that it’s resolved. And this grounding in first-party financial data is supposed to cut down on generic or wrong advice, Intuit says.

The move extends OpenAI’s recent effort to allow developers to publish apps on ChatGPT, which has seen early consumer-facing participants such as Booking.com, Expedia, and Spotify. Intuit represents a more consequential use case: taxes, lending, business finance — where there are costs for real mistakes.

Why it matters for fintech, accuracy, and AI compliance

Embedding workflows for tax and credits within a general-use AI assistant elevates the satisfaction of all the parties involved, while raising the bar on accuracy, traceability, and compliance. Language models can generate high-confidence incorrect answers; finance software cannot. Intuit says it will factor into the model layers not just accuracy guarantees and domain checks that are already built in, but also engines governing its rules, historical context, and human-authored guidance from decades of tax and accounting experience.

It’s a trend that extends beyond the industry, too. By 2026, Gartner predicts that 80 percent of enterprises will have built or developed genAI-based applications and services from generative AI APIs — a significant increase over 2023. The differentiator isn’t access to a model so much as how companies combine homegrown data, guardrails, and more automated workflows to produce results they can trust.

Intuit’s AI strategy and its expanding OpenAI footprint

Intuit has been quietly injecting AI throughout its products, including the 2023 debut of Intuit Assist, its cross-product assistant that draws on numerous commercial and open-source models. The new partnership expands access to OpenAI’s cutting-edge models and extends Intuit’s reach to the vast user base of ChatGPT; OpenAI has said that ChatGPT serves over 100 million weekly active users.

The company also leverages ChatGPT Enterprise to optimize employee workflows internally. Intuit had a powerful testing ground on the customer side: QuickBooks has more than eight million online accounting subscribers globally, Credit Karma has over 120 million members, and TurboTax processes tens of millions of returns each year. Every data set yields structured, high-signal information that can help in grounding AI agents within real financial context.

Competitive landscape and industry precedents to watch

Competitor fintech firms are already testing AI copilots and agents. Klarna said in some markets its customer service inquiries were largely handled by its assistant powered by OpenAI, which helped reduce resolution times and improve satisfaction. Banks and payments companies have launched AI chat for fraud alerts, card controls, budgeting advice — but those services tend to terminate short of perfectly executing end-to-end financial actions within a generalized AI interface.

By incorporating tax prep, credit discovery, and small business workflows into ChatGPT, Intuit is experimenting to see whether consumers and entrepreneurs will trust a single conversational surface for both advice and action. If adoption takes off, expect competitors in accounting, payroll, and marketing automation to respond with their own ChatGPT-ready agents.

Questions of data governance, consent, and liability

Key open questions remain. Who is to blame when a recommendation by an AI goes wrong — the app provider, the model provider, or the customer who approved it? Intuit says its current guarantees still apply to eligible products, but did not specify the details regarding responsibility for AI-generated recommendations.

Regulators are watching. The FTC has cautioned companies against making exaggerated claims about what AI can do, and the CFPB has expressed fears about automated credit counseling services. For Intuit, that entails auditable logs, opt-in consent flows for all users whose data are being used to train the AI, minimizing data, and providing prominent notifications about what the AI can and can’t do — particularly when its output has tax, credit score, or cash flow implications.

What to watch next as rollout timing and scope emerge

The timing of the rollout and the scope of features will matter, especially with another tax season on the horizon. New metrics involve adoption among those using ChatGPT, conversion to paid Intuit services, rates of task completion, and accuracy benchmarks against traditional workflows. The companies did not reveal terms or revenue-sharing deals, but the strategy is obvious: get a trusted financial agent into where people are already spending time and pave the way for them to both advise and execute.

If the integration results in accurate, data-based outcomes at scale, it could establish a new baseline for how consumers and small businesses engage with financial software: via one conversational hub that knows their numbers and can safely act on them.