Intel’s comeback is real enough to move the stock and soothe jangled nerves, but the next chapter will be written in its foundry. After a stronger-than-expected quarter and a strengthened balance sheet, investors and policymakers are now seeking evidence that Intel can take on entrenched leaders in Taiwan and South Korea as a contract manufacturer.

Foundry Becomes the Barometer for Intel’s Progress

It posted $13.7 billion in revenues and net income of $4.1 billion to finally end a string of losses. Management noted that about $20 billion was added to the balance sheet in recent months, thanks to a trio of outside investments and divestitures meant to “simplify our story and help us pay for manufacturing,” they said.

That SoftBank invested $2 billion, that the U.S. government would take a 10% equity stake in it with $5.7 billion of the $8.9 billion planned investment in hand and that Nvidia committed to invest up to $5 billion together represented statements of strategic interest in Intel’s turnaround plan. Intel also finalized the sale of its Altera stake for $5.2 billion and sold off its remaining Mobileye position, as part of moves to sharpen focus and unlock capital for fabs and advanced packaging.

There’s a catch, though: New money always comes with new demands. Government assistance effectively ropes in Intel’s commitment to continue investing and to expand its foundry operations, as evidenced by cost reductions and reorganization within the manufacturing group. (Reminder, the message isn’t just this: Recovery is not about having a better quarter but showing Intel can build chips for others at leading-edge nodes on time and with competitive yields.)

What Intel Needs to Show to Win Foundry Wafers

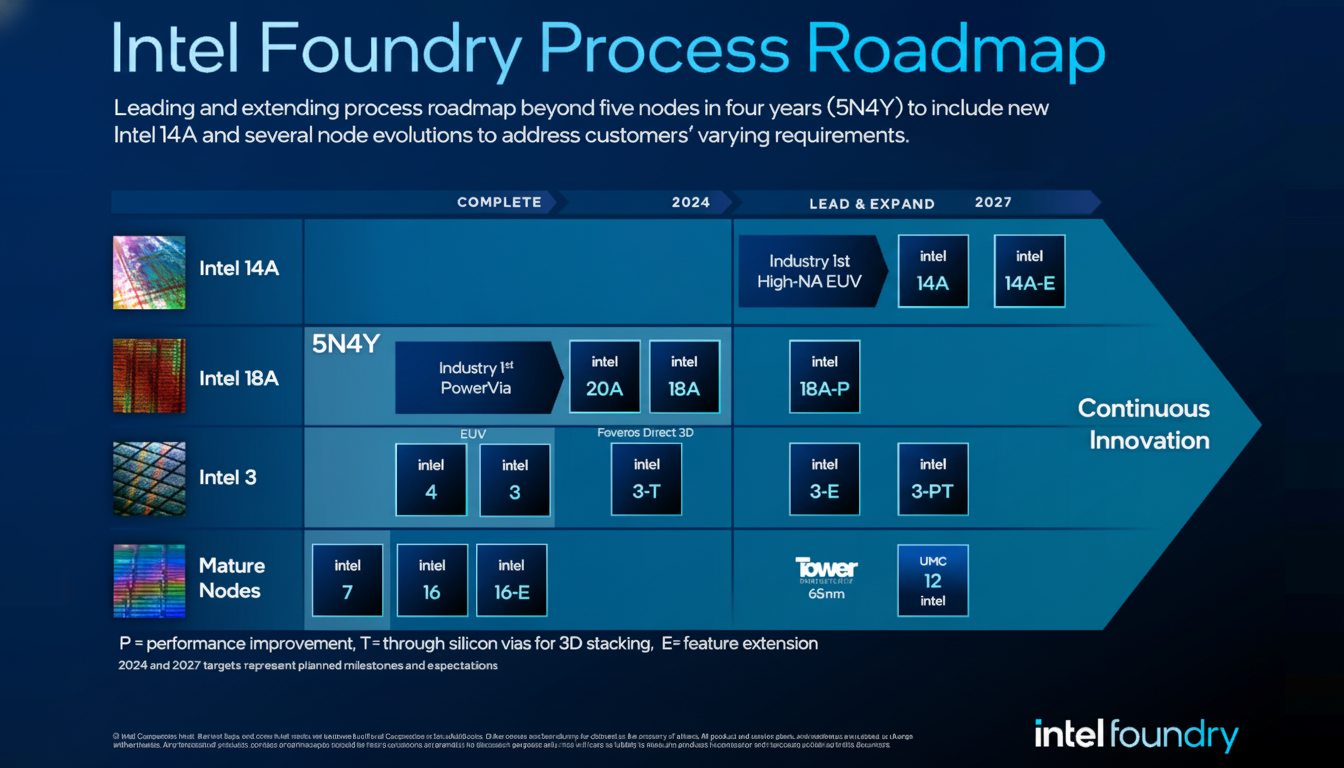

On the outside, winning customers depends on three deliverables: process competitiveness, ecosystem being open, and predictable execution. On process, Intel’s roadmap around Intel 3, 20A/18A et al. not only requires great TP but also nice yield curves which pinch fast after ramp. It depends on who you ask, but analysts from both Gartner and IDC have routinely stated that time to yield is just as important (or more so) than straight-line performance when the foundry buyers planning a high-volume part are considered.

On openness, Intel will need to demonstrate that its design kits, EDA flows and IP libraries are really foundry-grade – customers can bring their tools and technology (standard cells, memories) and third-party designs without friction. This is where relationships with leading EDA suppliers and mature process design kits will be tested. Packaging is the third leg: Intel’s EMIB and Foveros are competitive, but customers will want clear capacity, pricing and multi-vendor interoperability for both chiplets and HBM stacks.

The Competition’s Not Standing Still in Foundries

TSMC leads, stepping up to high-volume 3nm manufacturing and has outlined plans to lead with 2nm with backside power delivery.

Samsung Foundry is promoting its gate-all-around process and growing in advanced packaging. TrendForce forecasts that leading-edge wafer demand associated with AI accelerators, networking, and high-end smartphones will continue to strain top-tier capacity markets in a way that biases towards those who are incumbents with established platforms and deep customer pipelines.

Against that backdrop, Intel’s point of difference can’t simply be “Made in America.” It requires credible total cost of ownership as well as good yields and high advanced packaging throughput, which is on par with CoWoS-class capacity. If Intel can promise cycle times and secure supply (especially for AI silicon and chiplet-based designs) it has a chance to capture programs that like geographic dispersion and assurance of supply.

Customer Pipeline and the Nvidia Signal for Intel

Nvidia’s $5 billion bet is striking. It’s not a wafer ordered, but it is an indication of strategic alignment which may lead to some joint activity that can be in chips or packaging. Others who might be interested are cloud providers building custom accelerators, network vendors and even defense applications that place importance on domestic manufacturing, the analyst adds. Government-supported programs, like defense prototyping programs, can also act as anchor tenants by promoting utilization in early ramps, industry consultants who have worked on CHIPS Act projects say.

The critical milestone: a high-profile external tape-out at a leading-edge node going into volume production. Public, named customer wins – spurred by third-party IP being accessible and reference flows – would move perception from ambitions to reality.

Economics and Risk in Intel’s Foundry Ambitions

Foundry is a scale game. If history is any guide, usages north of 80% are where the gross margin model begins to kick into gear for advanced nodes when taking depreciation and the capital intensity in both front-end fabs and back-end packaging into account. Intel’s recent job cuts and portfolio pruning are intended to simplify that path to scale but also increase execution risk if keystone knowledge walks during that ramp.

There is also policy risk. It does, however, lock us into some conditions that may punish us if we do decide to abandon the foundry approach in a few years. That leaves Intel on the hook to deliver, but it limits optionality if market conditions change. The question for investors, of course, is whether that incremental capital spending still leads to predictable return on investment and signed multi-year wafer agreements.

What to Watch Next as Intel’s Foundry Plan Unfolds

Look for third-party validation that Intel’s process is ready – PDK 1.0 releases, EDA certifications and ecosystem IP announcements. Find reported external tape-outs at advanced nodes and signs of packaging capacity increasing in U.S. facilities in Arizona, Oregon, New Mexico, and Ohio. And watch for commentary from leading silicon designers; when they start mentioning Intel in the same breath as TSMC and Samsung, then the foundry story will have shifted.

Intel’s financial recovery purchased time and flexibility. Converting that into credibility in the foundry is the true proving ground for this. If management can align technology claims with delivery predictability, then, the company’s recovery story will be transformed from balance sheet repair to sustained manufacturing leadership.