H&R Block just rolled out a Presidents’ Day promotion cutting 25% off its online tax preparation plans, giving do-it-yourself filers a timely price break as peak filing season ramps up. The company is also taking $50 off its expert-prepared option for those who prefer full-service help, stacking convenience with meaningful savings.

What the 25% Discount Covers in H&R Block Online Plans

The discount applies to H&R Block Online, including Deluxe, Premium, and Self-Employed tiers. New customers get an added boost: a complimentary Tax Pro Review on those paid tiers, which means a certified tax professional gives your return a final check before you file. That safety net pairs with H&R Block’s accuracy and maximum refund guarantees, plus upfront pricing to help avoid add-on surprises.

- What the 25% Discount Covers in H&R Block Online Plans

- Who Should Consider Each H&R Block Online Tax Tier

- How the Presidents’ Day Savings Add Up Across Tiers

- Filing Context and Why Timing Matters for Refunds

- Fine Print to Know About This Limited-Time Promotion

- Smart Alternatives and Free Help for Tax Filing

- Bottom line: is H&R Block’s Presidents’ Day deal worth it?

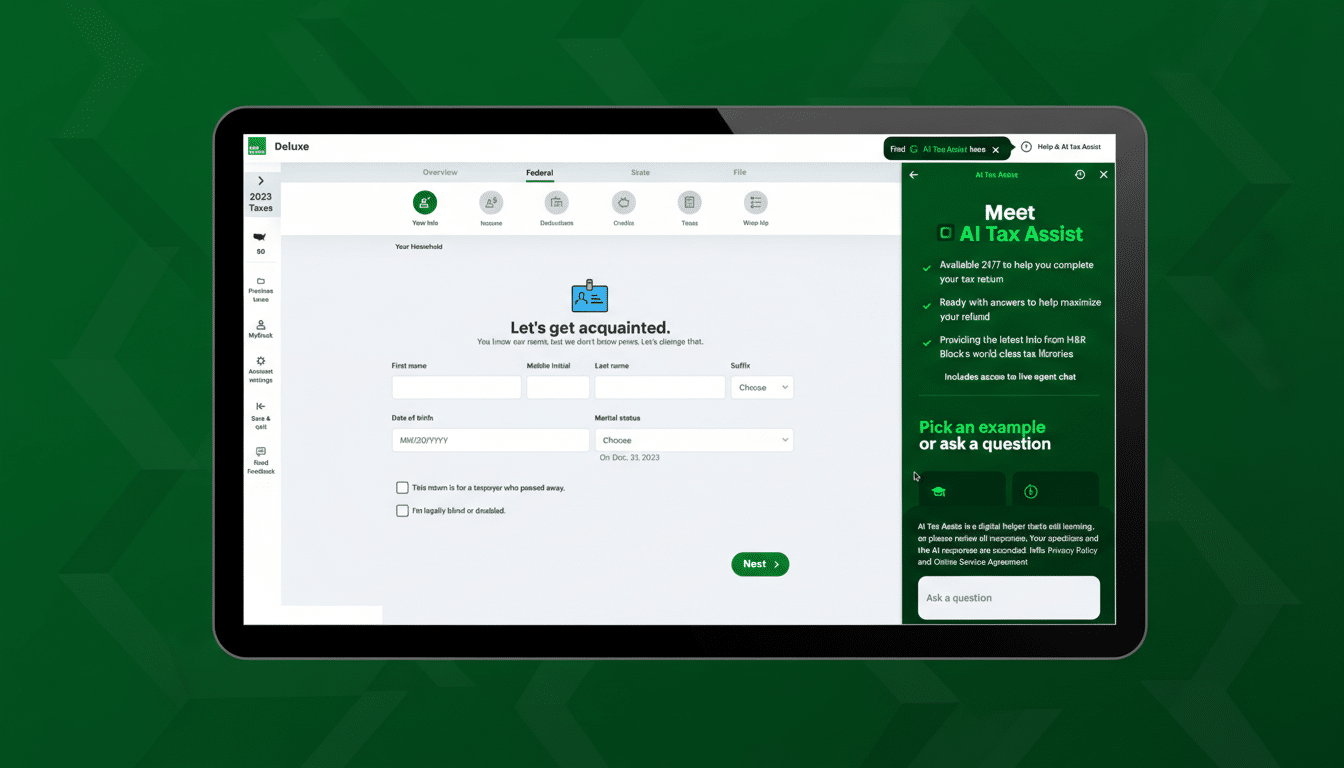

Key software features include step-by-step guidance, W-2 import by photo, and secure transfer of prior-year returns from leading competitors, making it easier to switch. State returns are available for an additional fee, and you can add audit support or live help if your situation warrants it. If you want someone to handle everything, the separate $50 discount on expert tax prep brings down the cost of having a pro complete and file your return end-to-end.

Who Should Consider Each H&R Block Online Tax Tier

Deluxe typically fits W-2 earners who itemize or claim homeowner deductions, student loan interest, educator expenses, or charitable contributions. If you received a 1098 for mortgage interest or have childcare credits to evaluate, this tier usually has the right forms and guidance.

Premium is designed for investors and more complex households—think 1099-B for brokerage activity, ESPP or RSU sales, rental income, or health savings account reporting. If you dabbled in crypto, sold mutual funds, or rent out a property, this is often the safer lane.

Self-Employed targets freelancers, gig workers, and small-business owners filing Schedule C. It handles 1099-NEC and 1099-K reporting, mileage tracking, depreciation, and business deductions. If you drive for deliveries on weekends or run an online shop, the prompts here can help surface write-offs that general software might gloss over.

How the Presidents’ Day Savings Add Up Across Tiers

A straight 25% cut materially lowers out-of-pocket costs across tiers. As simple math: a plan normally priced at $80 drops to $60; a $120 plan falls to $90. The $50 markdown on full-service prep is a flat reduction off the quoted price when you choose to hand your documents to an H&R Block tax pro. Promotions generally don’t stack, so expect to choose either the online discount or the full-service discount based on how you file.

For many households, the dollar value of properly claimed credits can dwarf software fees. The Earned Income Tax Credit and Child Tax Credit remain among the most consequential benefits for eligible filers, and software prompts help flag potential eligibility. If you experienced life changes—marriage, a new dependent, or a home purchase—the guided interview can catch deductions you might otherwise skip.

Filing Context and Why Timing Matters for Refunds

The IRS reports that roughly nine in ten individual returns are e-filed, and direct deposit remains the fastest way to receive a refund. Last season’s average refund hovered around the $3,000 mark according to IRS statistics, a reminder that accuracy and speed matter to household cash flow. Filing earlier reduces the risk of identity theft-related delays and helps you resolve any document mismatches—like a late 1099—before crunch time.

If you received a 1099-K from a payment platform or marketplace, double-check that gross receipts align with your records. The National Taxpayer Advocate frequently notes that common errors—incorrect Social Security numbers, misstated income, and missing schedules—trigger notices that can stall refunds. The Tax Pro Review add-on for new customers can serve as a final guardrail against those headaches.

Fine Print to Know About This Limited-Time Promotion

This is a limited-time Presidents’ Day promotion. The 25% discount applies to H&R Block Online for an original personal federal return and typically excludes amended returns and certain add-ons. The offer generally cannot be combined with other promotions, has no cash value, and may not be transferable. As always, state filing and optional services can carry separate fees, and exclusions may apply based on your specific situation.

Smart Alternatives and Free Help for Tax Filing

Before you decide, remember that IRS Free File partners offer no-cost online preparation for eligible incomes, and IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly provide in-person help to qualifying taxpayers. Those options can be excellent if your situation is straightforward and you qualify for free assistance. For complex returns or when life changes raise questions, the discounted H&R Block tiers—and the $50 off full-service prep—can justify themselves with time saved and errors avoided.

Bottom line: is H&R Block’s Presidents’ Day deal worth it?

If you plan to file soon and want guided software with an option to tap a pro, H&R Block’s 25% Presidents’ Day discount is a strong, timely value. Add the $50 off full-service prep and new-customer Tax Pro Review on select tiers, and this promotion stands out as one of the season’s more compelling ways to file accurately without overspending.